The CRM Is a Tax. Day AI Wants to Repeal It.

How an AI-native context graph turns customer conversations into pipeline actions.

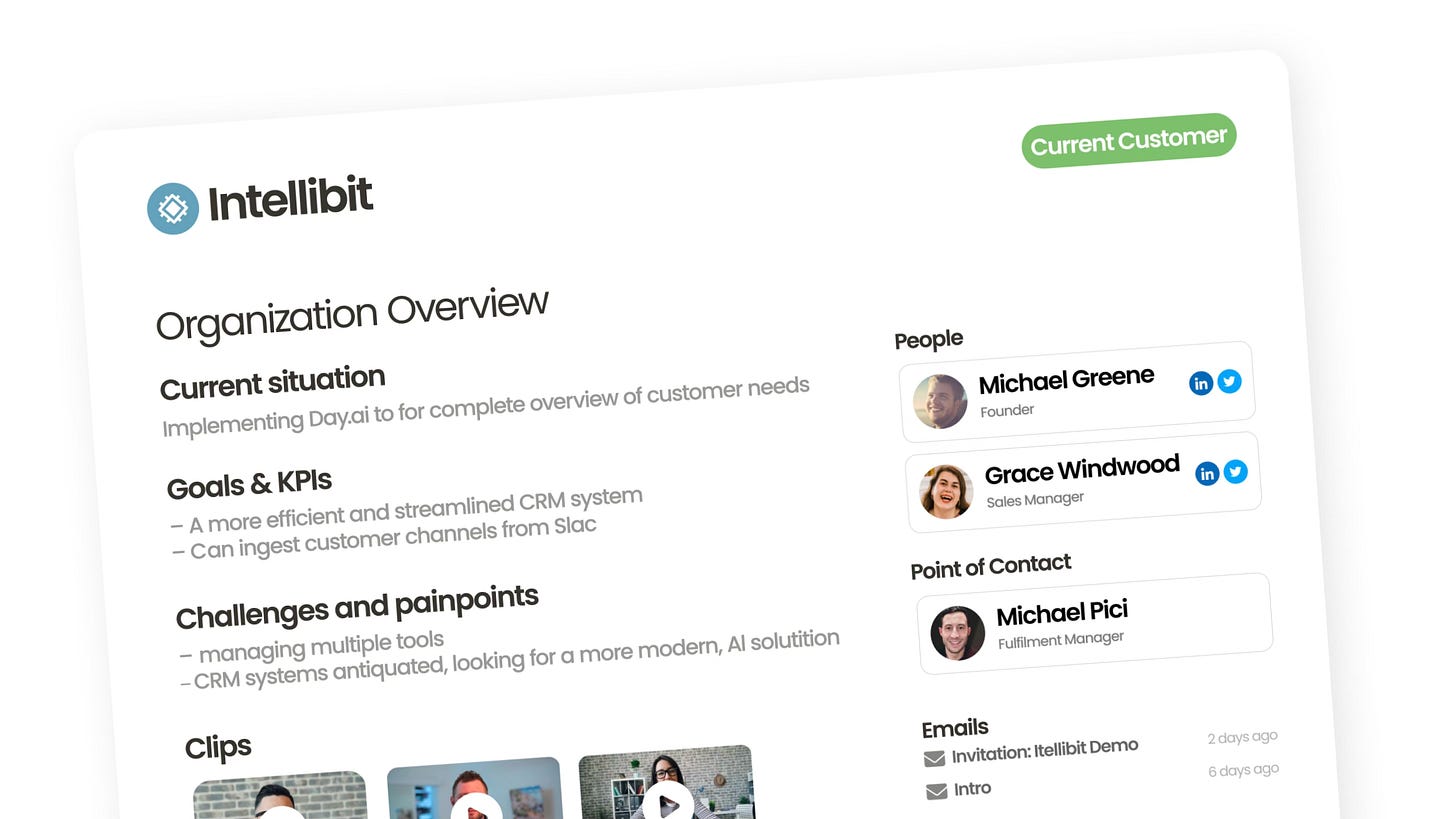

Day AI builds an AI-native CRM (CRMx) that turns customer conversations into structured context so AI assistants can answer questions and execute go-to-market work. The company markets a bundle (meeting assistant, CRM, knowledge base, automation) but the durable core is the data model: a context graph designed for AI agents. Day AI frames the mission as restoring speed and clarity: reducing CRM from a system of delay to a system of action, with transparent reasoning behind updates.

The CRM Tax

The customer pain is cognitive overhead. CRM work is a tax on attention: logging data, reconstructing context, and fearing that something important will fall through the cracks. Day AI also targets a second-order pain: even when teams do the work, the resulting CRM is a compressed and often misleading representation of reality (drop-downs instead of narratives, checkboxes instead of nuance).

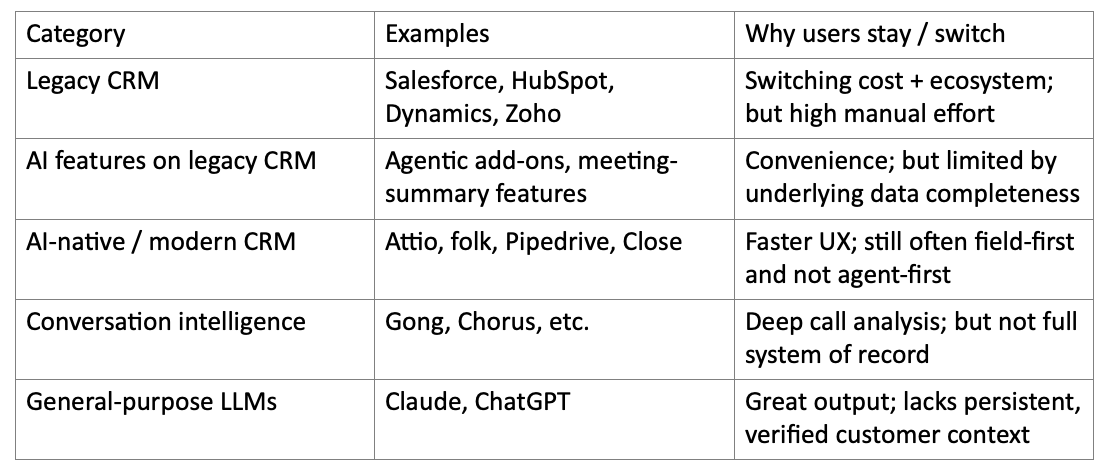

Status quo solutions split into three camps:

Legacy CRMs (Salesforce, HubSpot, etc.) that require humans to maintain structured fields; they struggle with completeness and freshness.

Bolt-on tooling (meeting assistants, revenue intelligence, enrichment, workflow automations) that adds more surfaces and integrations, but does not fix the underlying data model.

Ad-hoc AI usage (copy-paste transcripts into Claude/ChatGPT) that produces helpful drafts but lacks persistent, verified business context.

Day AI is explicit that simply bolting”AI onto legacy CRM cannot deliver trustworthy, end-to-end understanding because the underlying system is incomplete and fragmented.

