The Leviathan’s UI: Palantir and the Shape of Modern Power

A sober look at software built for states and megacorporations.

Palantir builds software platforms that fuse an organization’s data with its day-to-day operations, so decisions can be made and executed securely at scale. The company is trying to become the software layer that turns analytics into action, where the consequences are real (war, factories, hospitals, supply chains).

The problem

Palantir’s customers (governments and enterprises) have plenty of data, but their operations still run on partial information and stale dashboards. The pain is that decisions happen in a hurry, while data is scattered across systems, access rules, and organizational silos. Palantir frames the job as integrating an institutions’s data and operations so users with different skills can’t collaborate.

Today’s default approach is a patchwork:

data warehouses/lakes + ETL pipelines

BI dashboards

point ML models built by specialized teams

long tail of custom sofware and system-integrator work

This works for reporting and incremental automation but breaks down when you need: (a) end-to-end traceability, (b) permissioning that propagates from source data to derived inputs, and (c) the ability to push decisions into live workflows.

Palantir highlights a failure mode in the typical data stack: data projects fail because pipelines are hard to understand and recreate, the kind of brittleness that turns data transformation into a perpetual migration.

The customer is buying time and certainty. Time because the implementation timeline matters, and certainty because the same data must mean the same thing across teams and tools. Palantir argues that recent crises and shocks make the usual timelines for new software not a viable option, pushing buyers toward solutions that can be ready in days rather than months or years.

The solution

Palantir treats operations as a first-calss product primitive. Instead of stopping at a data warehouse and hoping downstream teams build the last mile, Palantir builds an integrated system where data integration, governance, modeling, and operational workflows live in one continuous surface.

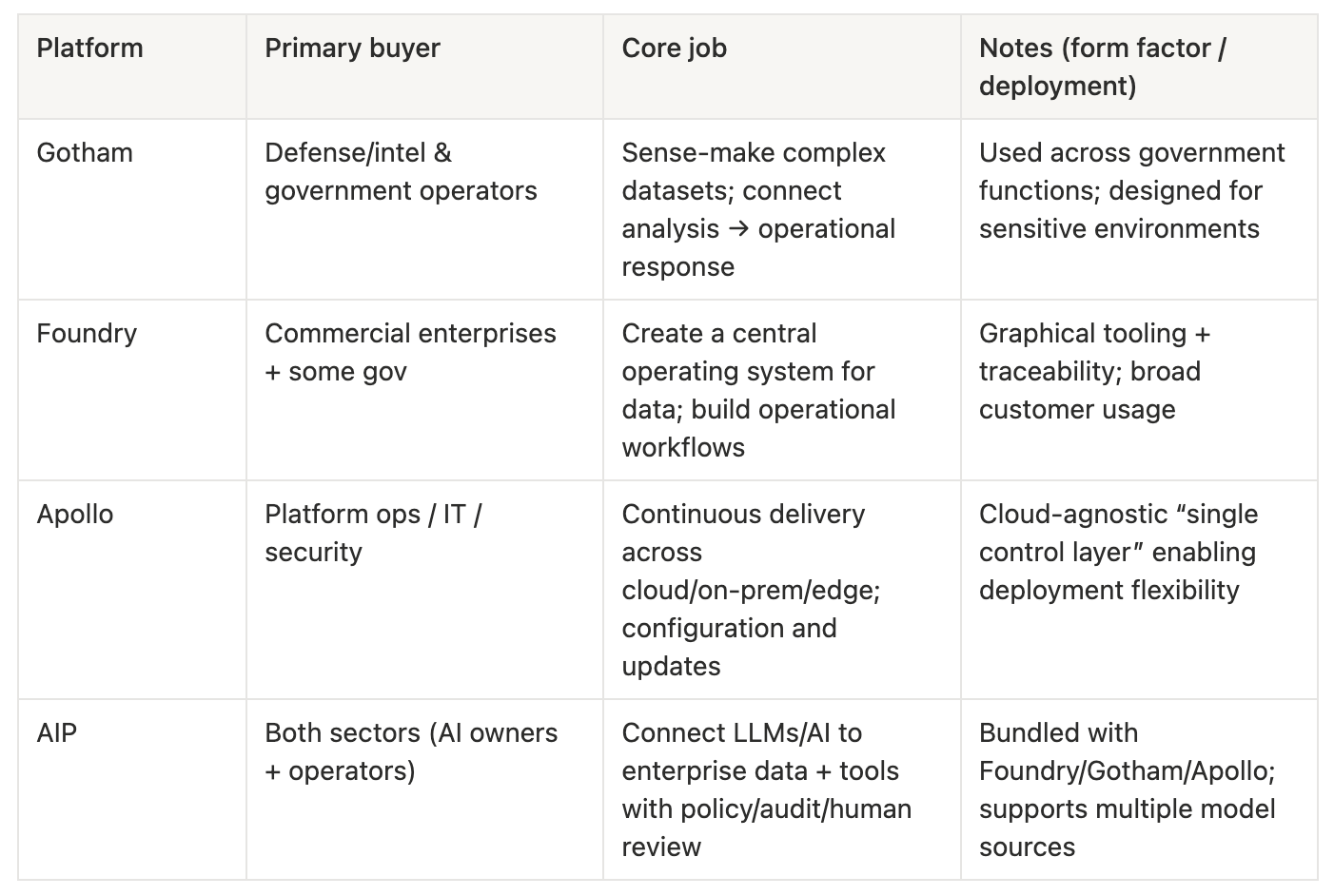

Gotham and Foundry turn information into an integrated data asset that reflects their operations, and AIP extends that surface so organizations can operationalize LLMs and other AI directly inside those platforms.

Uniqueness comes from end-to-end control of the stack:

Foundry/Gotham: unify data + semantics + permissions into an operational model.

Apollo: deliver software continuously across cloud / on‑prem / edge.

AIP: connect LLMs/agents to enterprise data with policy, audit, and human‑in‑the‑loop checkpoints.

