The Revolut Bundle

How bundling financial primitives turns distribution into durable economics.

Revolut is a mobile‑first, global financial platform that turns an ordinary current account into an operating system for money: spend, save, invest, and run a business from one app. The bundle is a choice of interface: one identity (KYC), one balance sheet (deposits + e‑money), one distribution channel (the app), and a menu of money behaviors. You can also read that as a product thesis: simplify the interface, then attach more financial primitives. That’s how banking app can become a financial super‑app without feeling like bloat.

Money Still Feels Like Paperwork

Modern money is still an awkward patchwork: one bank for salary and bills, another card for travel, a brokerage for investing, a wallet for crypto, and an expense tool for business. Each silo adds friction: separate onboarding, separate fees, separate security, separate support.

Cross‑border friction: FX markups, opaque spreads, weekend surcharges, slow international transfers.

Fragmentation: the ‘best’ product per category forces users into a dozen apps, and a dozen risk surfaces.

Untrusted interfaces: legacy banks make simple actions (freeze a card, see a charge, share an IBAN) feel like paperwork.

SMB pain: founders and finance teams manage multi‑currency payments, cards, approvals, and reconciliation across disconnected tools.

Incumbent banks solve the deposit + debit core, but typically monetize through a tangle of cross‑subsidies and fees that are hardest to see when you most need clarity (travel, FX, urgent transfers). Specialist fintechs solve one slice (remittance, brokerage, BNPL) but recreate the fragmentation problem at a higher UX standard.

Revolut describes the category problem indirectly: growth comes from customers choosing Revolut as their primary spending account, keeping more balances, and using services more frequently, i.e., replacing the patchwork with one default.

Bundle the Primitives Behind One Interface

“Banking” is mostly workflow. If you can make the workflow instant, from onboarding, cards, FX, transfers, savings, to trading, then the bank becomes a programmable layer. Revolut’s product is a new default interface that makes existing instruments feel modern.

One account, many primitives: multi‑currency balances, cards, P2P, subscriptions, savings, investing, and credit sit behind one login.

Global distribution without branches: the product ships as software; marginal geography is largely compliance and localization.

A flywheel between balances and features: higher primary‑account usage increases balances; balances increase interest income; interest income funds product expansion.

Security as product: in‑app controls (freeze/unfreeze, disposable virtual cards) make risk management tangible for customers.

Endurance comes from habit and switching costs. Once a user routes salary, bills, subscriptions, savings, and travel spending through one app, the app becomes their financial memory. Revolut’s best products are the ones you don’t think about: money arrives, gets split, earns yield, pays bills, and leaves a clean trail for reporting.

Revolut’s direction points toward deeper vertical integration (credit, mortgages) and more physical distribution (ATMs). In late 2024 it framed an explicit vision that included an in‑app AI assistant and a fully digital mortgage product, and it later piloted branded ATMs in Spain.

The value proposition

A traveler lands in Tokyo: pays with the same card, sees the FX rate and fee instantly, and freezes the card in one tap if something looks wrong.

A freelancer invoices in EUR, spends in GBP, and sets aside tax automatically, without juggling multiple accounts.

A small business runs multi‑currency payroll, issues cards with approval rules, and reconciles spending through accounting integrations.

Revolut sits in two places: (1) the phone (as the control plane for identity, balances, and rules) and (2) the payments rails (cards, local and international transfers, and merchant acceptance).

Representative use cases

Everyday primary account: salary payments, bill pay, budgeting, savings vaults (App → Accounts/Payments/Savings).

International living: multi‑currency balances, transfers, and travel insurance (App → Exchange/Transfers/Insurance, where available).

Wealth and trading: stocks/ETFs, commodities, crypto; plus Revolut X in supported markets (App → Wealth / Exchange).

SMB finance: multi‑currency business account, corporate cards, approvals, and merchant acquiring (Revolut Business app/web).

Why This Works Now (and Not 10 Years Ago)

Revolut is not the first company to imagine “one place for money.” It is one of the first to ship it at global scale with consumer‑grade UX and bank‑grade controls. The missing piece was infrastructure. A decade ago, building a cross‑border, always‑on money app meant negotiating bespoke integrations with every bank, relying on batch transfers, and accepting weak user‑controlled security. The cost of one app was many bespoke backends. Three waves set the stage: (1) card networks standardized merchant acceptance; (2) smartphones and mobile wallets normalized “tap to pay”; (3) regulators forced open access and stronger authentication, turning banks from walled gardens into platforms. In Europe, PSD2 explicitly pushed an ecosystem of new account‑linked services (payment initiation and account information) by requiring banks not to block access when customers consent. In parallel, instant payments moved from novelty to baseline. The SEPA Instant Credit Transfer scheme (SCT Inst), launched in November 2017, set a pan‑European expectation: money moves in seconds, 24/7/365. And in the UK, the Open Banking remedy, born from the CMA’s 2017 investigation, helped formalize standardized APIs and a regulated ecosystem of third‑party providers.

Recent trends that made Revolut possible

APIs + cloud + modular architecture reduced the cost of adding new financial products.

Higher interest rates turned customer balances into meaningful revenue (interest income), making primary account behavior economically attractive.

Regulatory maturation: e‑money institutions, passporting frameworks, and clearer crypto/wealth regimes in many markets lowered uncertainty (though did not remove it).

Consumer expectations shifted: instant notifications, real‑time spend controls, and digital onboarding became table stakes.