Conversations → Context → Actions

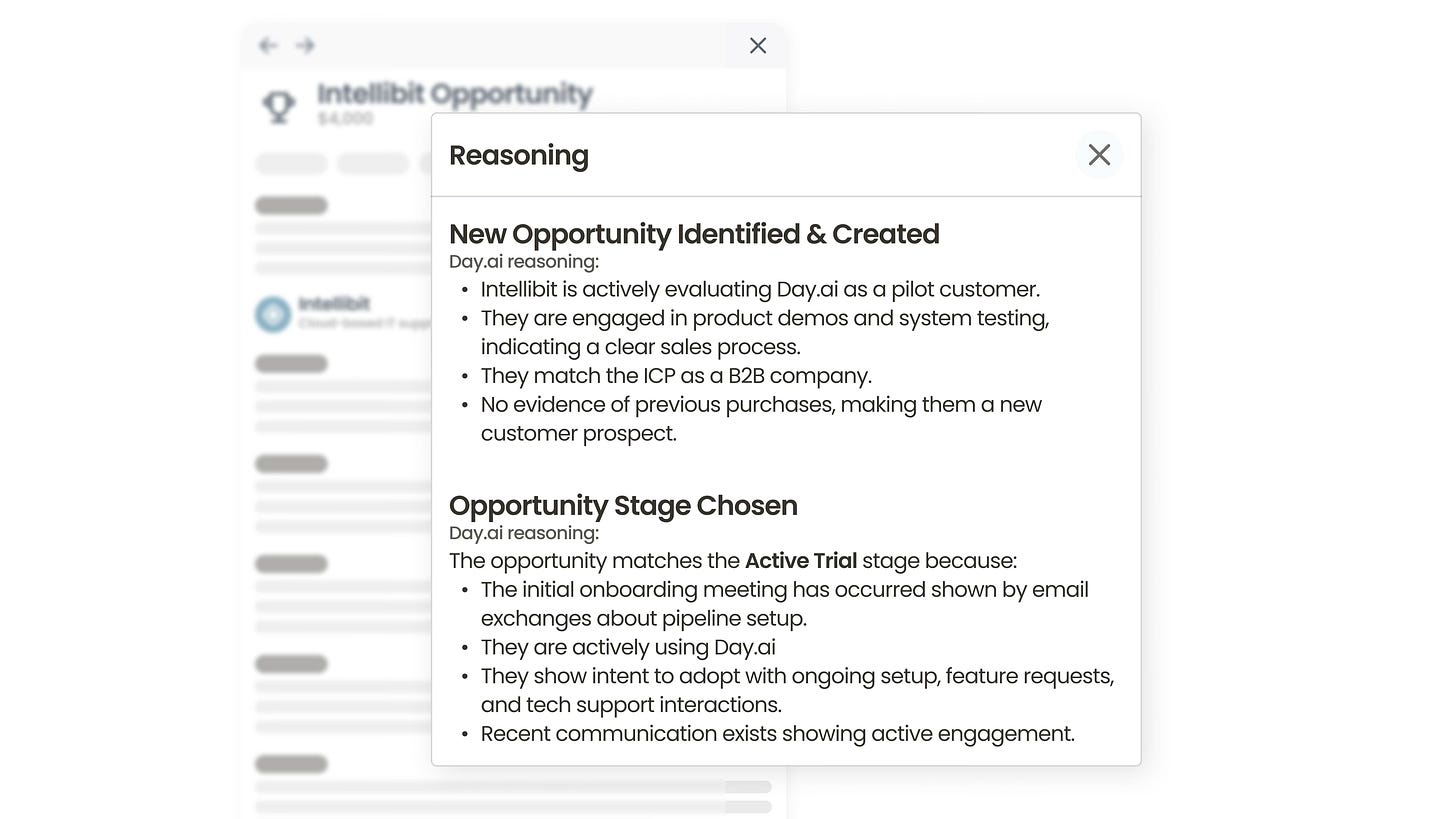

Flip the primary user: build CRM for AI agents, not for humans. This means a context graph that agents can traverse, with ingestion replacing logging.

Day AI’s differentiation on three axes:

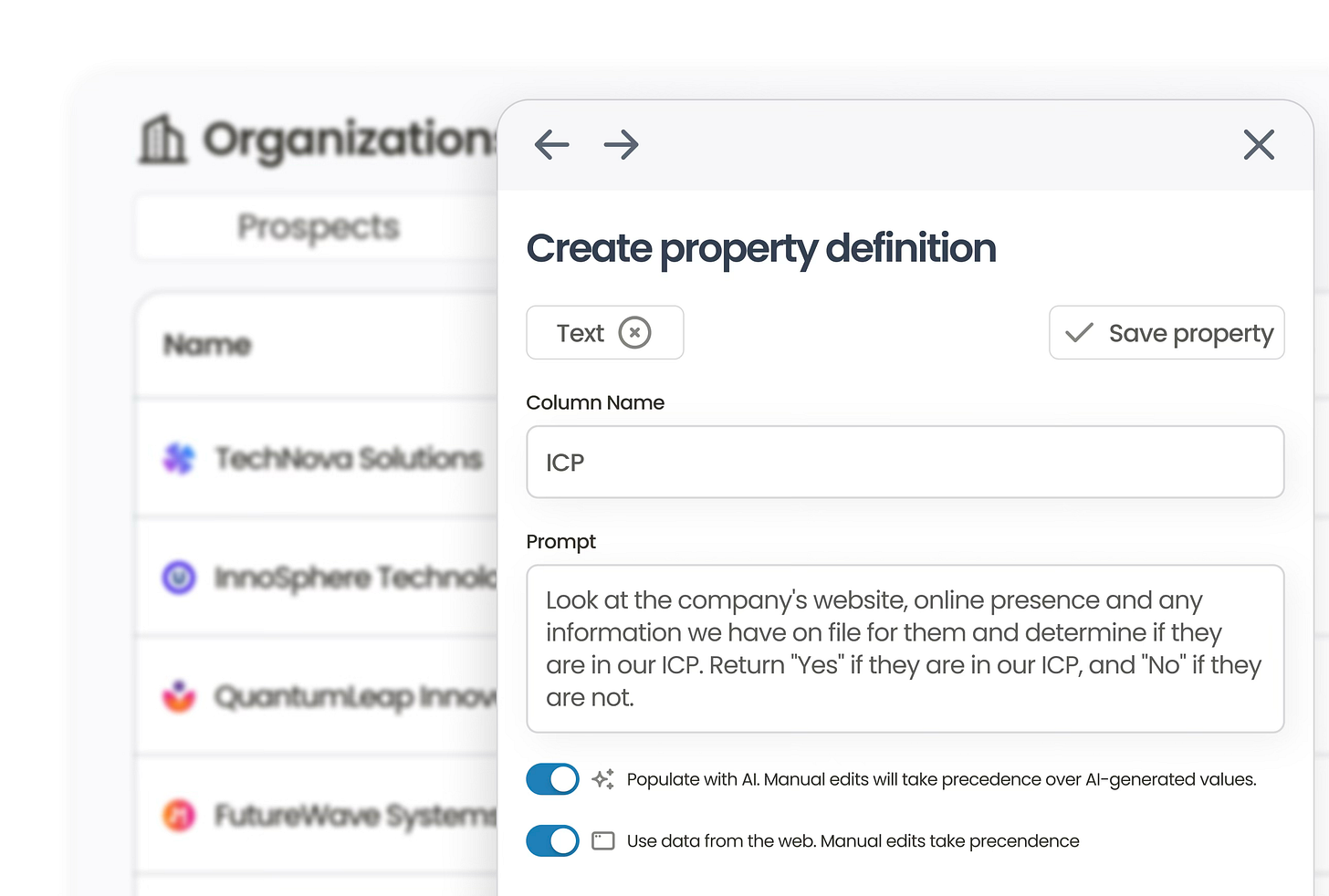

Agent-first data model (context graph) rather than a UI-first database.

