The Credit Layer You Don’t See

Inside Slope’s attempt to embed bank‑grade underwriting into B2B workflows.

Slope is a fintech infrastructure company sitting at the seam between payments and credit: it helps platforms and enterprises embed B2B payment flows and short-term working-capital products directly into checkout, billing, or seller portals. The company describes itself as “AI-powered credit and risk infrastructure” and positions its core competency as real-time underwriting from transaction and cash-flow data.

Two product lines capture the strategy:

Embedded Capital: financing/terms embedded at the point of purchase (e.g., Net 60/90), plus configurable credit-line and purchase-order financing use cases.

SlopeScore: a cash-flow underwriting score and transaction-intelligence layer marketed to lenders and platforms as an API-first decisioning system.

Slope is not a bank; credit products are originated by Lead Bank.

The business: where value is created

The cleanest mental model for Slope is a “credit layer” that can be bolted onto existing commercial workflows. Where consumer BNPL lives inside a checkout button, Slope aims to live inside the less glamorous but higher-volume plumbing: net terms, invoice payment, and working-capital cycles for businesses.

A typical embedded-terms flow looks like this:

A platform (marketplace, enterprise eCommerce, billing system) offers Net 60/90 or installments at checkout.

Slope ingests permissioned data (bank transactions and/or platform performance data) and produces an underwriting decision in seconds/minutes.

Credit is originated by a partner bank (Lead Bank) and funded via facilities / capital structure set up by Slope; the merchant receives funds while the buyer repays on agreed terms.

Slope’s software handles monitoring, credit line management, and reconciliation hooks (order-to-cash).

In the company’s own phrasing, “real-time underwriting” is the wedge: the decision is meant to be fast enough to sit inside a purchase flow and precise enough to satisfy bank-grade risk standards.

Slope’s revenue model is not fully disclosed, but the official materials imply two monetization streams:

Balance-sheet or facility-backed lending economics (interest income / fees) tied to credit line utilization and repayment.

Software / infrastructure fees for APIs that power underwriting, KYB/KYC, monitoring, and order-to-cash automation.

Slope’s business is not one business but a portfolio of closely related ones, and the durability question is whether the underwriting layer becomes a long-lived “habit” for platforms.