This is hard to replicate because it spans what are usually separate buying centers (data engineering, security, ML, operations).

Can a non‑technical operator ask a question, get an answer, see the lineage, and then take an action, without breaking security rules or waiting two sprints for IT? Palantir says yes: engineers integrate sources, analysts transform data, data scientists write models, business users run workflows, leaders make decision, inside one environment:

Defense / intelligence: fusing signals, reports, and logistics into operational planning and execution loops (Gotham).

Manufacturing & supply chain: connecting demand, inventory, production constraints, and transportation into real‑time decisions (Foundry + operational apps).

Healthcare: operational planning (capacity, staffing) and data‑driven clinical workflows, with governance and audit trails.

Financial services: fraud/risk workflows that require explainability and strict access controls.

Enterprise AI rollouts: connecting LLMs to internal systems with fine‑grained policy, human review, and full auditability (AIP).

Why now?

Operational stakes are rising (geopolitical conflict, supply shocks), and AI is moving from demos to deployment, forcing enterprises to connect models to real systems. Customers can no longer tolerate multi‑year implementation timelines, shifting the willingness‑to‑buy toward platforms that can be deployed quickly.

Three constraints historically blocked this category:

Compute and cloud maturity: continuous delivery across heterogeneous environments (including edge/on‑prem) was brittle and expensive.

Data governance as a product: fine‑grained controls that propagate from source data to derived outputs are hard to retrofit into ad‑hoc pipelines.

AI usability gap: until LLMs and modern ML tooling, there was no strong pull for agentic interfaces into enterprise operations.

Palantir’s platform set, Apollo for delivery and AIP for controlled LLM integratio, maps directly onto these historical gaps.

A simplified lineage:

1990s–2000s: data warehouses and BI for reporting.

2010s: data lakes + big‑data tooling, but limited operational integration.

Late 2010s–early 2020s: cloud data platforms and MLOps; still mostly model building rather than model use.

2023–2026: LLMs shift the UI and raise the stakes for governance, because the model can now act.

Gartner’s AI spending forecasts underscore the timing: worldwide AI spending was forecast at $2.52T in 2026, with large increases in AI software and platforms.

Recent trends that favor Palantir’s approach:

AI embedded in incumbents: Gartner expects AI to be sold largely via incumbent vendors during the 2026 trough of disillusionment, making integration and governance more important than novelty.

Software spend still rising: Gartner forecasts software spending growth into 2026, with global software spend projected at $1.43T in 2026.

Security/sovereignty pressure: enterprises and governments increasingly demand deployment flexibility (sovereign cloud, on‑prem, edge) rather than pure SaaS.

Palantir’s combination of Apollo (deployment flexibility) and AIP (controlled AI) reads as a product shaped by these constraints.

The market potential

Palantir’s core buyers share three traits:

High-stakes operations (mission-critical, regulated, or safety-critical).

Complex data reality (many systems, many formats, many permissions).

A mandate to deploy AI responsibly (auditable, governed, and secure).

This spans U.S. and allied government agencies (defense, intelligence, civil), and commercial sectors where operational decisions compound (industrial, energy, logistics, healthcare, financial services).

Palantir describes Foundry as a central operating system for institutions and industries, which is a category-creation move, an operational layer (not BI, not a data warehouse, not a system integrator) above data that can drive workflows. The AIP layer attempts a second category move, enterprise LLMs with controls, where agents can act, but every action is governed and auditable.

A Palantir-shaped customer:

has already spent heavily on data infrastructure

still cannot answer operational questions without manual reconciliation

must enforce strict access policies

wants to turn AI into workflows rather than experiments

These are also the customers most likely to reject multi-year build cycles, the timeline pressure Palantir highlights.