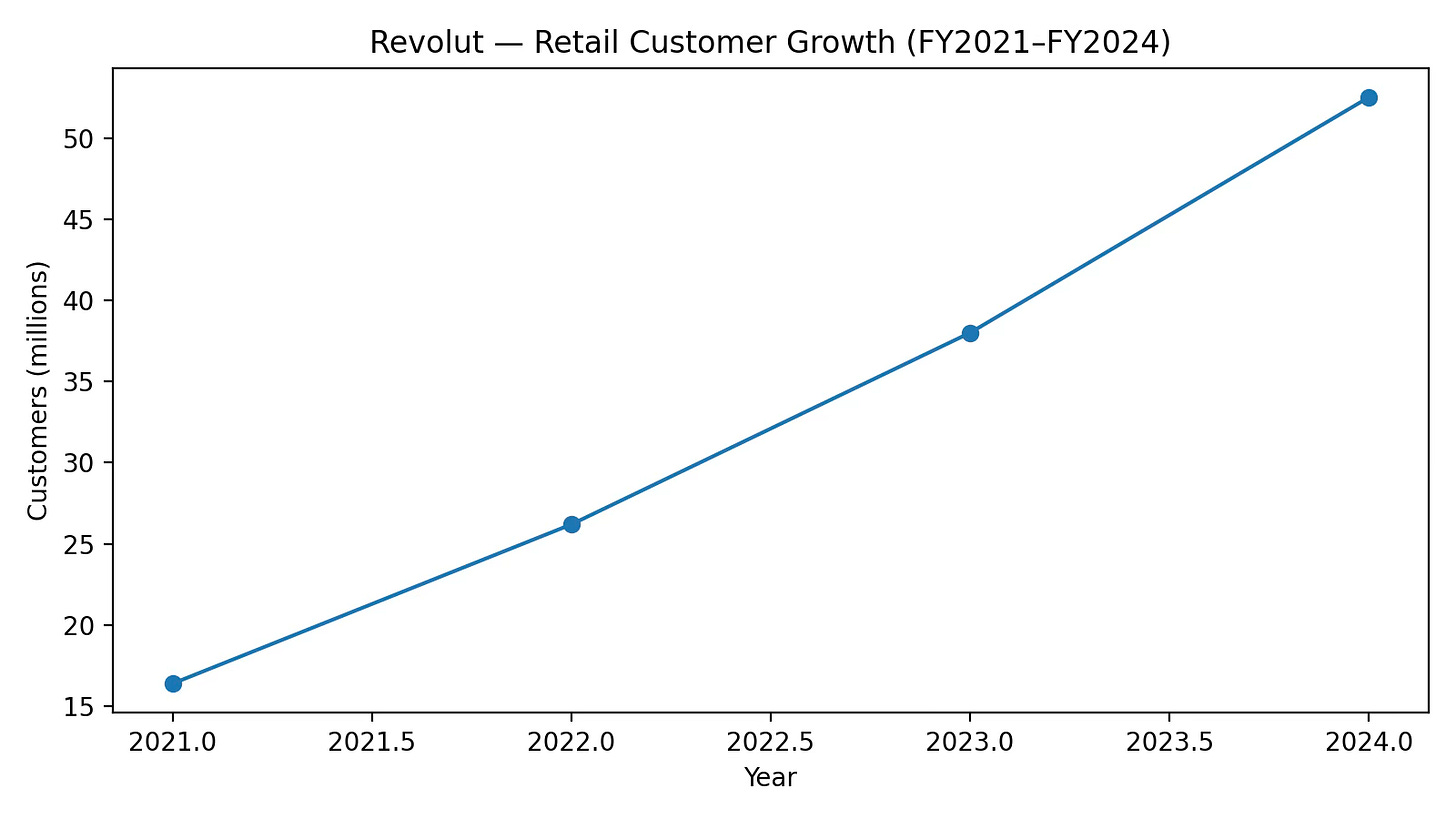

How Big Is “Primary Bank in an App”?