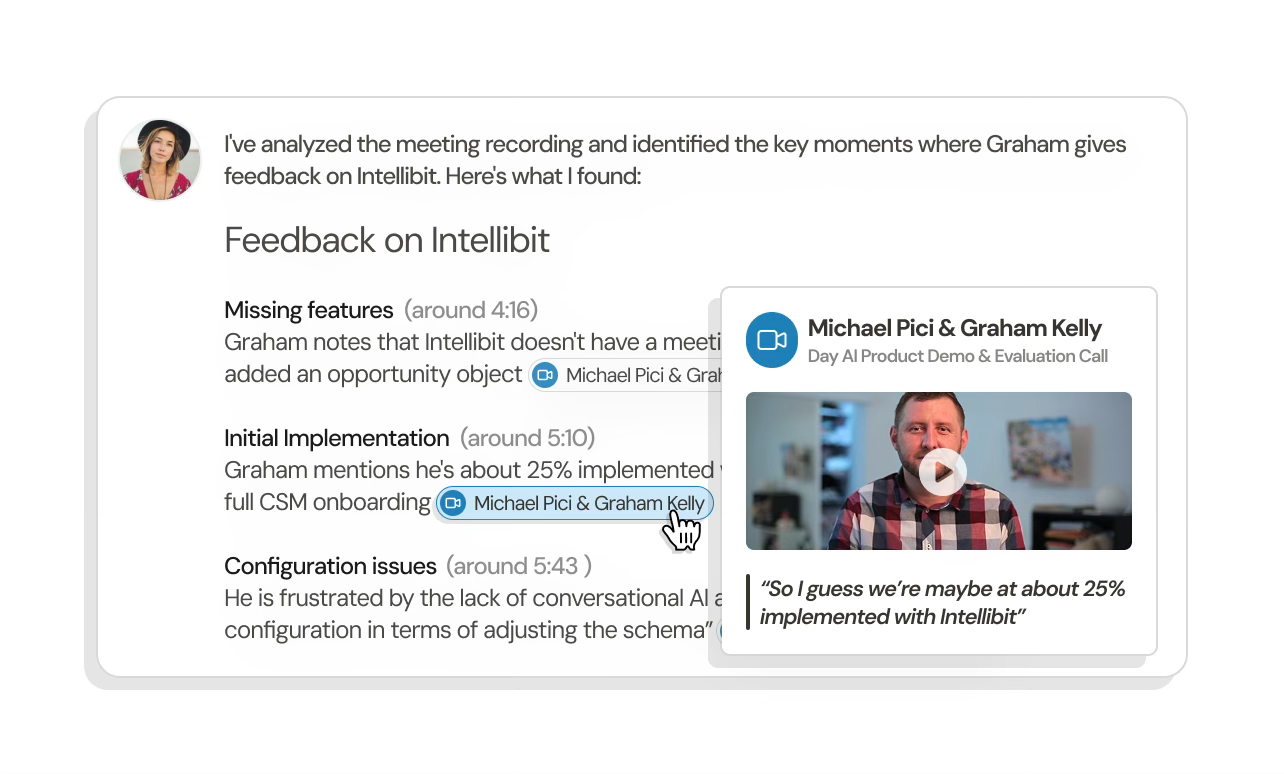

Provenance and trust: reasoning plus citations back to source conversations.

Actionability: assistants draft next steps, create actions, update records, and run schedules.

The UI is organized around conversations and assistants instead of forms.

If Day AI’s core asset is a continuously updated context graph, model improvements increase product value over time. The moat is the aggregation of high-signal customer context with explicit provenance, plus workflows built around that graph.

The ambition as a full go-to-market operating system: “Not just sales, but your entire go-to-market motion. From first touch to renewal.”

Before and after:

Before: A rep scans tabs, searches Slack/email, reconstructs the last call, then manually updates CRM and drafts a follow-up.

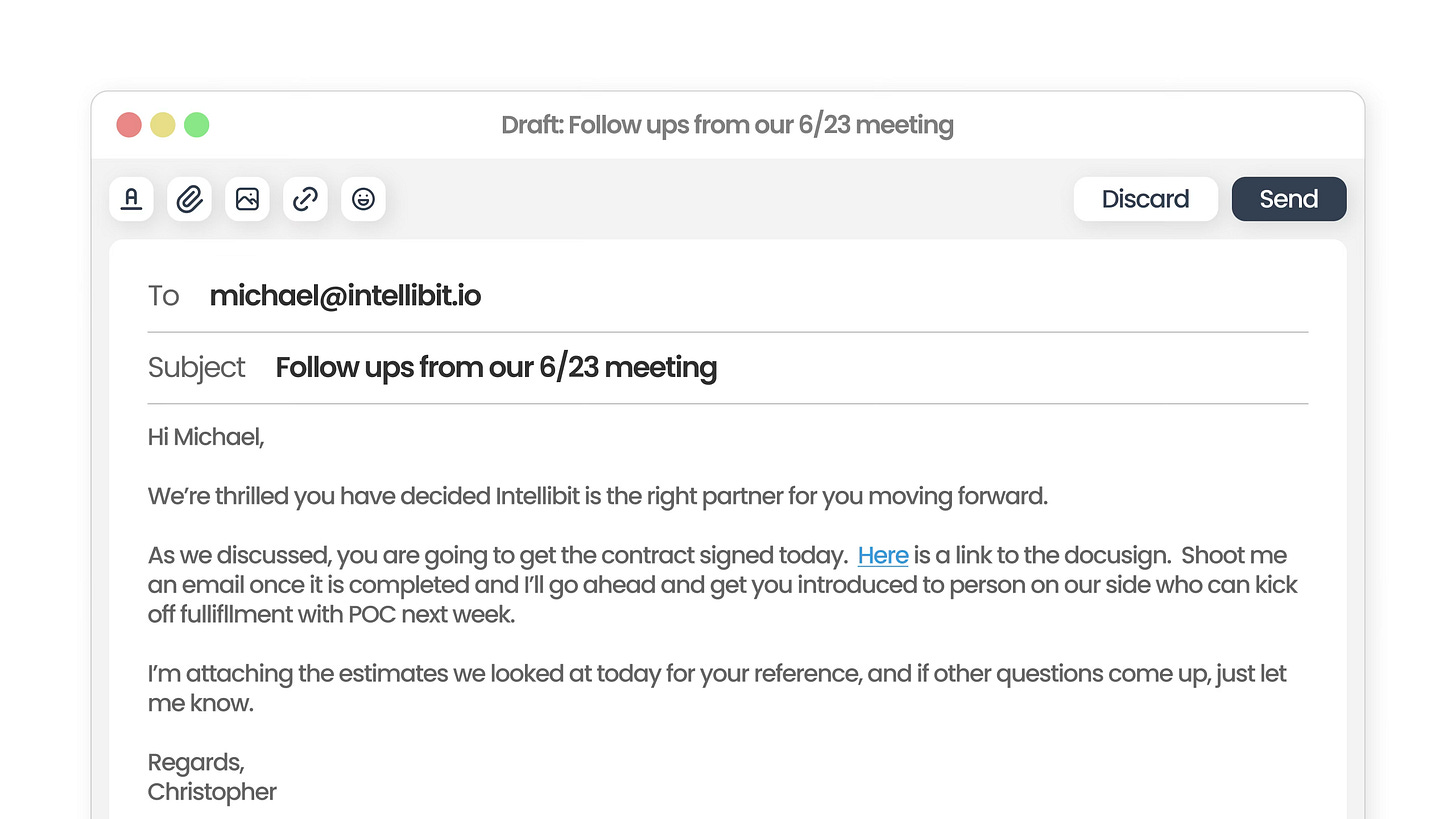

After: The system ingests the call/email/Slack thread, updates the opportunity with reasoning, surfaces risks, and drafts the next step in the user’s voice.