Partner/customer examples

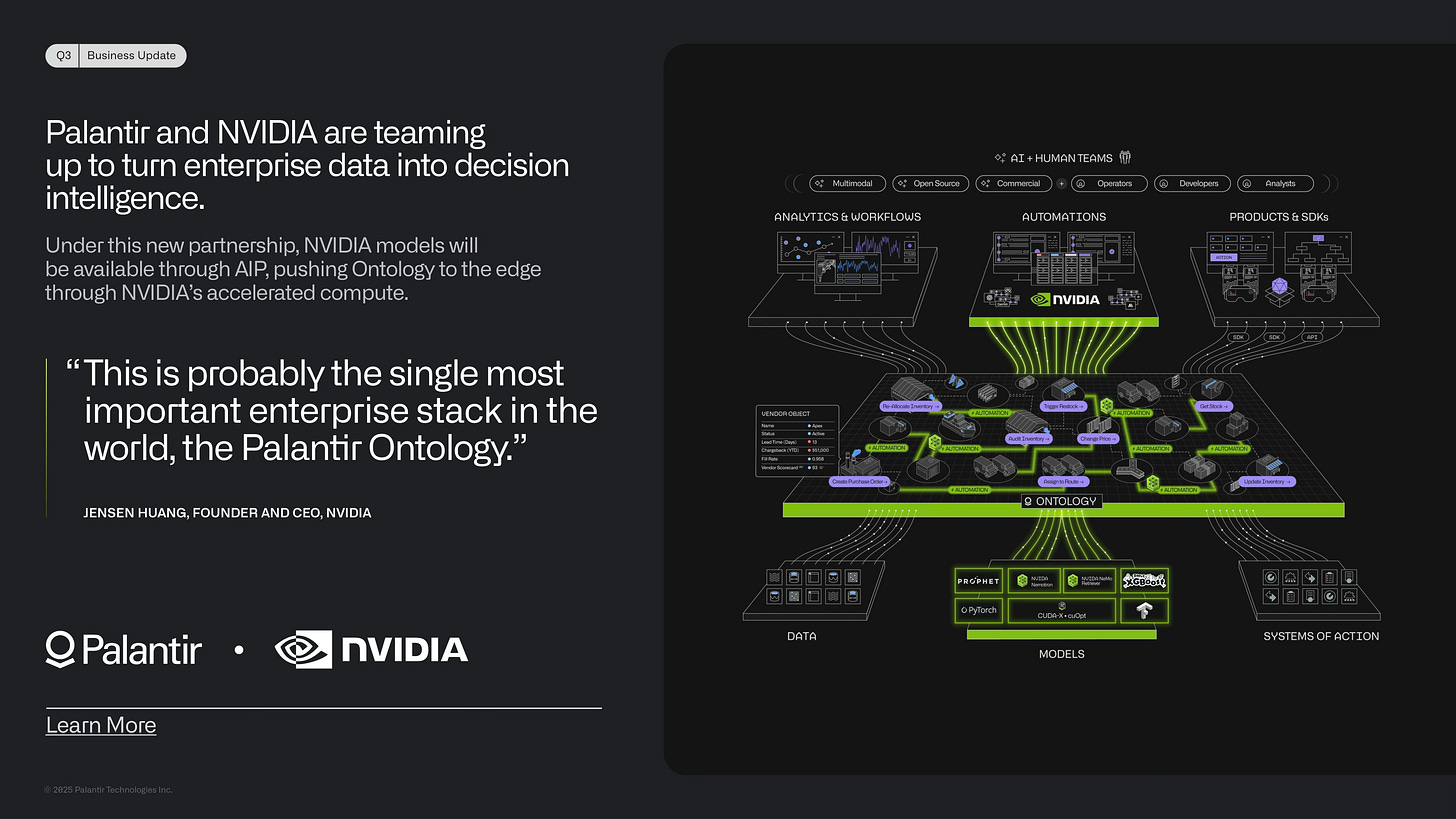

NVIDIA partnership to operationalize AI using Palantir’s Ontology and AIP (including reference to Lowe’s supply chain work).

HD Hyundai group-wide partnership expansion (industrial/shipbuilding footprint).

Accenture partnership expansion to help enterprises scale AI and operational decision making.

These logos sit at different chokepoints: hyperscaler/compute (NVIDIA), heavy industry (Hyundai), and implementation/distribution (Accenture).

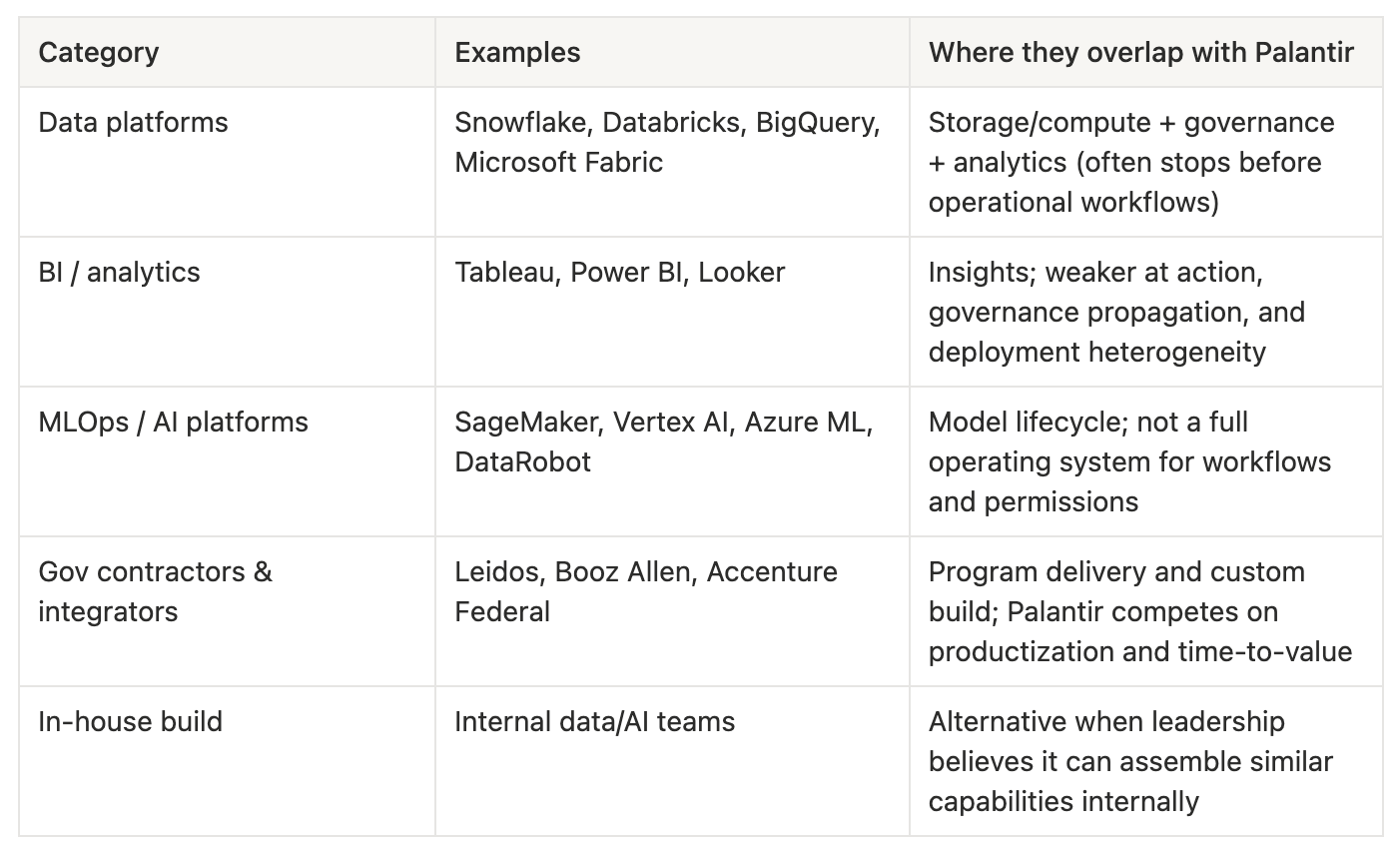

The competition

Palantir characterizes its competitive set as broad: large enterprise software companies, government contractors, system integrators, emerging companies, and in‑house development projects favored by internal IT departments.