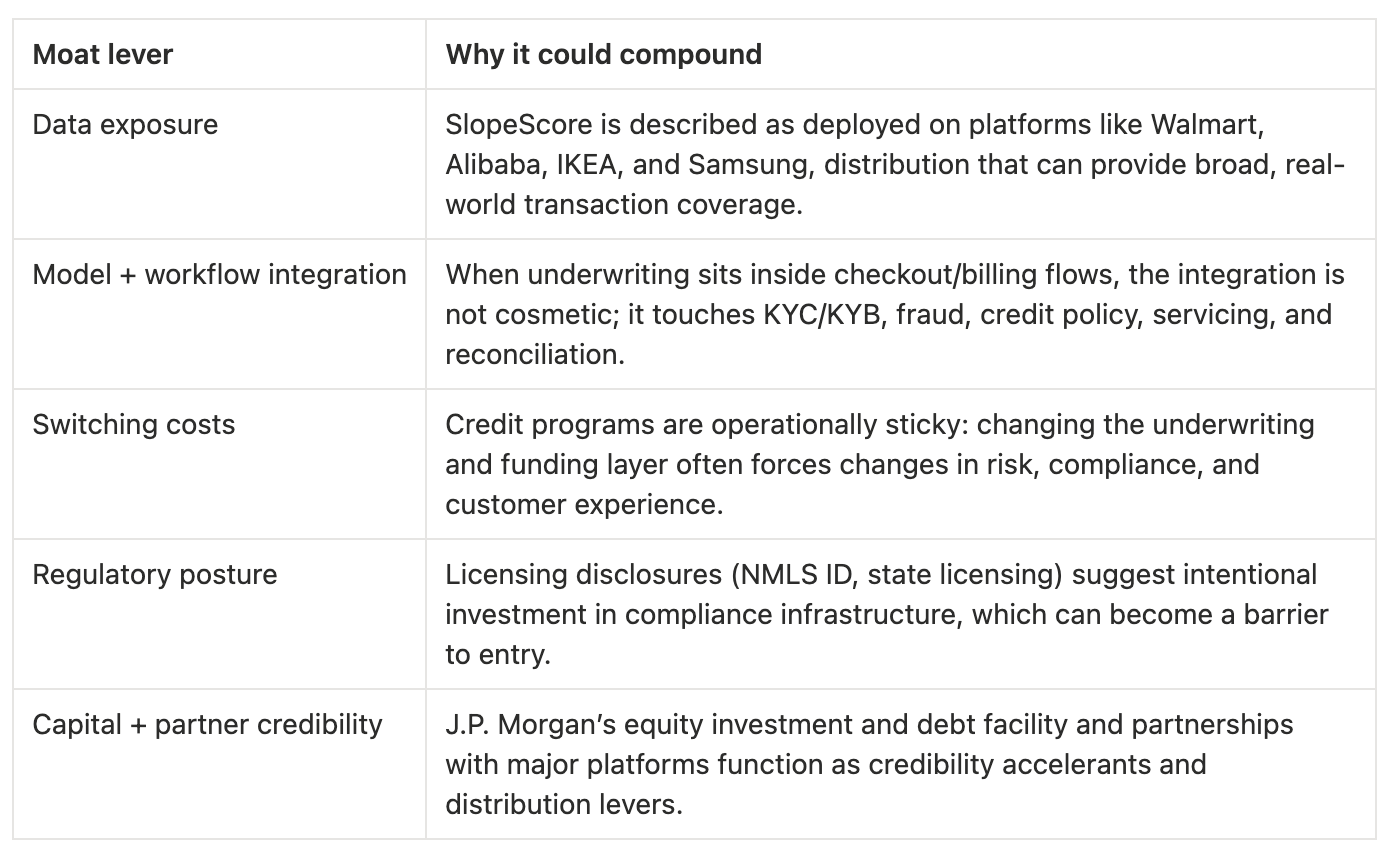

Moat, durability, and the data flywheel

Buffett’s default move is to ask whether a business has an enduring advantage that gets stronger with time. Slope makes the case that the advantage is the capital pool and transaction understanding: a specialized model that turns messy bank data into credit-grade signals at scale.

Management, culture, and incentives

Slope emphasizes their founder origin story and a simple mission: digitize B2B commerce and remove cash-flow friction. They frames the problem as the persistence of “offline, manual, and labor-intensive” order-to-cash processes.

Values that show up repeatedly are iteration speed and ownership.

The clearest observable evidence of operating tempo comes from employee accounts around major partner launches. In a December 2025 post about the Amazon lending rollout, Slope’s partnership lead wrote that the team “completed the integration in just 1.5 months” despite being lean.