Day AI is a web app (system of record) fed by ambient capture (email, meetings, Slack) and extended by two integration surfaces: Slack (in-context chat) and MCP/SDK (developer and AI-assistant integrations).

Representative use cases:

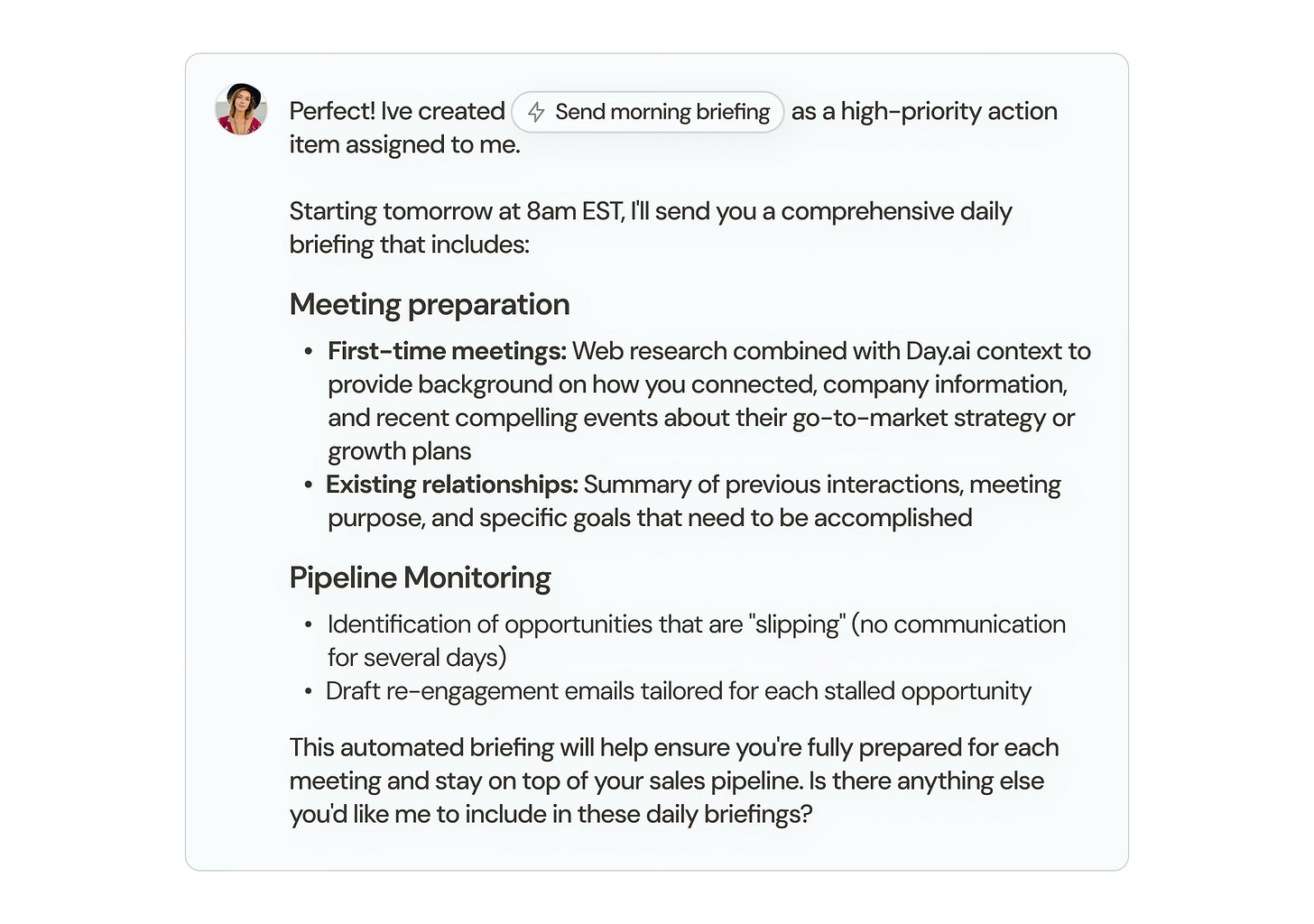

Daily briefings with meeting context for each person.

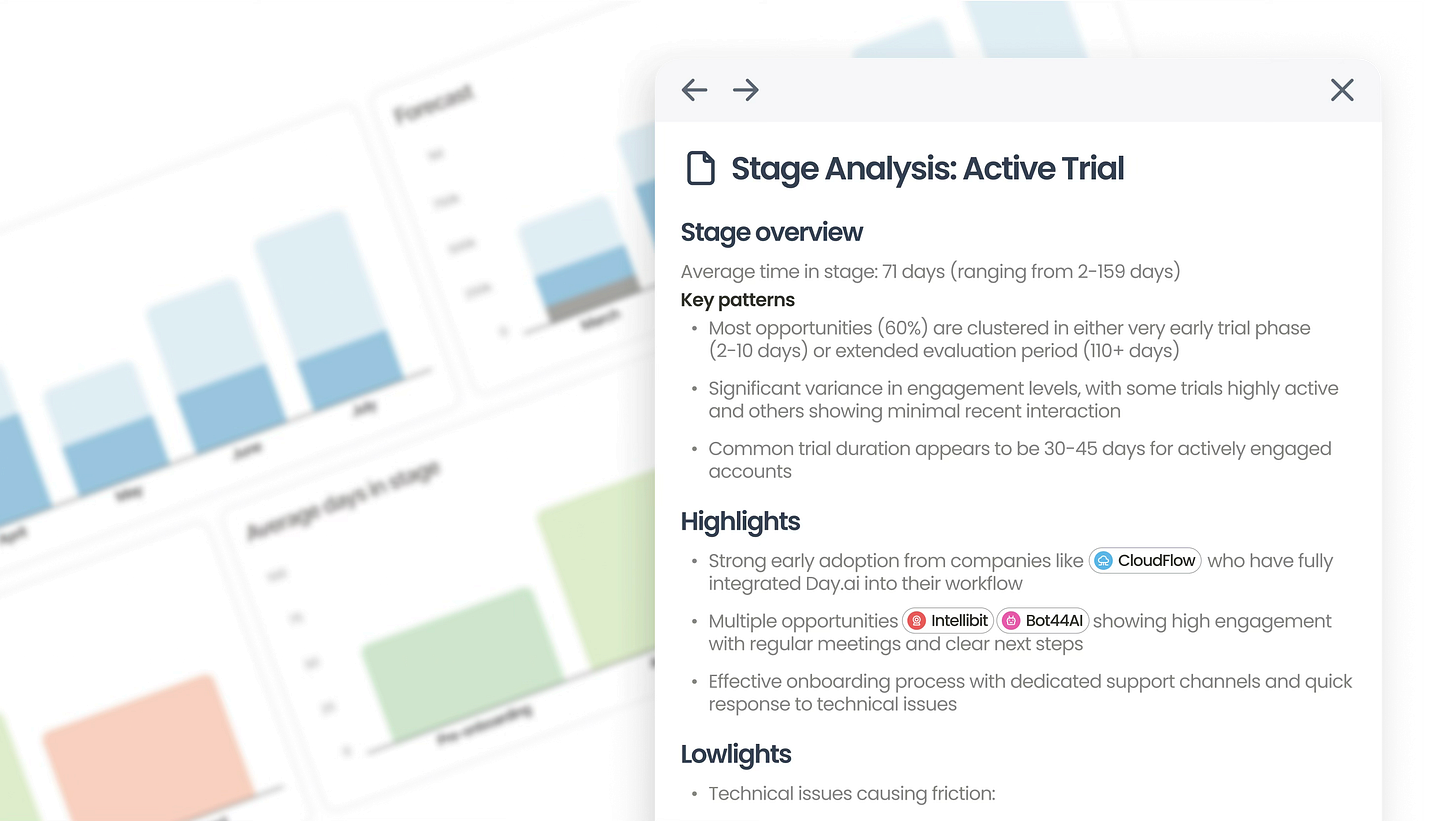

Weekly pipeline analysis that flags stalled deals and recommends next steps.