A credible plan to win against the above categories must answer two questions: why buy a unified platform instead of assembling a stack, and why Palantir’s unified platform instead of someone else’s.

Palantir’s answer: time-to-operational-value + governance + deployment flexibility. The company argues customers increasingly choose software that can be ready in days over internal development that takes months/years, especially under crisis timelines:

End-to-end stack (Gotham/Foundry + Apollo + AIP) rather than a single layer.

Deployment anywhere (cloud, on‑prem, edge) with continuous delivery via Apollo.

Fine‑grained access controls and auditability designed to propagate across data, analysis, and actions.

Reporting and operational workflows and systems of action orientation.

High-stakes credibility: long history in defense/intelligence plus expanding commercial footprint.

The product

Palantir’s product surface is best understood as four tightly coupled platforms (plus packaging around them): Gotham (government ops), Foundry (enterprise ops), Apollo (delivery/control), and AIP (LLM/agent layer). Palantir treats these as the principal platforms, designed to integrate customer data and operations and run across virtually any environment.

Foundry/Gotham define the operational truth (data + semantics + permissions); Apollo ensures the software runs and updates wherever it must run; AIP attaches modern LLM/agent capabilities while preserving governance and auditability.

Palantir does not publish a single, unified roadmap, but product announcements reveal direction:

AI forward deployed engineer (AI FDE): natural-language operation of Foundry, with explicit controls over context and tools.

AIP Analyst: chat-based ontology exploration and analysis with transparent ‘shows its work’ lineage.

Deeper interoperability: e.g., working directly with Snowflake tables inside code workspaces, and improved observability/log streaming.

The common thread: reduce time from question → governed action, while expanding interoperability with the modern data ecosystem.

AI FDE is a telling roadmap bet: it turns Palantir from a platform you operate into a platform that can be operated for you, while still enforcing the platform’s access control model. This makes adoption easier (broader user base) without weakening governance.

The business model

Palantir is trying to do something rare in enterprise software: compound a product business while keeping a services-heavy go-to-market that drives fast time-to-value. The company’s durability depends on converting deployment success into renewals and expansions, i.e., landing with a focused use case and then becoming the operating substrate for more of the institution.

Revenue is primarily subscription (platform access) plus services. Contract terms are typically one to five years, with revenue recognized ratably over the contract term. Palantir also notes many contracts include termination-for-convenience provisions (especially in government).