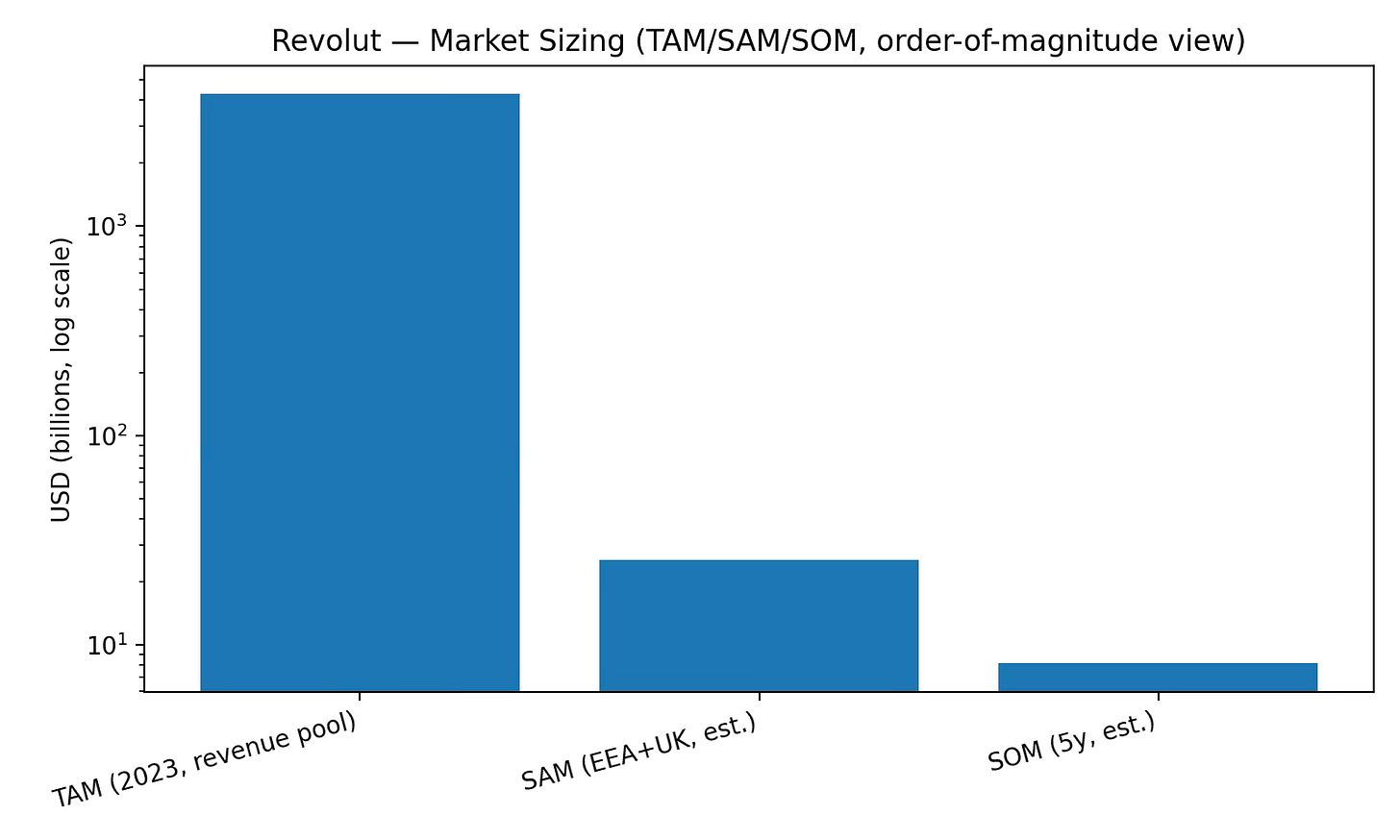

Revolut serves two overlapping markets: retail consumers who want a primary account that works globally, and businesses that want multi‑currency money operations without the overhead of a traditional bank. In practice, Revolut’s market is primary account share rather than neobank downloads.

Digital‑native consumers: want real‑time controls, instant onboarding, and a clean UX.

Cross‑border lives: immigrants, expats, frequent travelers, remote workers paid in multiple currencies.

Yield‑sensitive savers: will move balances to the highest effective rate if friction is low.

SMBs and internet businesses: multi‑currency receivables/payables, team cards, approvals, and reconciliation.

Top-down TAM: McKinsey estimates the 2023 total revenue from global financial intermediation at $6.8T. A rough Revolut‑relevant slice: retail banking (33%), payments (16%), and wealth/asset management (14%)—is ~63% of that pool (~$4.3T).

Bottom-up SAM: start with the population base of Revolut’s core region (EU + UK), then apply conservative adoption and monetization assumptions. EU population was ~449–450m around 2024–2025, and UK population is ~67–68m; together ~518m. Assume (i) 80% are adults and (ii) 90% are banked → ~373m serviceable adults. Multiply by FY2024 retail ARPU (~£50/year) → ~£18.7B (~$25.4B) annual revenue potential.

SOM (serviceable obtainable): Revolut’s own published ambition is 100 million customers by mid‑2027. Using the same FY2024 unit economics (and holding them flat), 100m customers implies ~£5.0B in retail revenue; adding Business and other segments yields an order‑of‑magnitude revenue run‑rate of ~£6B (~$8.2B).

The Competitive Board: Banks, Neobanks, and Specialists

Direct competitors (multi‑product consumer fintech accounts):

Europe: N26, Monzo, Starling, bunq, Monese; plus local digital banks in specific countries.

US: Chime, Cash App, PayPal/Venmo (different product mixes), and brokerage‑plus‑bank hybrids.

Adjacent/specialist competitors (a single wedge product):

Cross‑border money: Wise, Remitly, PayPal/Xoom.

Brokerage/wealth: Robinhood, Trading 212, eToro; crypto exchanges (Coinbase, Binance, etc.).

SMB accounts and spend management: Brex, Ramp, Airwallex, Stripe Treasury‑adjacent offerings.

Incumbent alternatives:

Retail banks with strong digital experiences (varies by country).

Card issuers + airline/hotel ecosystems that compete on rewards.

Big Tech wallets (Apple Pay / Google Pay) that own the last mile of payments but not the full account relationship.

Revolut’s plan to win: (a) deepen primary‑account behavior to grow balances and interest income; (b) monetize high‑frequency flows (cards, FX) through fee income; (c) attach higher‑margin, lower‑frequency products (wealth, credit, subscriptions).

Competitive advantages:

Breadth with coherence: multiple revenue lines, with no single product meant to be the whole company.

Scale economics: more customers → more transactions → better fraud models, better unit costs, stronger negotiating position with partners.

Regulatory progression: operating as a licensed bank in many markets, and pursuing deeper licensing where it matters most (UK, France, etc.).

High‑velocity product shipping: official roadmap includes AI‑assisted experiences, mortgages, and physical distribution (ATMs).