Automatic follow-up email drafting using personal templates and full customer context.

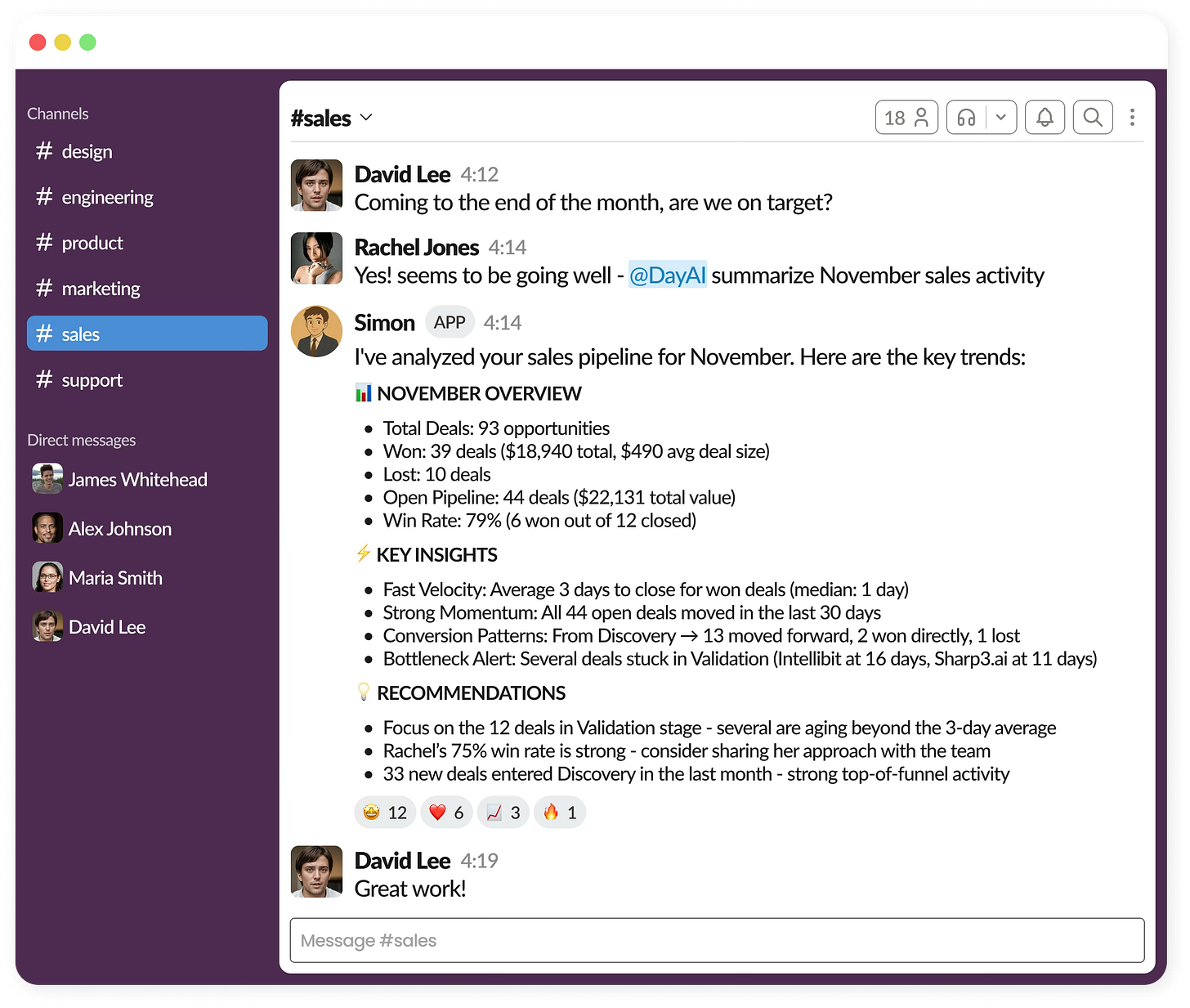

Slack-first workflows: mention @DayAI to summarize, update an opportunity, or create actions in the thread you are already in.

Developer workflows: build custom apps that query contacts, opportunities, meetings, and transcripts via MCP tools and OAuth.

Why now?

Day AI’s bet is that frontier models can already reason and write at high quality, but enterprise adoption has been bottlenecked by context: capturing, structuring, and trusting business data in real time.

Two missing ingredients have only recently matured: (1) models capable enough to interpret messy conversation streams reliably, and (2) integration standards that let assistants safely act inside real systems (for example, MCP).

Day AI frames CRM disruption as a three-act story: Salesforce industrialized cloud CRM, HubSpot simplified CRM for SMBs, and AI unlocks a decompressed, narrative-first model that is infeasible with manual data entry.

Recent trends that makes this possible:

Ubiquity of recorded customer conversations (Zoom/Meet, Slack Connect, email) as source-of-truth streams.

Agentic tool-use patterns (LLMs calling tools) moving from demos to product surfaces.

Open integration standards (MCP) enabling assistants like Claude Desktop and developer apps to connect to business systems securely.

How Big Is the Prize?

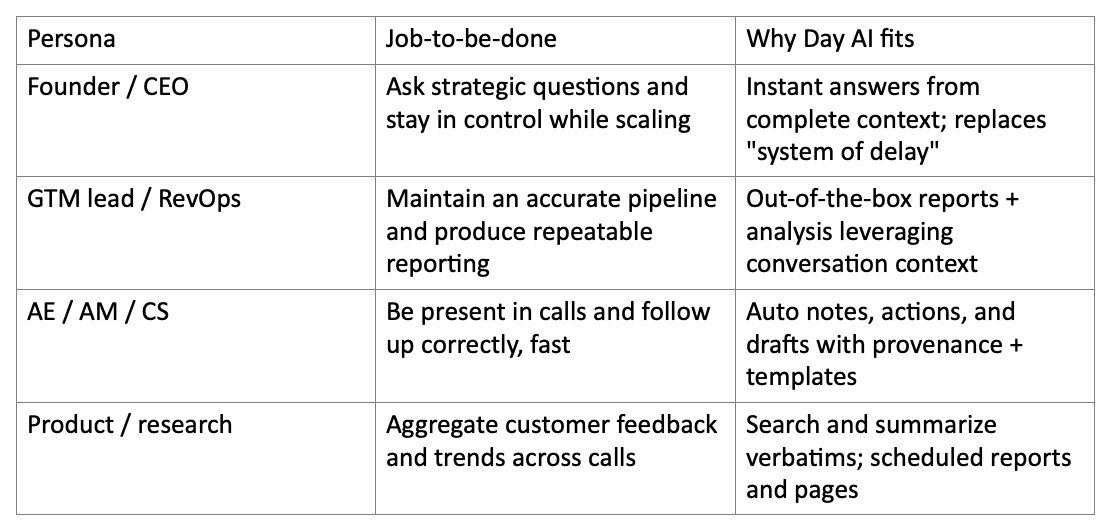

The primary customer are teams whose business is mediated by conversations (B2B sales, customer success, services, product discovery) and who need fast, trustworthy recall and action. Day AI explicitly calls out founders and early-stage GTM teams as early beneficiaries.