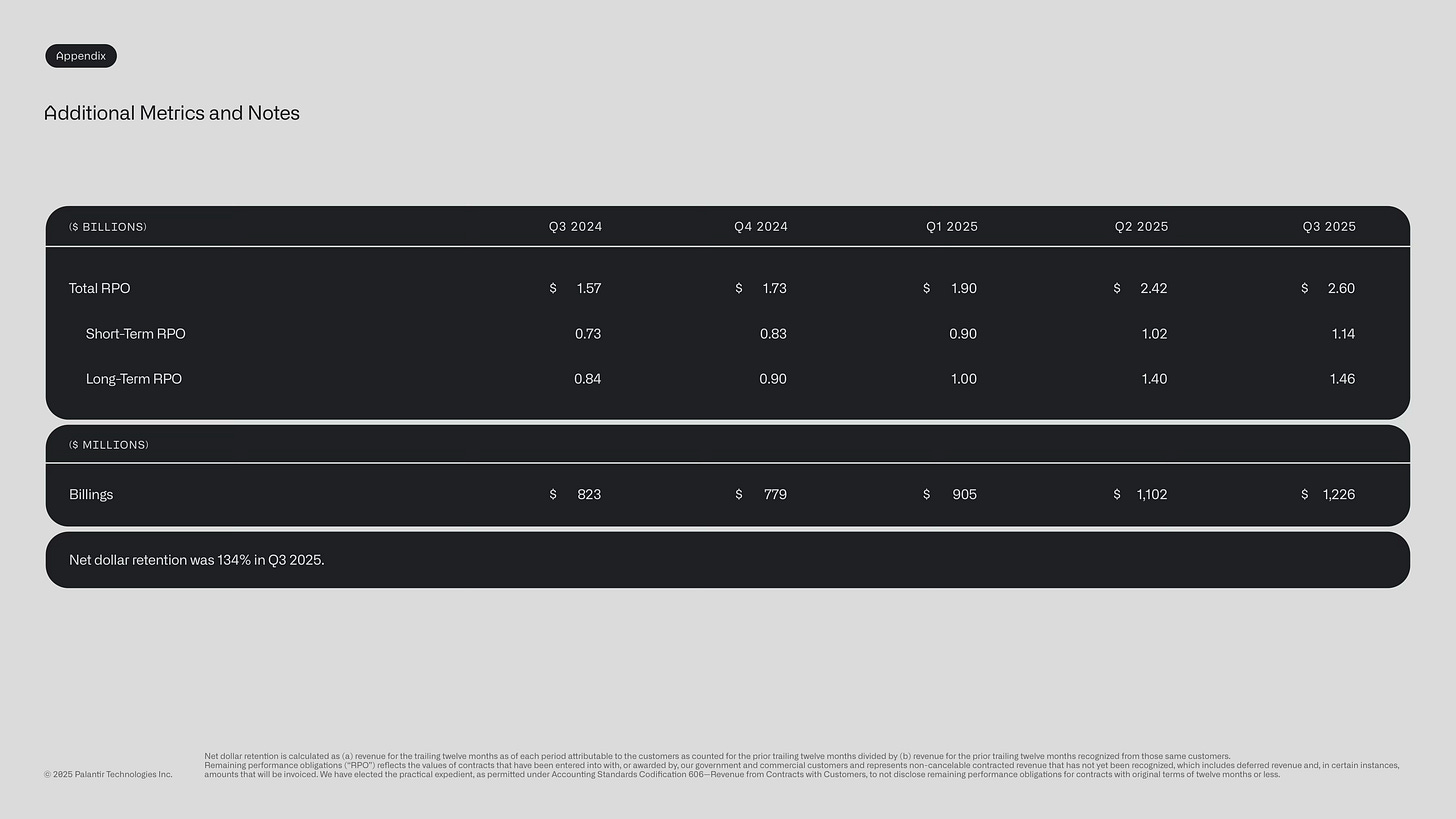

Palantir does not publish a simple per-seat price list; pricing is commonly contract-based and shaped by deployment scope (users, compute, environments, support, and compliance). The more reliable way to understand pricing is through the contract value metrics Palantir discloses (TCV/ACV/RDV/RPO) and the volume of $1M/$5M/$10M+ deals closed per quarter.

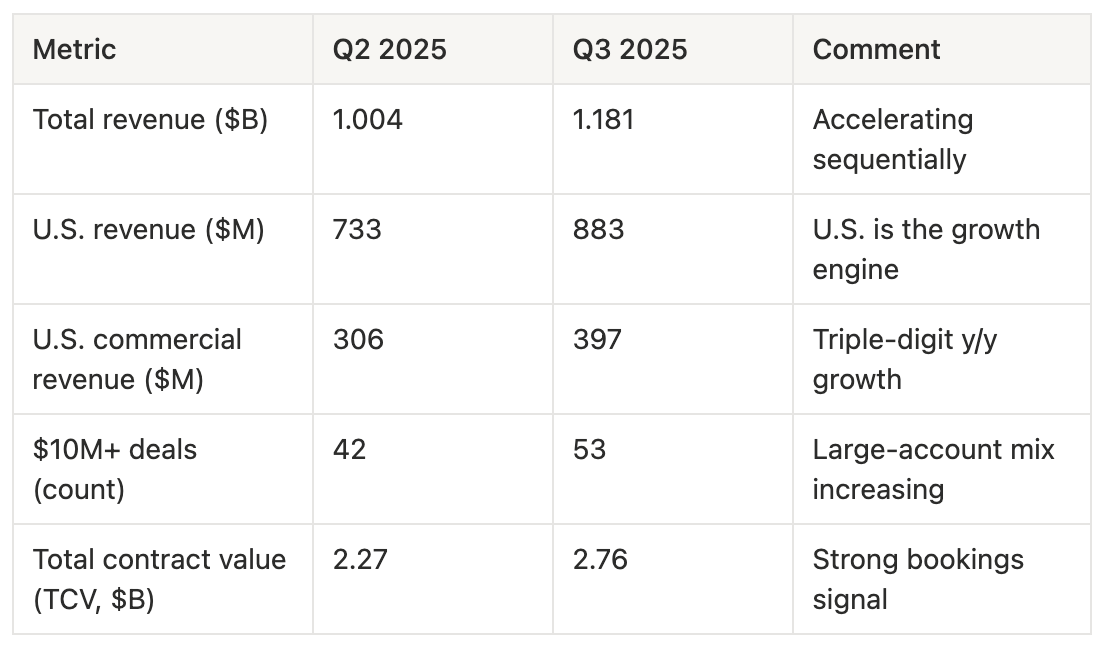

In Q2 2025, Palantir closed 42 deals of at least $10M; in Q3 2025, it reported 53 such deals. This indicates an increasing mix of large accounts capable of meaningful annual spend.

Using segment revenue and customer counts, you can estimate a rough revenue-per-customer range, but management metrics (ACV/RDV) are a better truth source than a simple average.

Practically: Palantir is priced like infrastructure, because it behaves like infrastructure once embedded.

Go-to-market blends direct enterprise sales with deep implementation support. Palantir emphasizes that expansion depends on the company’s ability to help customers identify new use cases, modernize data architectures, and succeed with data-driven initiatives, i.e., a product sold with operational accompaniment.

Distribution partnerships are increasingly relevant as the market broadens. For example, Accenture and Palantir expanded their partnership in late 2025 to help organizations scale AI and improve operational decision making by integrating siloed data, effectively using Accenture as a multiplier for enterprise reach.

We can triangulate pipeline quality from disclosed leading indicators:

Large-deal cadence ($10M+ deals per quarter).

U.S. commercial TCV and remaining deal value growth.

Net dollar retention and RPO.

These are the metrics that typically move first before revenue does.

The team

Palantir is founder-led and an opinionated enterprise software company. The company was founded in 2003 and began with U.S. intelligence community work before expanding to commercial enterprises facing similar data-operational challenges.

Key executive officers include Alexander Karp (CEO), Stephen Cohen (President), Shyam Sankar (CTO), David Glazer (CFO), and Ryan Taylor (CRO and CLO).

Palantir’s culture is part of the product. It sells a posture: fast deployment, strong opinions about Western-aligned missions, and willingness to operate in sensitive environments. That posture creates differentiation in government and regulated enterprise, but it also raises reputational and procurement risk, a dynamic Palantir repeatedly acknowledges in risk-factor framing (competition, social/media scrutiny, and AI-related liability).