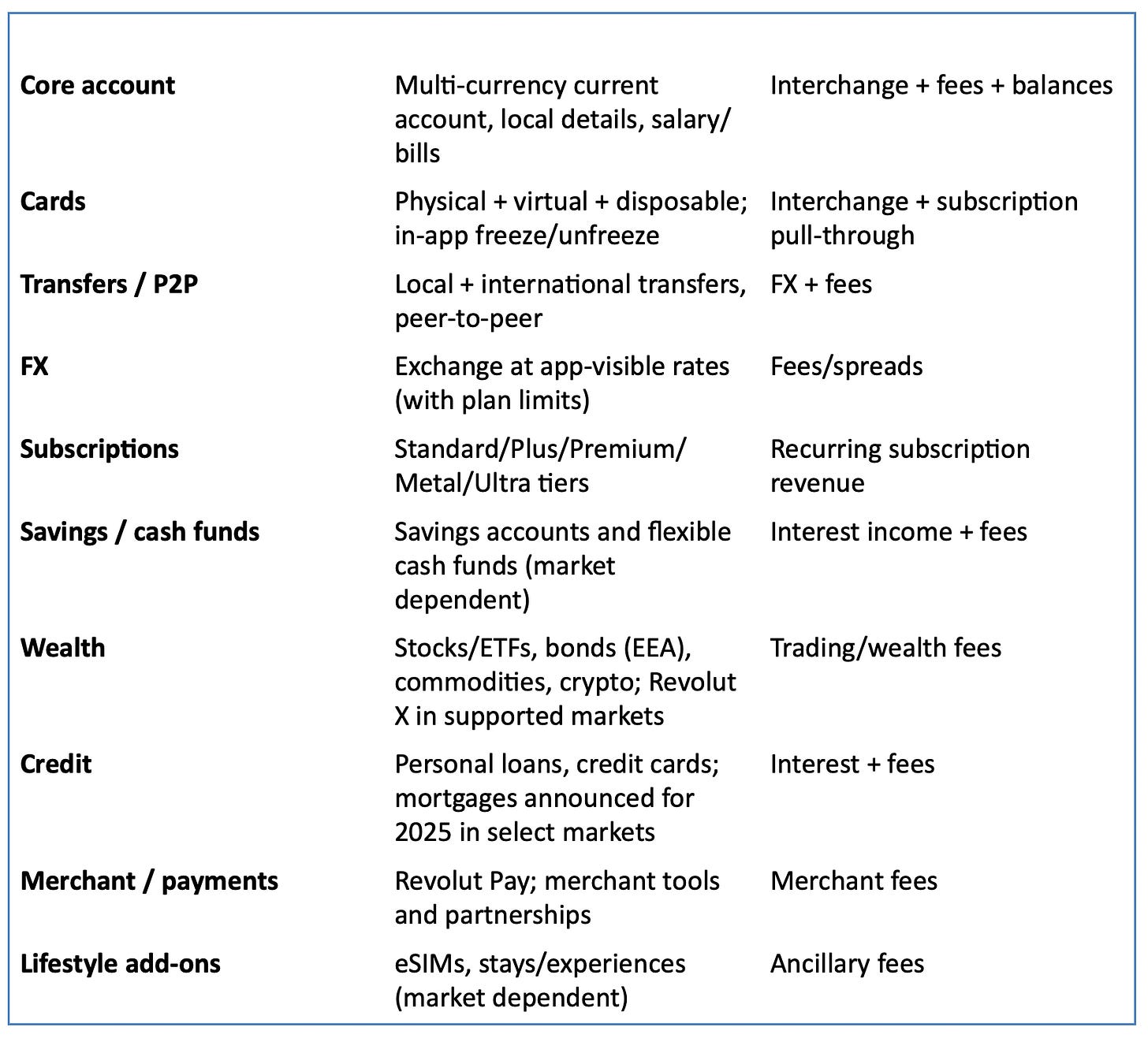

What’s in the Bundle

Revolut’s product line is best understood as layers. The outer layer is the interface (app + cards). The middle layer is the rails (payments, FX, trading access). The inner layer is risk/compliance (KYC, fraud, AML) and balance‑sheet management (deposits, treasury).

Revolut’s public roadmap for 2025–2027 has two themes: deepen credit (including mortgages) and broaden distribution (including ATMs), while scaling internationally toward 100 million customers by mid‑2027.

Mortgages: Revolut publicly confirmed plans to launch mortgages in Lithuania followed by Ireland and France in 2025, with a goal of fast digital approvals (subject to checks).

AI assistant: Revolut described an AI assistant intended to guide customers toward smarter money habits and streamline admin.

Physical distribution: Revolut announced and then launched its first branded ATMs in Spain, with a longer‑term plan to expand capabilities (e.g., deposits) and scale.

Global expansion: timeline to 100 million customers by mid‑2027; aim to enter 30+ new markets by 2030.

Monetizing the Interface

Revolut’s model is multi‑line revenue + primary‑account behavior. The business is a portfolio of money flows. The strategy is to become the default interface (balances + daily spend), then attach higher‑margin products over time.