Day AI also positions itself as Customer Intelligence rather than just CRM: a unified system that captures, analyzes, and shares the voice of the customer across teams.

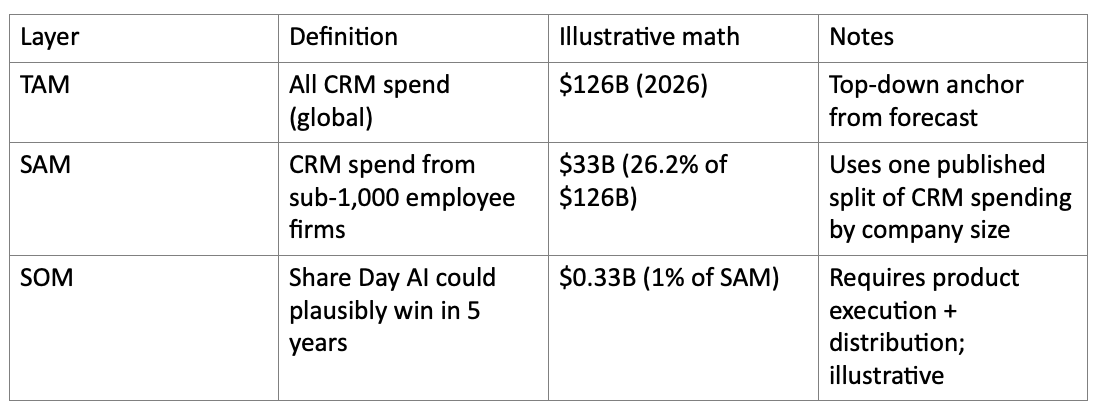

Top-down TAM anchor: one estimate sizes the global CRM market at $112.91B (2025) and $126.17B (2026), forecasting $320.99B by 2034.

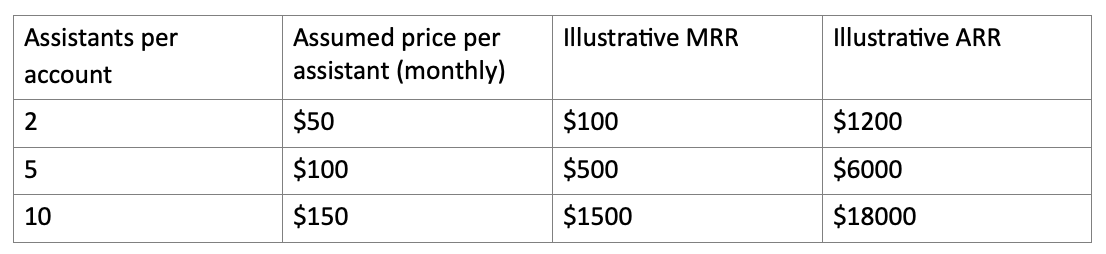

Bottom-up SAM and SOM require assumptions because Day AI does not disclose its average pricing per assistant by tier publicly. The numbers below are therefore scenario-based, not official.

The Battlefield

Day AI competes across multiple layers of the stack, because it is collapsing multiple tools into one.

Day AI’s explicit critique is that transcription-and-summary layers without a connective context graph do not enable assistants to reason across the whole business.

A plan to win:

Win on trust: citations and explicit reasoning reduce the adoption barrier for automation.

Win on surfaces: be present where users already work (Slack, email, meetings), then centralize in the CRMx graph.

Win on extensibility: SDK + MCP tools let developers and external assistants build on the same underlying graph.

Win on pricing ergonomics: charge for assistants (digital labor) instead of seats, aligning cost with automation value.

Competitors:

Salesforce (CRM platform)

HubSpot (CRM + sales suite)

Microsoft Dynamics 365 (CRM platform)

Zoho CRM (SMB CRM)

Gong (revenue intelligence / conversation analytics)

Zoom/Meet add-ons + call-note tools (meeting assistants)

AI-native CRMs (e.g., Attio)

Competitive advantages:

Agent-first context graph vs. UI-first tables.

Built-in provenance: citations to the exact moment in transcripts, with more data sources rolling out.

Automation that keeps working while the user context-switches (assistants run in background).

Unified system: capture + structure + analysis + action in one place.

What Ships

Product line-up:

CRMx core (organizations, people, opportunities) populated via email/meeting/Slack ingestion.