The financials

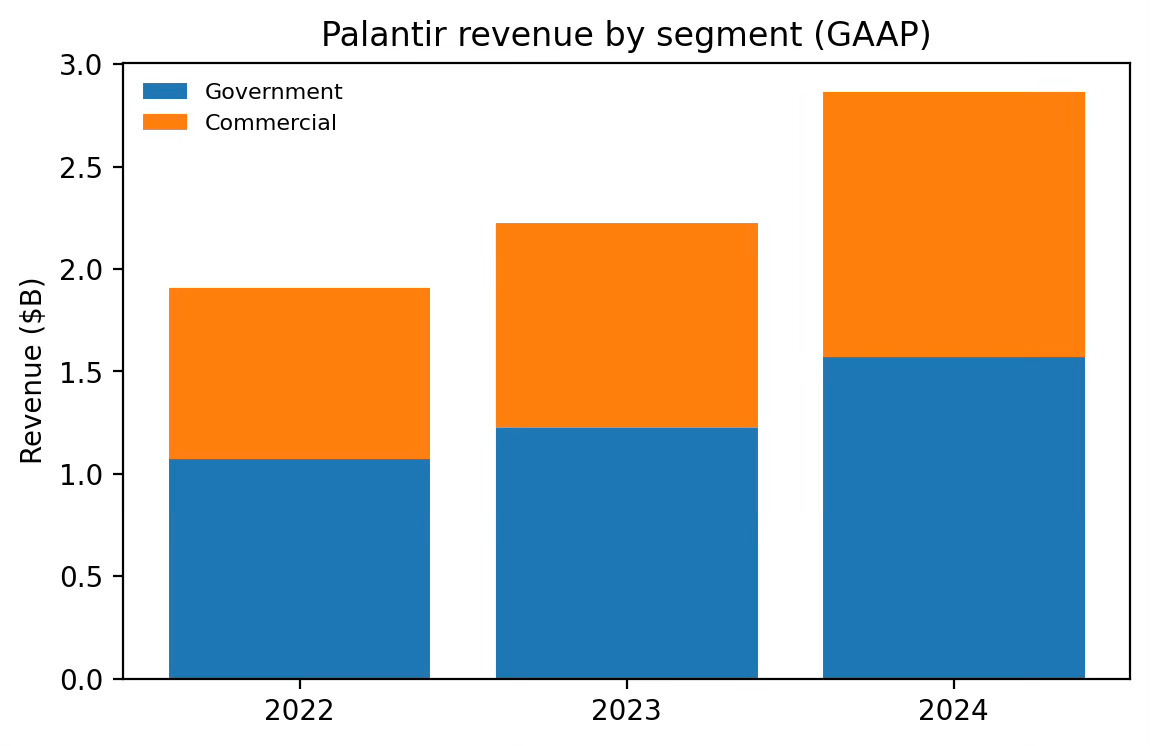

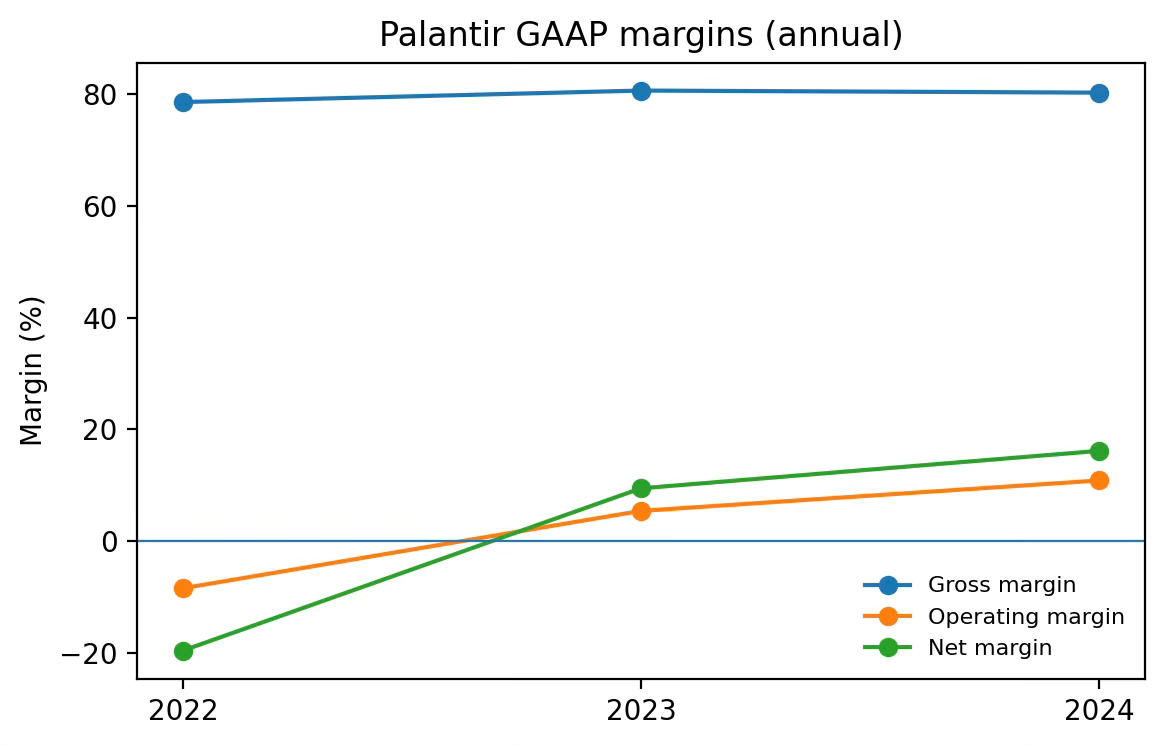

A compact view of Palantir’s GAAP P&L shows a clear story: revenue growth, strong gross margins, and expanding operating profitability. The company also emphasizes non‑GAAP measures that exclude stock‑based compensation; in this section, we keep GAAP front-and-center and treat non‑GAAP as supplemental.