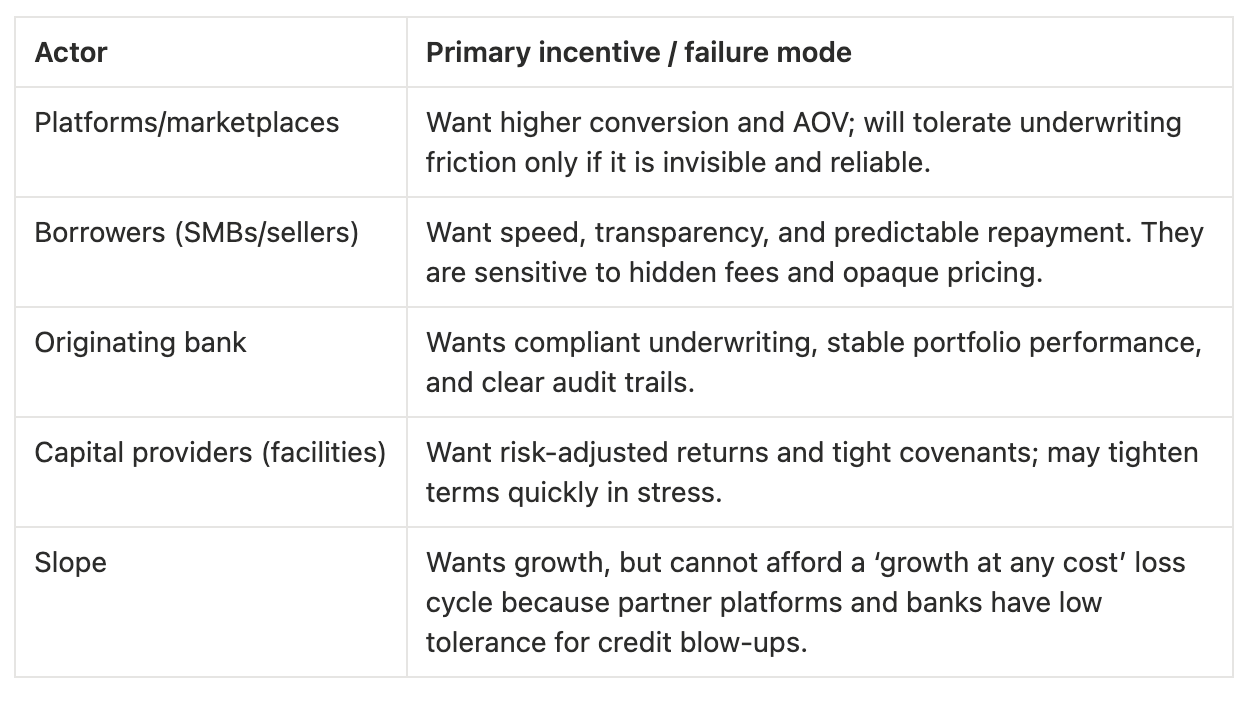

A useful way to evaluate Slope is to map incentives across the embedded-credit stack:

An additional (imperfect but informative) signal of engineering intensity: Slope reports that OpenAI recognized it for surpassing 10 billion tokens processed through the API, framing this as evidence of production-scale AI underwriting.

Capital structure and allocation

In a private company, capital structure is often the most “public” window into strategy. Slope’s July 2024 press release states total funding of $252M, split between $77M equity and $175M debt.

Debt’s dominance is rational if the intent is to scale lending capacity; it is also a reminder that Slope’s performance is tethered to capital markets and facility terms. The Elite partnership disclosure is explicit that J.P. Morgan provides a debt facility “in connection with this program” while not directly originating or servicing credit lines.

A capital-allocator checklist

For Slope, the highest-leverage allocation decisions are likely to be:

Where to sit on the risk curve (credit policy): approvals vs losses.

How to fund growth: more debt capacity vs more equity resiliency.

Whether to monetize as software (recurring fees) vs as lending spread (capital-intensive).

When to walk away from partner requests that demand suboptimal risk pricing.

Operating evidence: metrics, case studies, and what they imply

Slope’s public claims cluster into two buckets: (1) underwriting lift (approve more with controlled risk) and (2) workflow lift (higher conversion/AOV via embedded terms). Because the company is private, these should be treated as directional until validated in diligence; still, the specificity is useful.