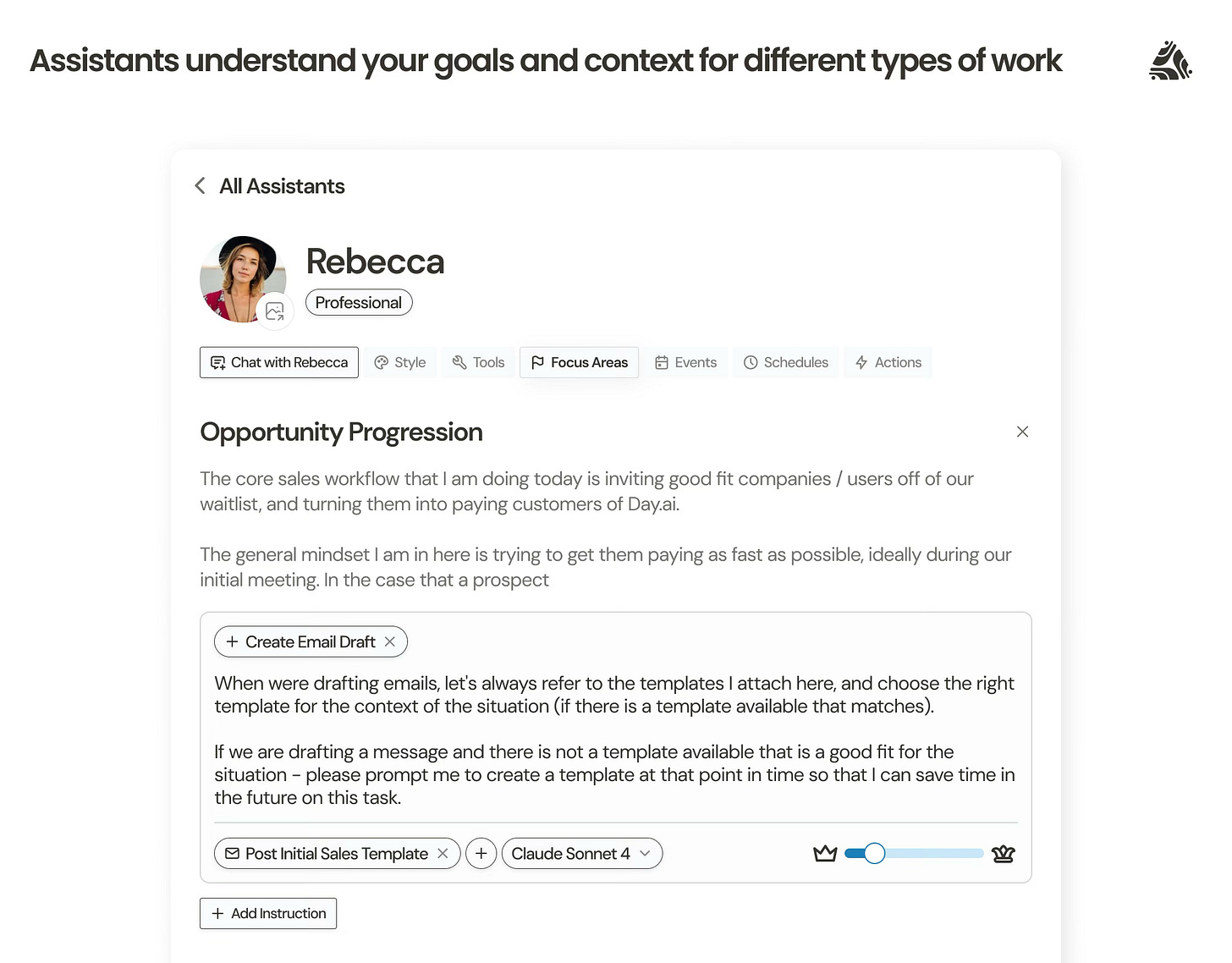

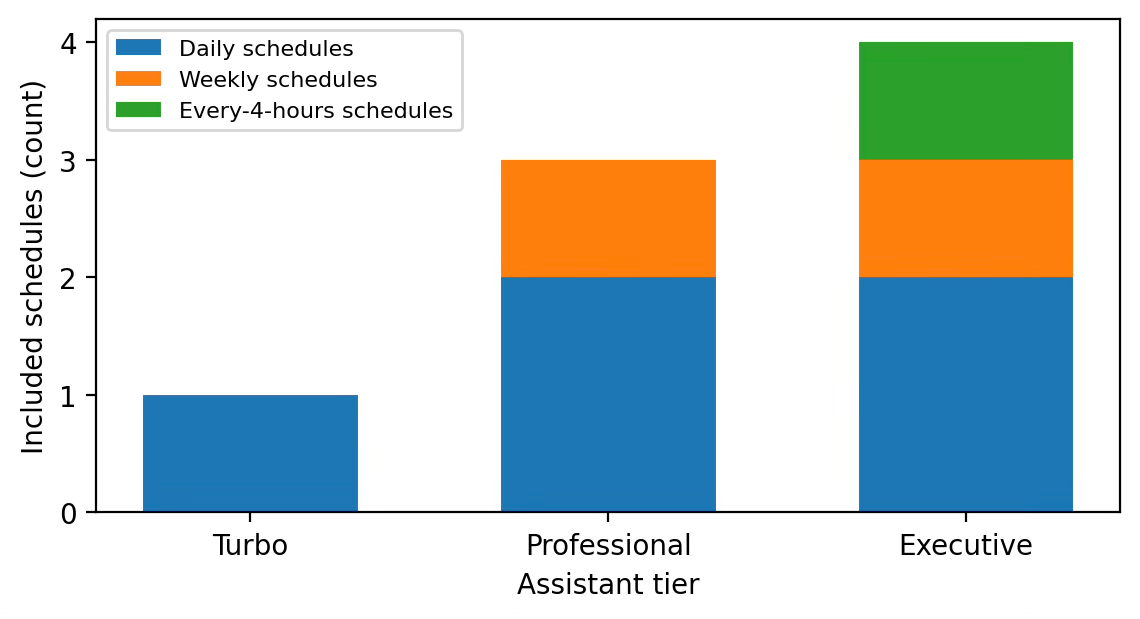

Assistants (tiered) that can query, configure, and automate work through conversation.

Reports & Analysis (weighted forecast, time-in-stage, pipeline review, stage analysis).

Custom properties and table views to adapt the schema to the business.

Reasoning + citations for trust and auditability.

Slack integration (mention @DayAI for in-context updates and queries).

Developer platform: TypeScript SDK + OAuth + MCP tools.

Roadmap signals explicitly stated in public updates include:

Citations beyond meeting recordings: email threads and other data sources described as rolling out next.

Import expansion: notes import described as upcoming after people/organization/opportunity import.

Deeper assistant schedules and workflow automation (tiering reflects intended expansion).

How This Becomes a Business

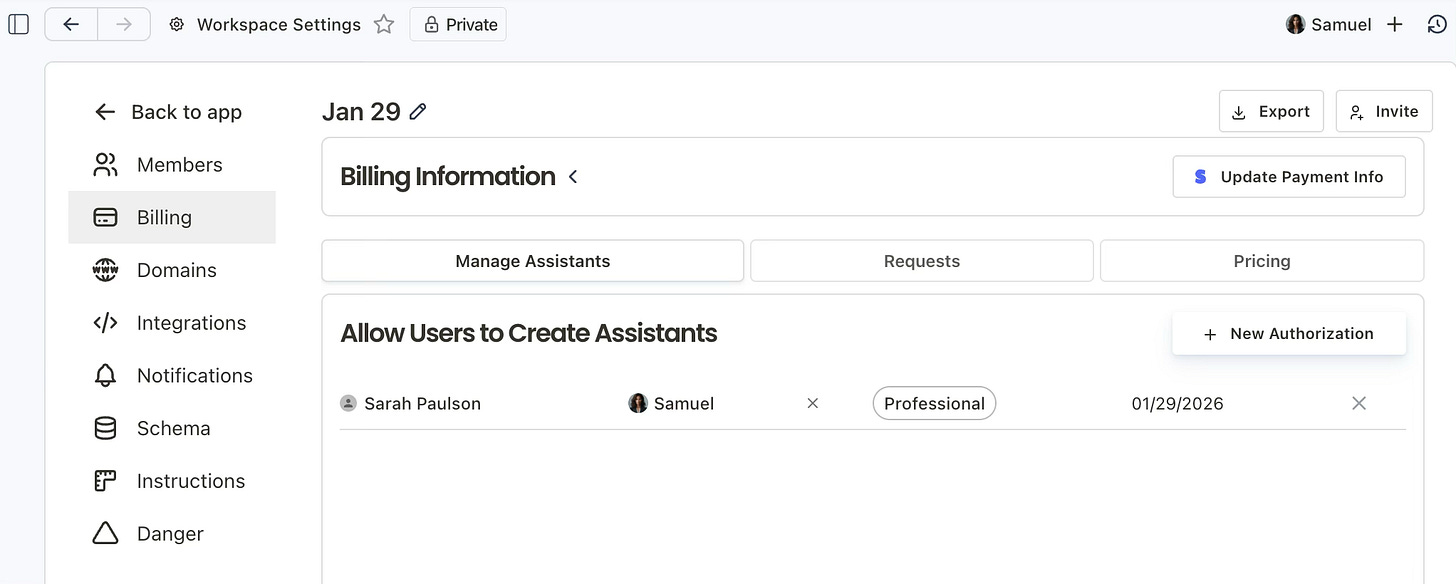

The model is to sell digital labor (assistants) layered on top of a free or low-friction multi-user workspace. This mirrors classic SaaS feature ladders, but the unit is an assistant that can do jobs.

The revenue model is Subscription revenue per assistant. Day AI states there is no charge for seats; billing is tied to assistant authorizations and tiers.