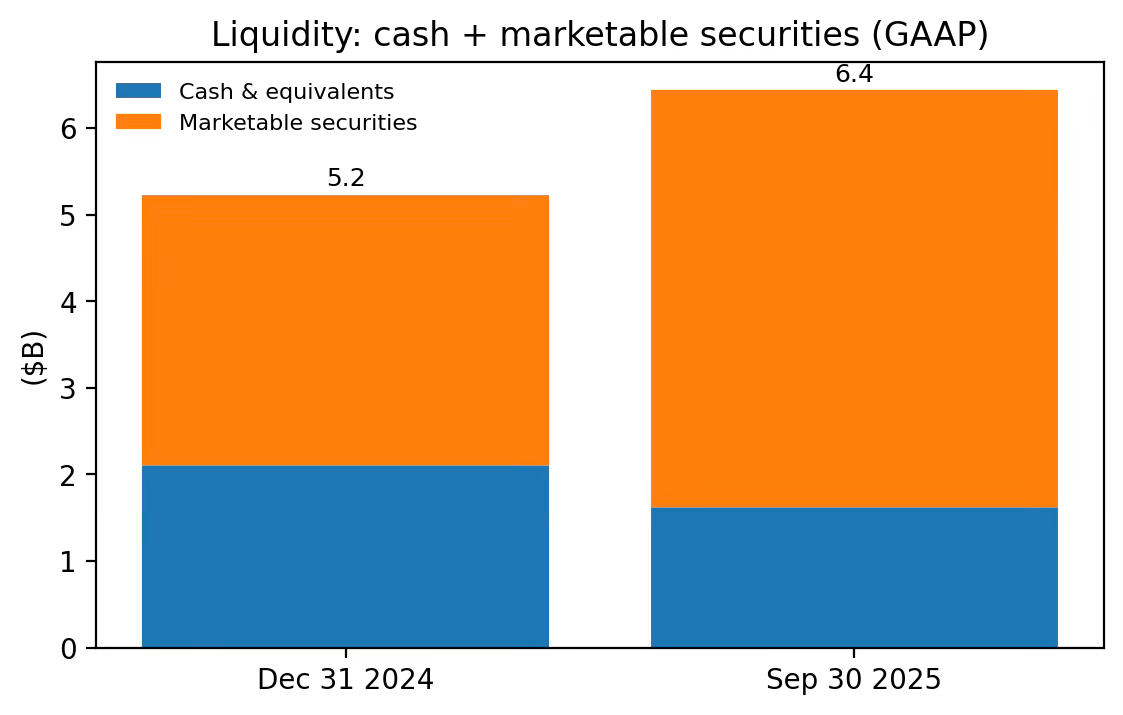

Palantir’s balance sheet is defined by liquidity. As of Dec 31, 2024, the company reported $5.2B of cash/cash equivalents and short-term U.S. Treasury securities and no outstanding debt. In the Q3 2025 10‑Q, liquidity composition shifts (more marketable securities) while remaining sizable.

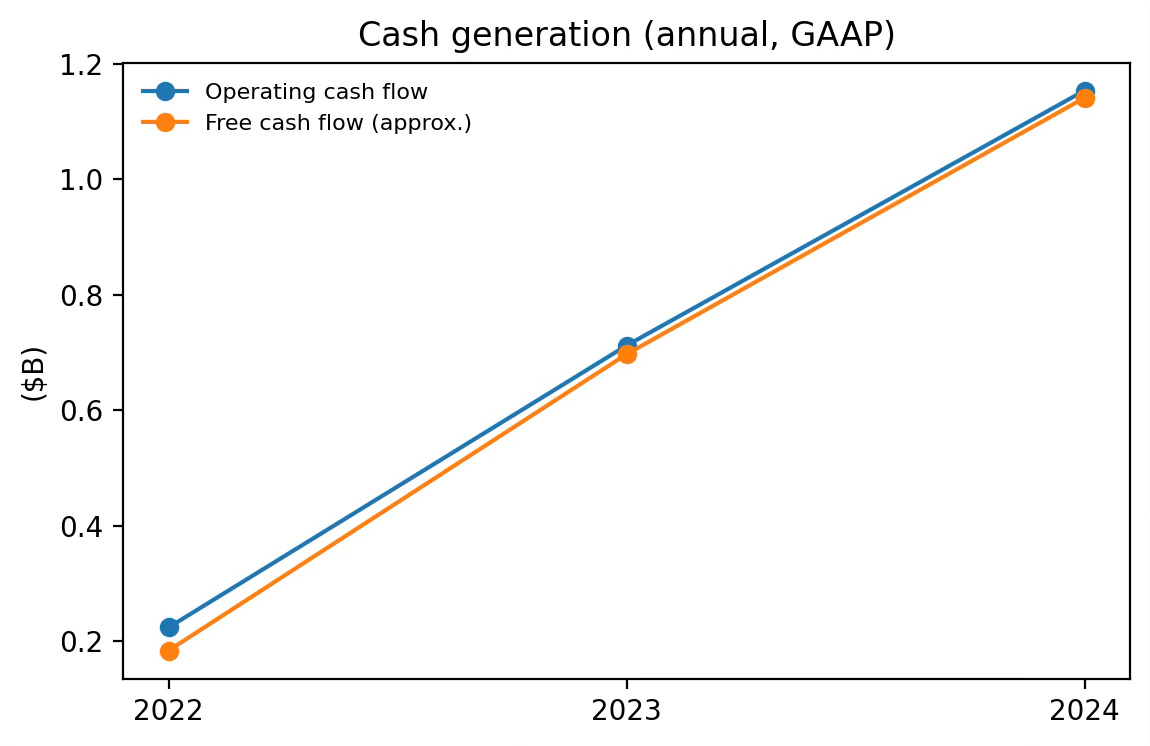

Cash generation is one of the company’s strongest reported signals. Operating cash flow has risen materially since 2022, with low capex relative to revenue (as expected for a software business). Palantir also emphasizes adjusted free cash flow in earnings releases; the chart below uses a simple GAAP approximation: OCF minus capex.

What matters most in the next 12–24 months:

Sustaining U.S. commercial growth without sacrificing margins (a high bar, but the recent trend is strong).

Converting large TCV/RDV into durable revenue (watch RPO, retention, and customer count growth).

Managing AI-related reputational and liability risk as AIP expands into more workflows.

Operating leverage vs. stock-based compensation optics (GAAP vs. non‑GAAP narrative).

The vision

Palantir aims to be the governed operational layer where enterprise and government decisions are made, audited, and executed, by humans and AI, across any environment.