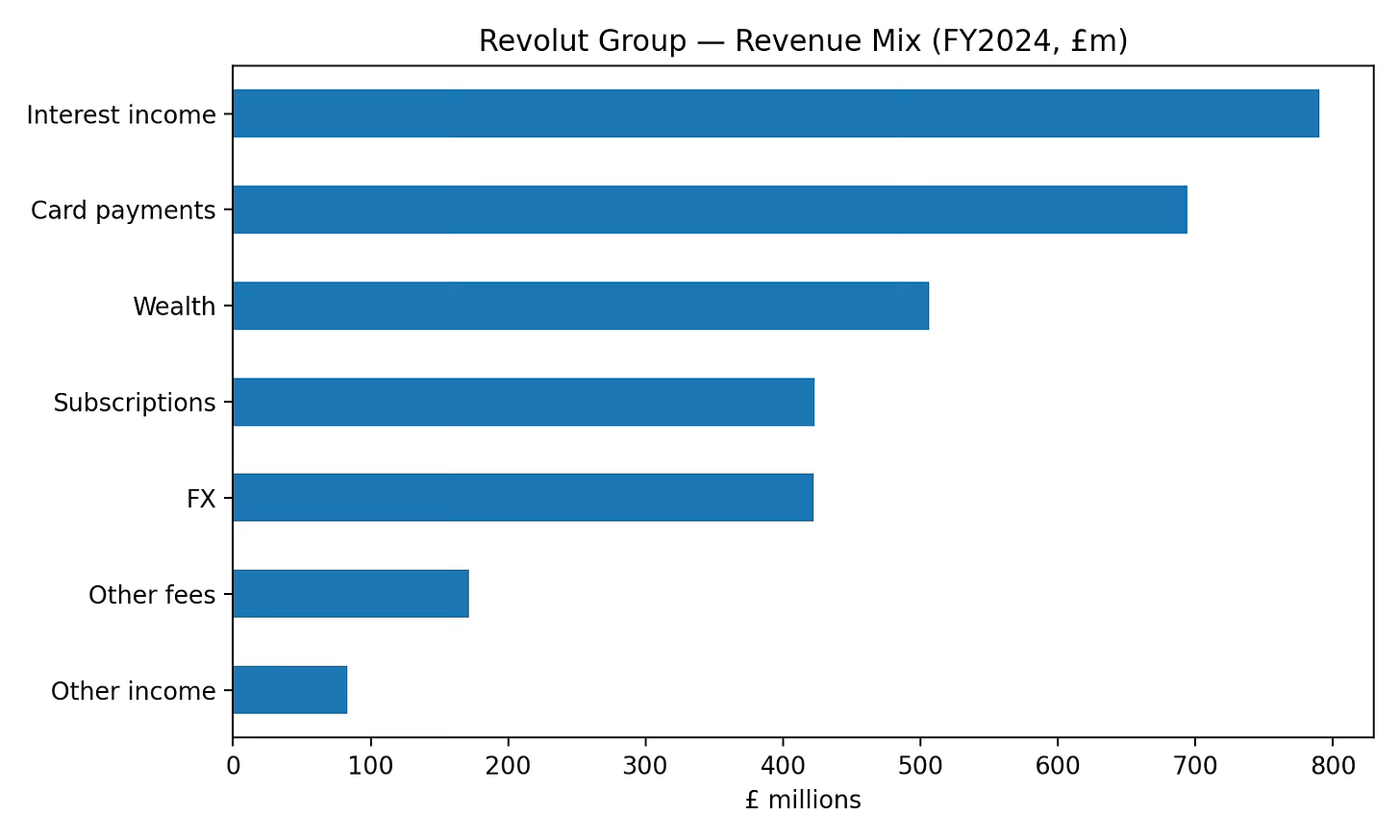

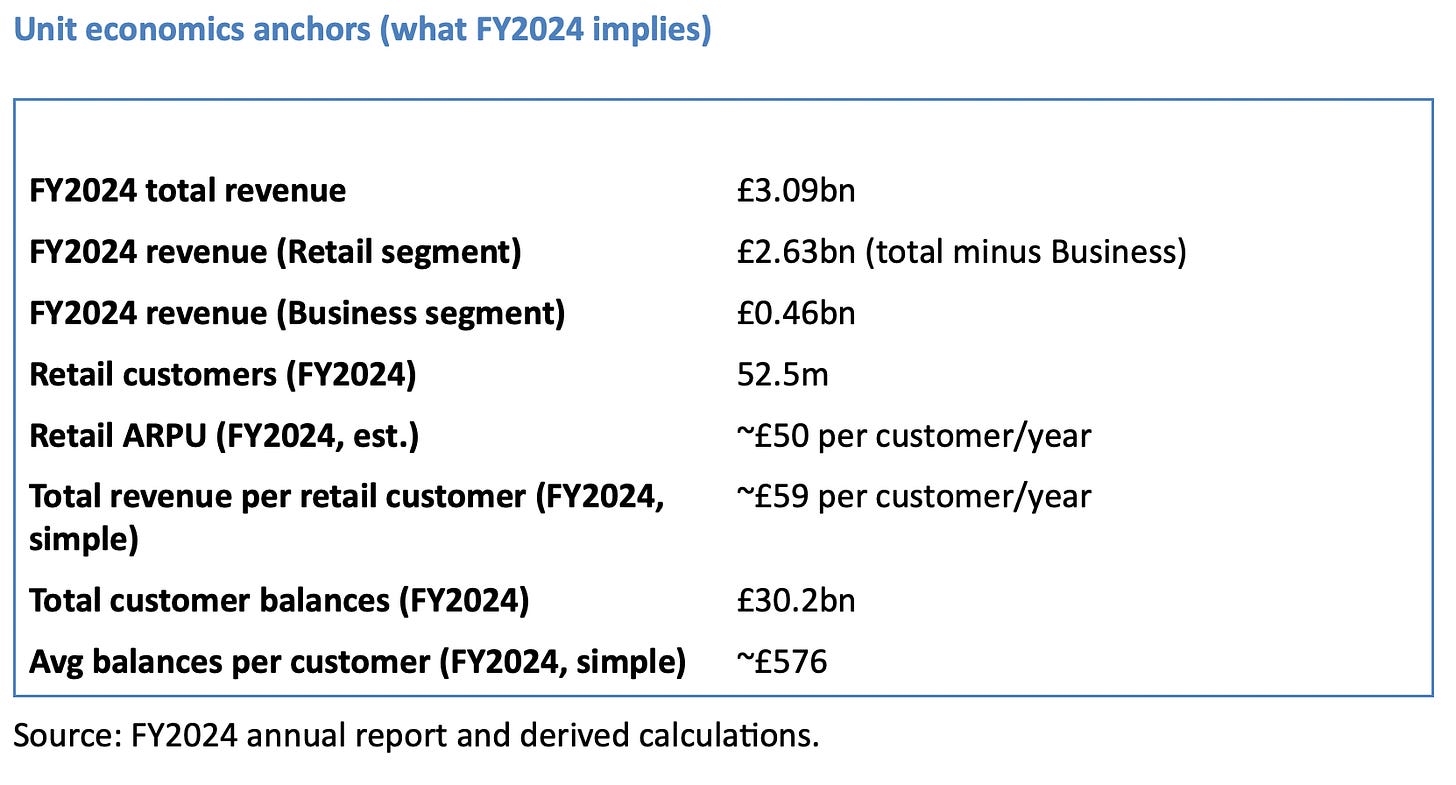

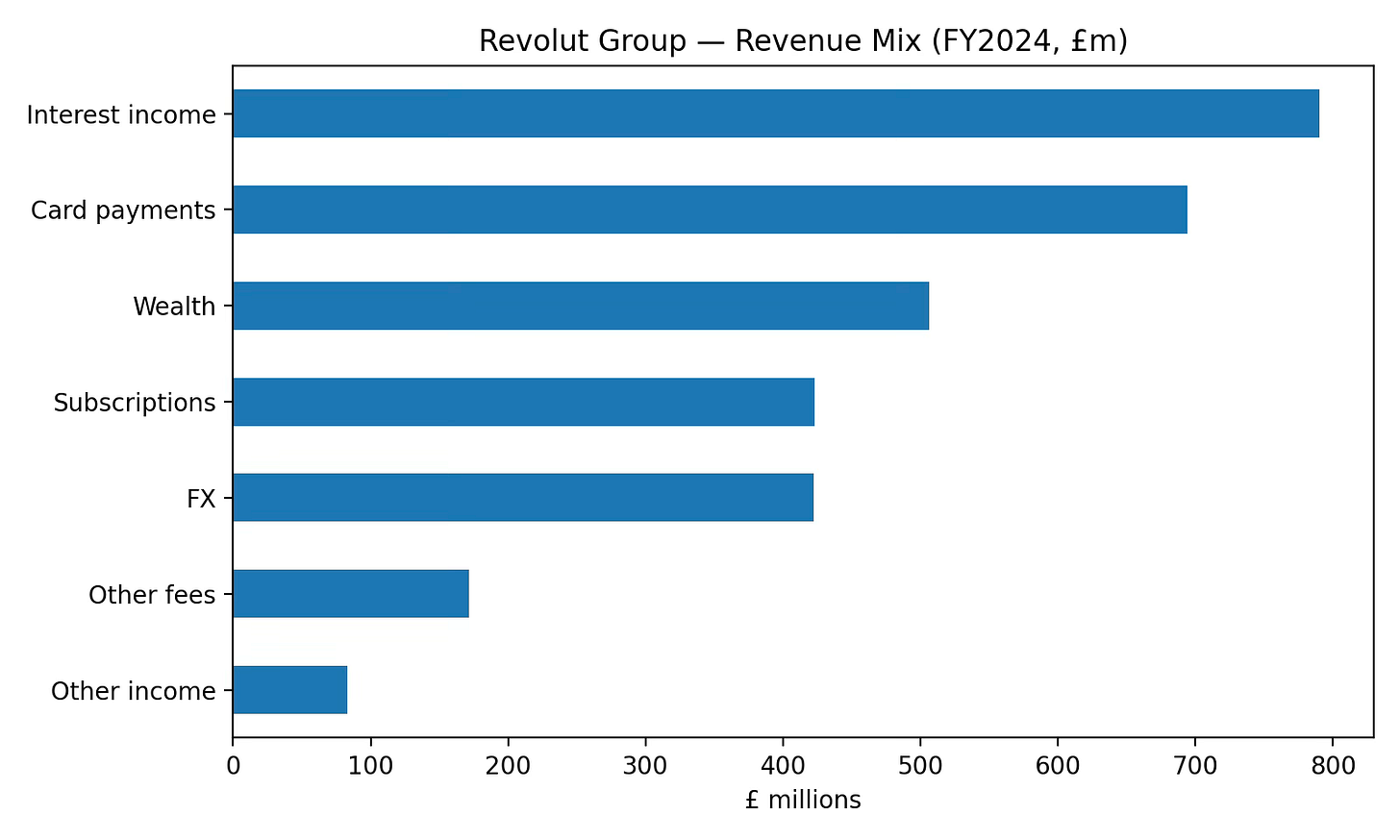

FY2024 revenue was £3.09bn, split primarily between fee income (£2.22bn) and interest income (£0.79bn), with a smaller contribution from other sources.