Pricing (what Day AI discloses publicly):

Paid plans start at $30 per month (entry point).

Monthly list price, annual discount (20% cited), and volume discounts as teams scale.

Transparent pricing intent: no negotiation required

Below is an illustrative range of average account size and/or lifetime value using only what is publicly stated (assistants are the paid unit) and generic SaaS math. Treat as a sensitivity table.

Day AI’s own framing is assistants as a blend of software and labor; higher tiers target complex workflows and leadership use cases.

Sales & distribution model signals from official material:

High-touch onboarding during early access; deliberate pacing to learn from customers.

Demand generation via press + investor/social amplification; waitlist as a control surface.

Product-led distribution through Slack and assistant integrations; developer-led distribution through SDK and MCP.

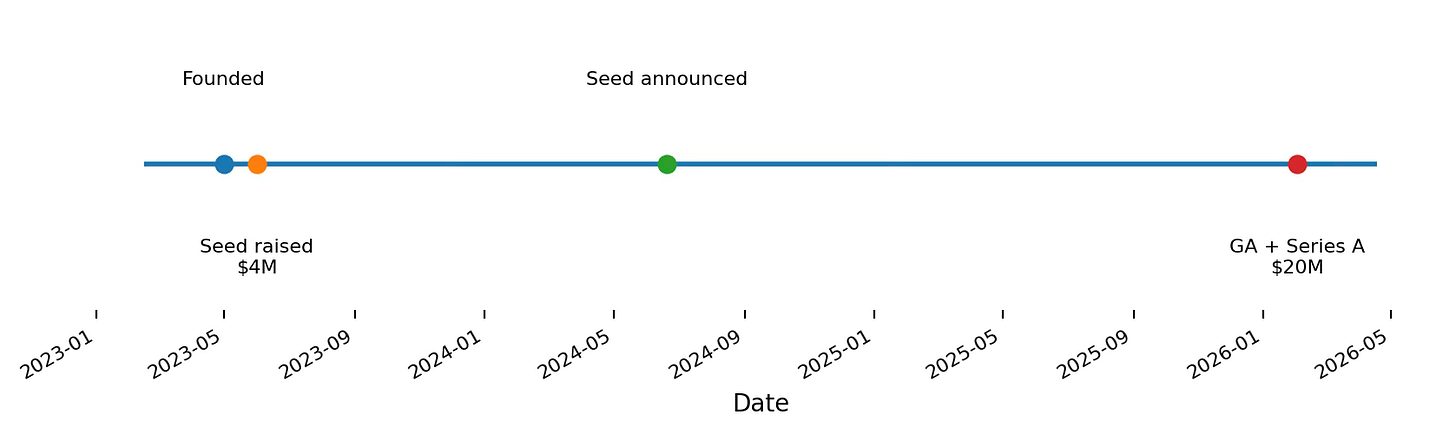

Momentum metrics disclosed in its seed-announcement playbook: 4,000+ waitlist signups in 72 hours, onboarding hundreds of teams with thousands more on the waitlist.

If This Works, What Exists in 2031?

If Day AI executes on its stated direction, the five-year artifact is a real-time business context layer where AI can: (1) remember every customer interaction with provenance, (2) keep the system of record continuously accurate, and (3) orchestrate end-to-end go-to-market workflows from first touch to renewal.

In that world, the primary interface to CRM is conversation plus scheduled intelligence, with forms and fields receding into implementation detail. The moat shifts from UI customization to context quality: the richness of the narratives, the correctness of the reasoning, and the tightness of the feedback loop between human judgment and automated action.

Sources

Day AI. “Series A, and the beginning of the shift in CRM.” Feb 2, 2026. https://www.day.ai/resources/series-a-and-the-beginning-of-the-shift-in-crm

Day AI. “Day AI raises $4M from Sequoia Capital to Reimagine CRM for the AI Age.” Jun 20, 2024. https://www.day.ai/resources/day-ai-raises-4m-from-sequoia-capital-to-reimagine-crm-for-the-ai-age

Day AI. “Building The AI-Native CRM at Day AI.” Feb 3, 2025. https://www.day.ai/resources/building-the-ai-native-crm-at-day-ai

Day AI. “Introducing Day AI Assistants.” Jun 19, 2025. https://www.day.ai/resources/introducing-day-ai-assistants

Day AI. “Day AI Setup Guide.” Jan 31, 2026. https://www.day.ai/resources/day-ai-setup-guide

Day AI. “New: Now Day AI fits your business.” May 21, 2025. https://www.day.ai/resources/new-now-day-ai-fits-your-business

Day AI. “Introducing Reports & Analytics.” Mar 5, 2025. https://www.day.ai/resources/introducing-reports-analytics

Day AI. “The AI-native way to bring your deals into Day AI.” Jan 31, 2025. https://www.day.ai/resources/the-ai-native-way-to-bring-your-deals-into-day-ai

Day AI. “Citations and assistants run in the background.” Oct 9, 2025. https://www.day.ai/resources/citations-and-assistants-run-in-the-background

Day AI. “Chat with your Day AI Assistant in Slack.” Nov 25, 2025. https://www.day.ai/resources/chat-with-your-day-ai-assistant-in-slack

Day AI. “Day AI SDK for custom integrations and automations.” Sep 24, 2025. https://www.day.ai/resources/day-ai-sdk-for-custom-integrations-and-automations

day-ai (GitHub). “day-ai-sdk (README).” https://github.com/day-ai/day-ai-sdk

Day AI. “Our Playbook for Announcing Our Seed Funding at Day AI.” Mar 11, 2025. https://www.day.ai/resources/our-playbook-for-announcing-our-seed-funding-at-day-ai

Sequoia Capital. “Day.ai (company profile).” https://sequoiacap.com/companies/day-ai/

Sequoia Capital. “Partnering with Day.ai: Customer Obsession, Productized.” Jun 20, 2024. https://sequoiacap.com/article/partnering-with-day-ai-customer-obsession-productized/

Sequoia Capital (Training Data podcast). “Why CRM Needs an AI Revolution, with Day.ai Founder Christopher O’Donnell.” https://sequoiacap.com/podcast/training-data-christopher-odonnell/

LinkedIn. “Day AI - company page.” https://www.linkedin.com/company/day-ai

LinkedIn (Markitecht / Christopher O’Donnell). “Introducing Day.ai’s Ergonomic Pricing Model (post).” Jul 2025. https://www.linkedin.com/posts/markitecht_we-just-set-our-first-pricing-model-and-activity-7348326242028322818-GOx8

Anthropic. “Introducing the Model Context Protocol.” Nov 25, 2024. https://www.anthropic.com/news/model-context-protocol

Model Context Protocol. “Specification (2025-11-25).” Nov 25, 2025. https://modelcontextprotocol.io/specification/2025-11-25

Fortune Business Insights. “Customer Relationship Management (CRM) Market Report.” https://www.fortunebusinessinsights.com/customer-relationship-management-crm-market-103418

HG Insights. “CRM Market Share, Size & Buyer Trends Report.” https://hginsights.com/resource/crm-market-share-report/

Superb analysis of Day AI's positioning. The reframe from "CRM for humans" to "CRM for agents" is exactly the kind of inversion that creates new markets. The provenance layer with citations is smart cause it addresses the trust gap that kills most autopilot features. One question on the TAM math tho, does the $30/month per assistant actually hold at scale, or does dispalcement of seats-based pricing compress average revenue as teams swap 10 Salesforce licenses for 3 assistants.