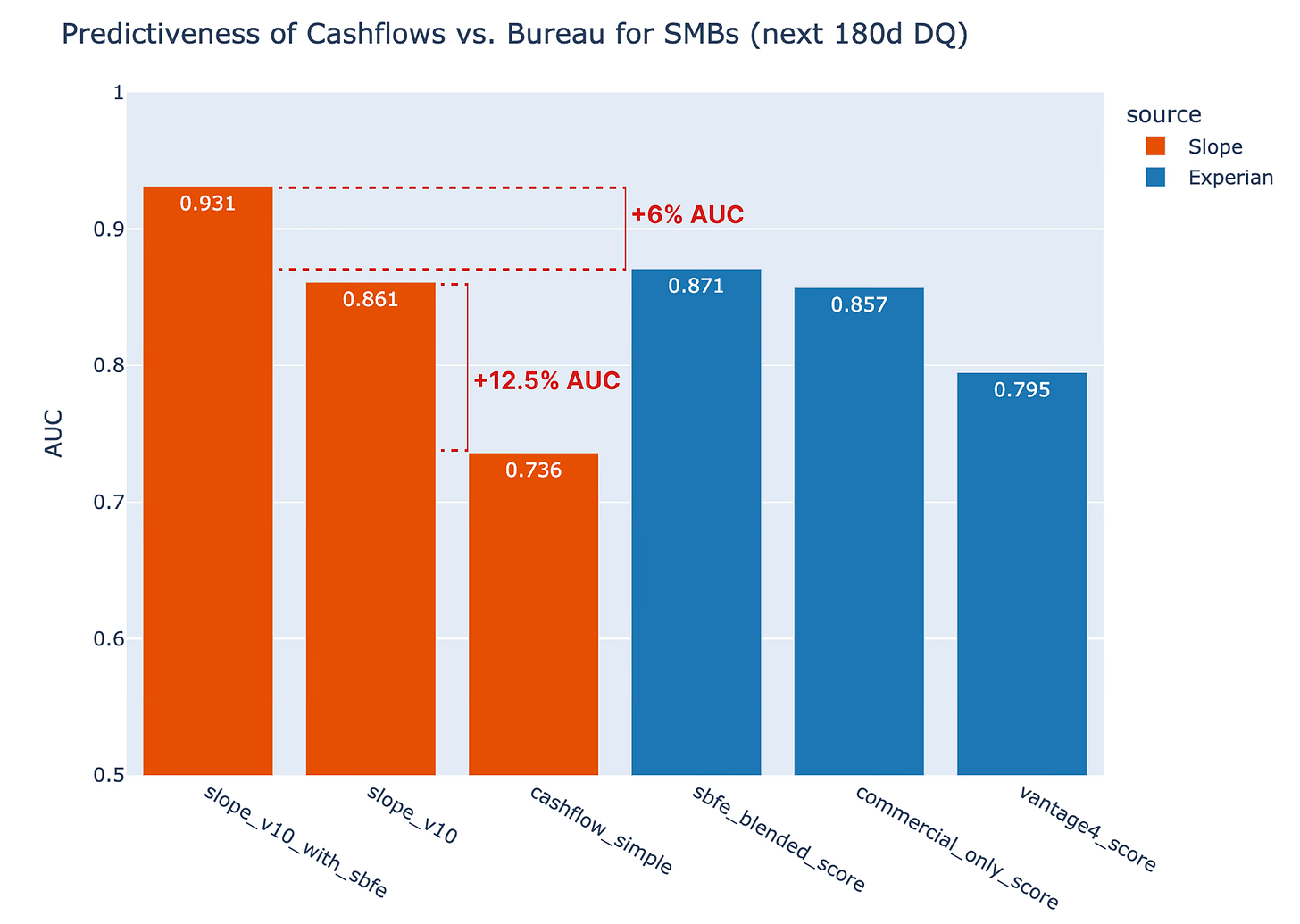

Underwriting performance (cash-flow scoring)