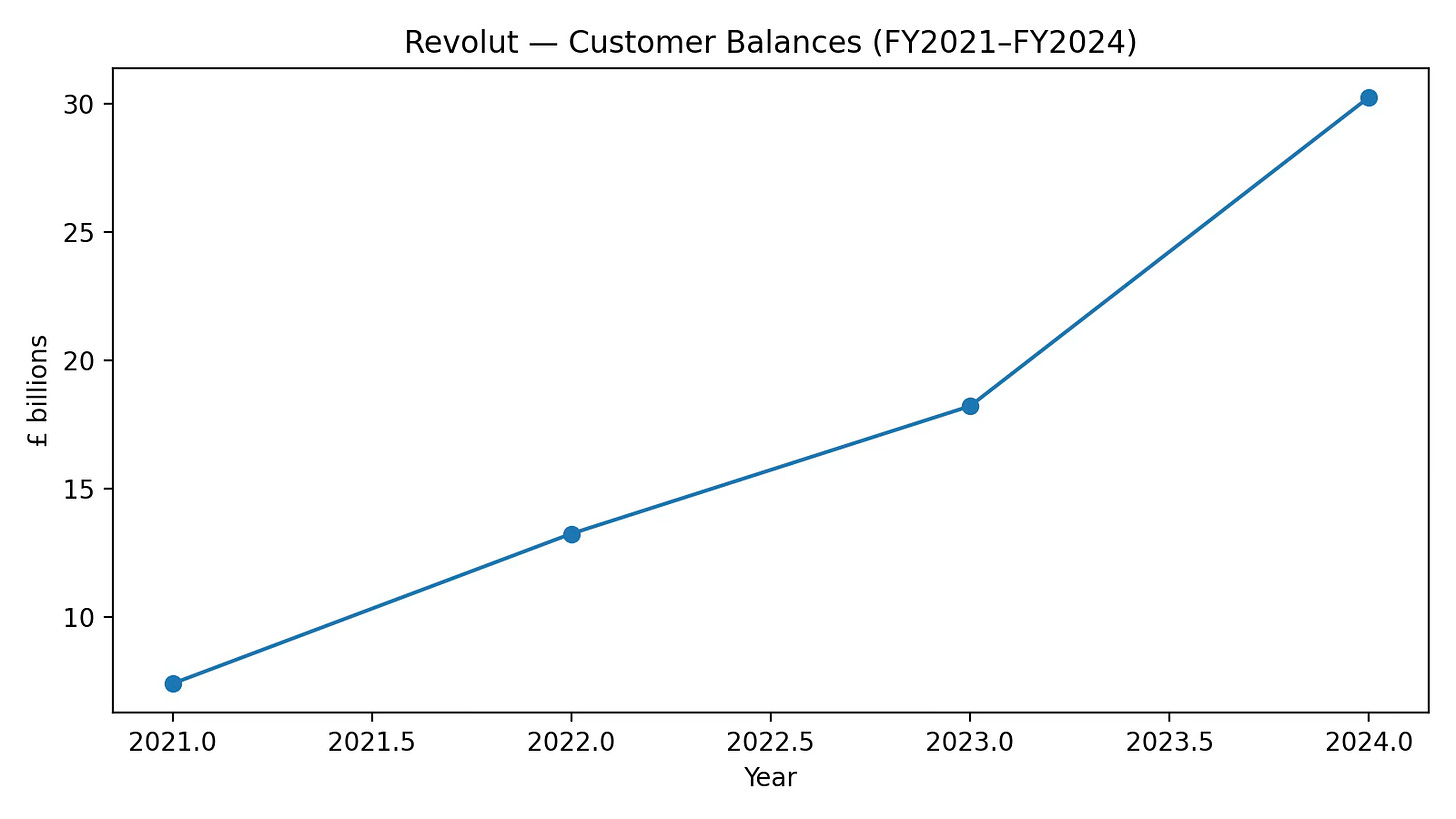

Revolut uses a freemium ladder. In the UK, public plan pricing ranges from free (Standard) to paid tiers like Plus (£3.99/month), Premium (£7.99/month), Metal (£14.99/month), and Ultra (premium tier). Prices and benefits vary by country, but the structure is consistent: higher limits + perks + better rates in exchange for monthly ARPU. Average account size is visible in balances. FY2024 total customer balances were ~£30.2bn, implying ~£576 per retail customer on average. Lifetime value (LTV) is not disclosed. A reasonable first‑order proxy is ARPU × expected retention period. Using FY2024 retail ARPU (~£50/year) and assuming multi‑year retention for a primary account, LTV is plausibly measured in the low‑hundreds of pounds per active retail customer, before considering multi‑product uplift (wealth, credit, subscriptions).

Retail distribution is predominantly product‑led. In FY2024, Revolut reported that over 65% of new customers joined organically or via referrals, a signal of both brand momentum and low CAC for the core account. Business distribution mixes self‑serve onboarding with more targeted acquisition for larger accounts and partnerships (e.g., Revolut Pay integrations).