If Palantir executes cleanly, the 5‑year end state looks like this:

A default operating layer for operational AI in regulated and asset-heavy enterprises.

A durable mission platform for U.S. and allied governments where decision advantage is existential.

A productized ecosystem where pieces of the platform become stand‑alone offerings (Palantir says it is identifying component parts embedded within platforms that could become independent products).

Palantir becomes less a set of applications and more an enterprise control plane for data + AI + action.

What has to be true for that vision to hold:

AIP becomes the safe default interface for agents and humans to act on enterprise data (not just chat on top of it).

Apollo’s deployment story stays differentiated as sovereignty and edge requirements expand.

Commercial growth stays broad-based (more customers) while sustaining large-account expansion (bigger customers).

Partner distribution (e.g., with Accenture) scales.

Governance and reputational risks remain manageable as AI use cases touch more sensitive workflows.

References

Palantir Technologies Inc.. Annual Report on Form 10‑K for fiscal year ended Dec 31, 2024 (pltr‑20241231). Filed Feb 18, 2025. https://www.sec.gov/Archives/edgar/data/1321655/000132165525000022/pltr-20241231.htm

Palantir Technologies Inc.. Annual Report on Form 10‑K for fiscal year ended Dec 31, 2023 (pltr‑20231231). Filed Feb 20, 2024. https://www.sec.gov/Archives/edgar/data/1321655/000132165524000022/pltr-20231231.htm

Palantir Technologies Inc.. Quarterly Report on Form 10‑Q for quarter ended Sep 30, 2025 (pltr‑20250930). Filed Nov 2025. https://www.sec.gov/Archives/edgar/data/1321655/000132165525000131/pltr-20250930.htm

Palantir Technologies Inc.. Exhibit 99.1 — Q3 2025 earnings release. Nov 3, 2025. https://www.sec.gov/Archives/edgar/data/1321655/000132165525000130/a2025q3ex991earningsrelease.htm

Palantir Technologies Inc.. Exhibit 99.1 — Q2 2025 press release. Aug 4, 2025. https://www.sec.gov/Archives/edgar/data/1321655/000132165525000105/a2025q2ex991pressrelease.htm

Palantir Technologies Inc.. Q3 2025 Investor Presentation (PDF). Nov 2, 2025. https://investors.palantir.com/files/Palantir%20-%20Q3%202025%20Investor%20Presentation.pdf

Palantir Technologies Inc.. Definitive Proxy Statement (2025 annual meeting). Apr 11, 2025. https://materials.proxyvote.com/Approved/69608A/20250411/NOMNP_605366.PDF

Palantir Technologies Inc.. Palantir Reports Q4 2024 Results (Business Wire release). Feb 2, 2025. https://www.businesswire.com/news/home/20250202290495/en/Palantir-Reports-Q4-2024-Revenue-Growth-of-36-YY-U.S.-Revenue-Growth-of-52-YY-Issues-FY-2025-Revenue-Guidance-of-31-YY-Growth-Eviscerating-Consensus-Estimates

Palantir Technologies Inc.. Palantir Announces Date of Fourth Quarter 2025 Earnings Release and Webcast (Business Wire release). Jan 12, 2026. https://www.businesswire.com/news/home/20260112206546/en/Palantir-Announces-Date-of-Fourth-Quarter-2025-Earnings-Release-and-Webcast

Palantir Technologies Inc.. Foundry Announcements — November 2025 (docs). Nov 2025. https://www.palantir.com/docs/foundry/announcements/2025-11

Gartner, Inc.. Gartner Forecasts Worldwide IT Spending to Grow 9.8% in 2026, Exceeding $6 Trillion For the First Time. Oct 22, 2025. https://www.gartner.com/en/newsroom/press-releases/2025-10-22-gartner-forecasts-worldwide-it-spending-to-grow-9-point-8-percent-in-2026-exceeding-6-trillion-dollars-for-the-first-time

Gartner, Inc.. Gartner Says Worldwide AI Spending Will Total $2.5 Trillion in 2026. Jan 15, 2026. https://www.gartner.com/en/newsroom/press-releases/2026-1-15-gartner-says-worldwide-ai-spending-will-total-2-point-5-trillion-dollars-in-2026

Stockholm International Peace Research Institute (SIPRI). Trends in World Military Expenditure, 2024. Apr 28, 2025. https://www.sipri.org/publications/2025/sipri-fact-sheets/trends-world-military-expenditure-2024

NVIDIA. Palantir and NVIDIA Team Up to Operationalize AI — Turning Enterprise Data Into Dynamic Decision Intelligence. Oct 28, 2025. https://investor.nvidia.com/news/press-release-details/2025/Palantir-and-NVIDIA-Team-Up-to-Operationalize-AI--Turning-Enterprise-Data-Into-Dynamic-Decision-Intelligence/

Palantir Technologies. AI Infrastructure and Ontology (Palantir blog). Oct 28, 2025. https://blog.palantir.com/ai-infrastructure-and-ontology-78b86f173ea6

Palantir Technologies Inc.. HD Hyundai and Palantir Expand Group-Wide Strategic Partnership (Business Wire release). Jan 20, 2026. https://www.businesswire.com/news/home/20260120055504/en/HD-Hyundai-and-Palantir-Expand-Group-Wide-Strategic-Partnership

Accenture and Palantir. Accenture and Palantir Expand Global Strategic Partnership to Drive AI Reinvention (Business Wire release). Dec 16, 2025. https://www.businesswire.com/news/home/20251216150307/en/Accenture-and-Palantir-Expand-Global-Strategic-Partnership-to-Drive-AI-Reinvention

Exceptional breakdown of how Palantir positions itself as operational infrastructure rather than just analytics. The framing of "time-to-operational-value" vs traditional multi-year builds is spot-on, especially when paired with Apollo's deployment flexibilty across sovereign/edge environments. Saw similar dynamics at a manufacturng client where governance propagation from source to derived outputs became the real blocker, not the ML models themselves.