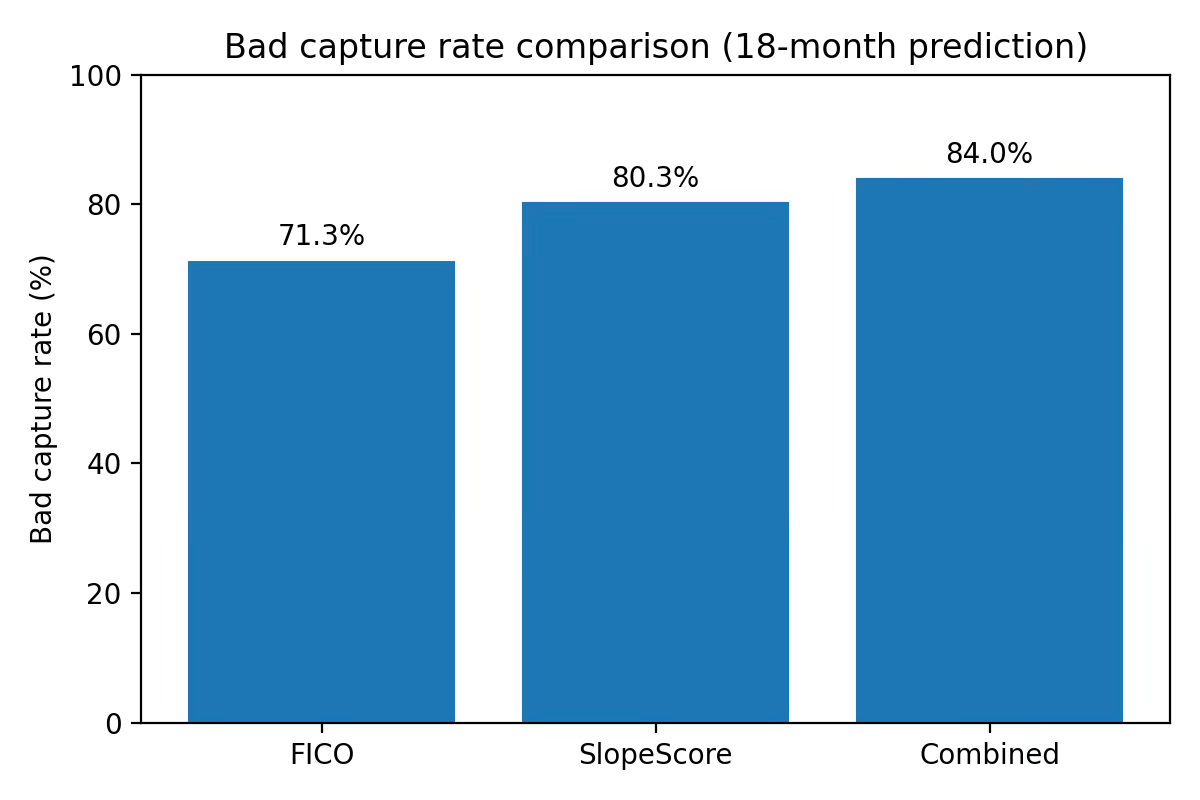

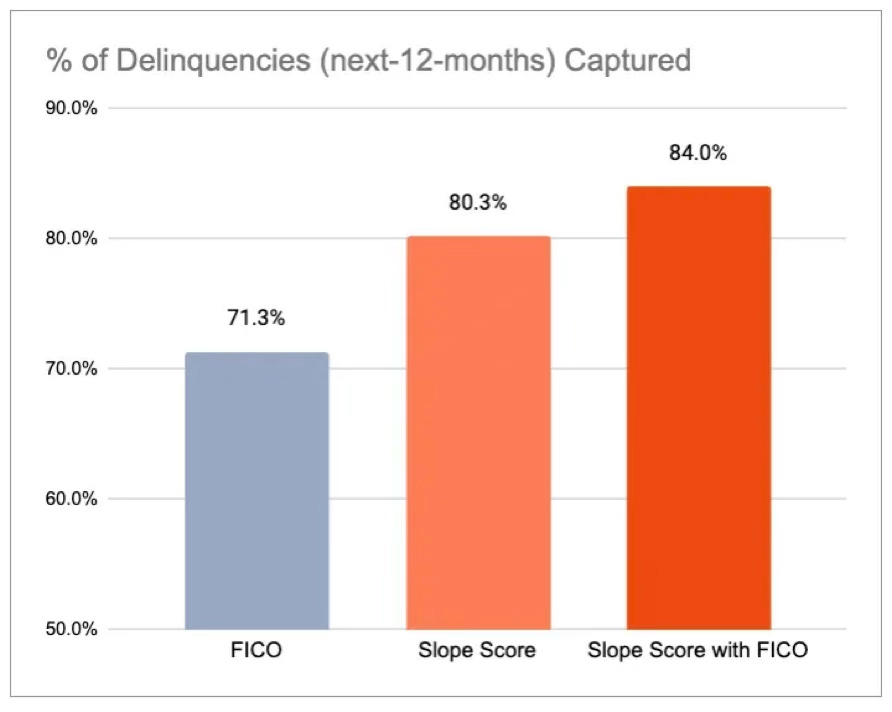

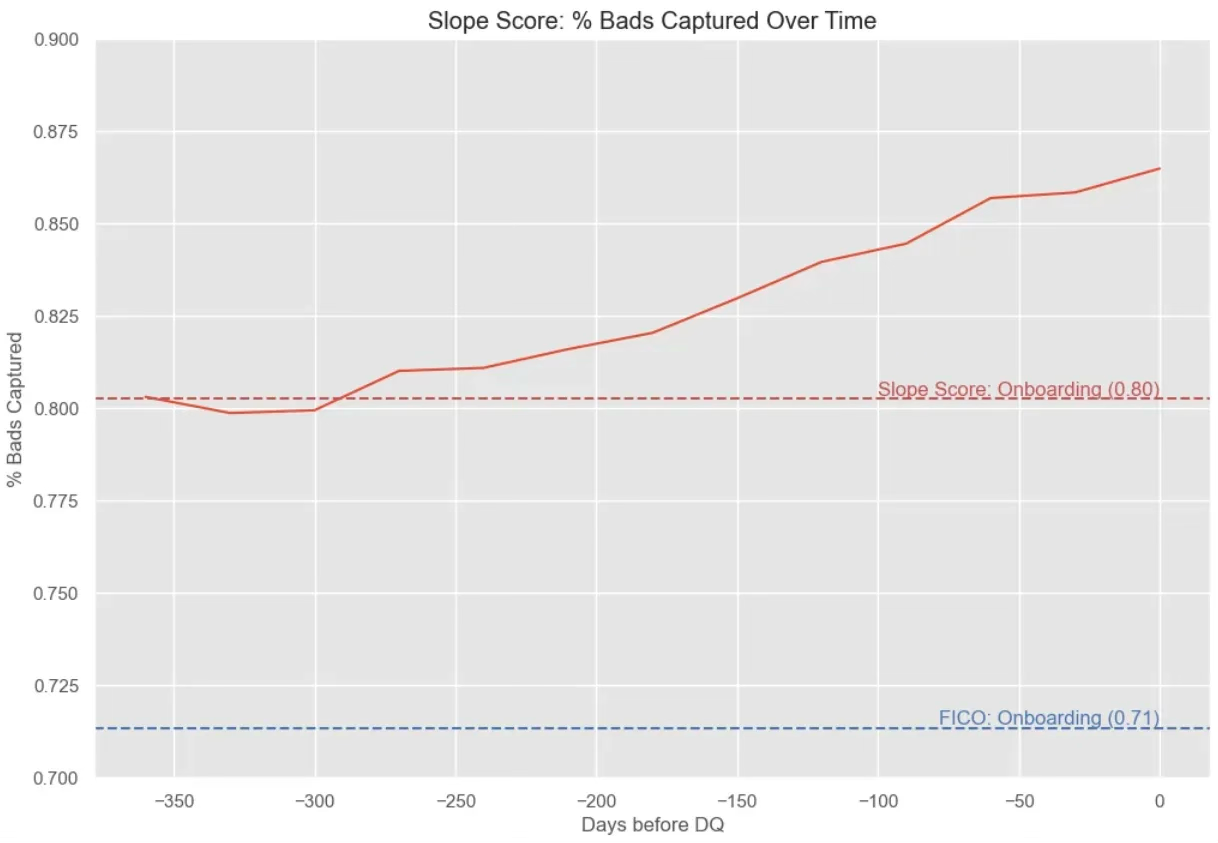

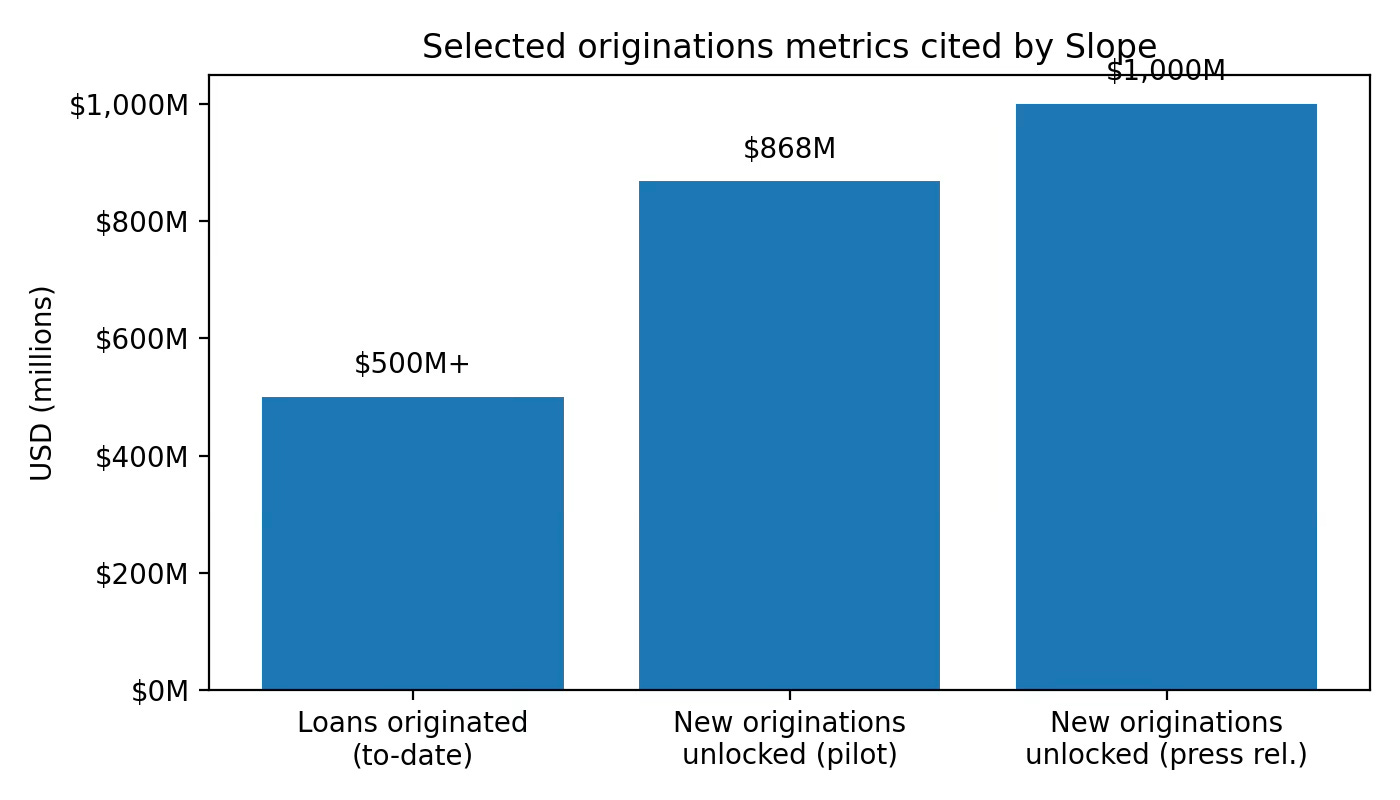

In a published case study with an anonymized “top U.S. bank,” Slope reports $868M in new profitable originations to near-prime and thin-file borrowers and a head-to-head bad capture improvement versus FICO.

Separately, Slope’s Business Wire launch release for SlopeScore claims that a pilot “unlocked nearly $1B in new credit originations,” delivered a lift over FICO, and achieved 99% transaction categorization accuracy in key fields.

Lending products and SMB outcomes (embedded credit)

Case studies focus on a practical thesis: credit terms are inventory strategy. In Slope’s Amazon-seller program description, the company advertises a reusable line of credit “up to $5M” for the strongest profiles, flexible terms, and an APR floor for top sellers.

In the GenCare case study, Slope describes an initial $250K line increased by another $100K, used to help fund a $400K product launch while the business maintained 100% year-over-year growth.

In another marketplace-focused case study, Kanso Worldshop pairs ~60-day supplier terms with Slope’s 90-day plan to create “roughly 150 days” of working-capital runway.