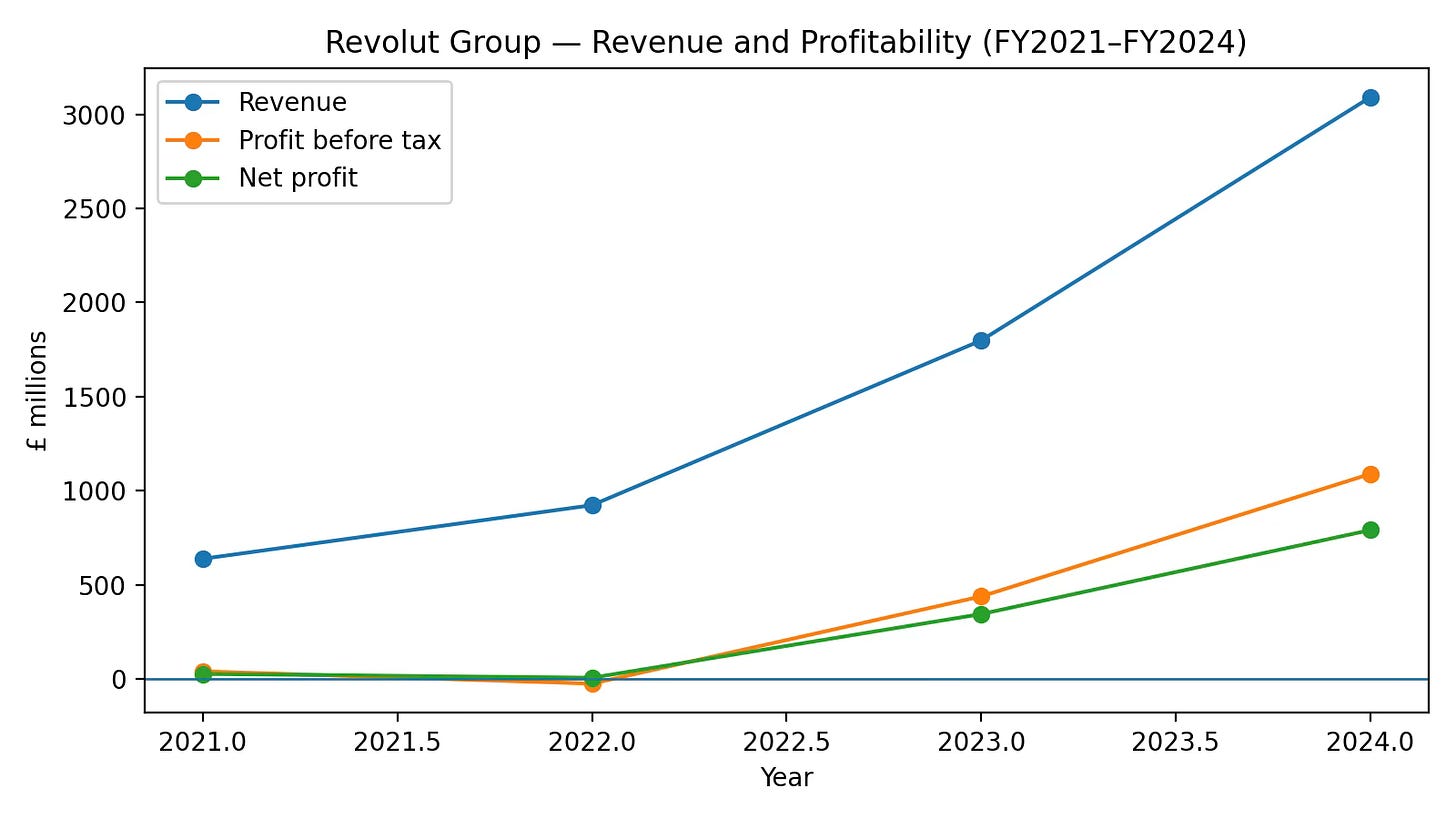

Financials

Revolut’s P&L tells a simple story: explosive revenue growth plus an increasingly meaningful net interest component. FY2024 revenue was £3.09bn, with profit before tax of £1.09bn and net profit of £0.79bn.

Revolut’s balance sheet is now large enough that it shapes strategy. At 31 Dec 2024, total assets were £25.85bn. Customer liabilities (deposits + e‑money and related customer balances) were £22.54bn, and equity was £2.57bn. The cash flow statement is dominated by growth in customer liabilities (deposits and e‑money), which is mechanically reflected as operating cash inflow. In FY2024, net cash from operating activities was £8.12bn and cash and cash equivalents ended the year at £15.91bn.

What changed between FY2023 and FY2024 (the drivers)

Fee income scaled with engagement: card payments, subscriptions, FX, and wealth all contributed to fee income growth.

Interest income grew with balances: higher customer balances and higher rates expanded interest income.

Cost discipline remained an operating principle: Revolut describes a zero‑based budgeting philosophy and continued investment in risk/compliance as headcount scaled.

The Endgame

Revolut aims for 100 million customers by mid‑2027, with entry into 30+ new markets by 2030. In five years, Revolut becomes a globally recognized, regulated financial institution where the app is the primary bank account for a meaningful slice of the world’s mobile‑first consumers.

Concretely, that world likely includes:

A broader, more bank‑like credit stack: unsecured lending at scale, plus mortgages in select markets where underwriting and funding economics make sense.

Physical touchpoints that reduce friction: a branded ATM network and potentially additional cash in / cash out infrastructure.

A tighter wealth loop: trading, savings, and long‑term investing integrated with everyday spend, so customers move from account to portfolio without changing apps.

A more explicit platform posture for merchants: Revolut Pay and business financial tooling embedded in partners’ checkout flows.

Institutional‑grade controls: audit, risk, and compliance capabilities that can survive the transition from private to public scrutiny.

The core question is whether Revolut can build a durable moat in an industry where products are easy to copy but trust is hard to earn. The moat is not the UI. it’s the compounding advantage of primary‑account behavior: low‑cost funding (balances), data for risk and fraud, and a distribution channel that can launch new products without paying for branches. The failure mode is also clear: regulatory lapses or trust shocks. Invert the problem: imagine the scandal, then build controls as if it’s inevitable. Revolut’s emphasis on fraud prevention, AML investment, and audit upgrading suggests it understands this.