The Neato case study is the most explicit about margin mechanics: it describes using financing to pay suppliers upfront, capture discounts, and improve Amazon delivery speed, and reports a margin boost (bps) and an ROI multiple.

Scale signals (AI + originations)

Slope cites three scale signals: (a) $500M+ in SMB loan originations using its own capital, (b) automated approvals up to $250K based on bank data in some flows, and (c) 10B tokens processed via OpenAI’s API as a proxy for production AI usage.

Risk, regulation, and model governance

Credit businesses fail in boring ways: a few quarters of mispriced risk, a funding line that tightens at the wrong time, or a compliance process that breaks under scale. Slope acknowledges key parts of that reality through repeated bank-origination disclosures and a licensing page that enumerates state-level requirements.

Regulatory / structural dependencies

Bank dependency: credit products are originated by Lead Bank (Member FDIC). This creates a reliance on bank relationships, underwriting alignment, and program governance.

Funding dependency: debt facilities are a growth accelerant, but they are also a risk amplifier if covenants tighten or markets freeze.

Collections and servicing: licensing disclosures include collection-agency and money-broker licenses in multiple states; operational rigor here is not optional.

Model risk (especially for LLM-centric underwriting)

Slope markets SlopeScore as “FCRA compliant, explainable and customizable,” and highlights accuracy and fraud detection use cases. Those claims point to an implicit model-governance burden: explainability, stability under drift, and fairness / adverse-action workflows.

Slope emphasizes why SMB cash flow is hard: complexity, diversity, and context-dependence. This is simultaneously the company’s moat narrative and its principal technical risk.

Concentration and partner-risk

Slope’s growth narrative is partnership-led: Amazon seller lending, Samsung Business checkout terms, Alibaba.com checkout financing, and an Elite integration in legal billing. The upside is distribution. The downside is concentration: a single platform policy change can meaningfully alter unit economics and volume.

A useful inversion question: what would you do if you wanted to break this business? You would (a) pull a critical data feed, (b) tighten the facility, (c) trigger a compliance escalation, or (d) induce a cohort of correlated losses. These are the failure modes to diligence explicitly.

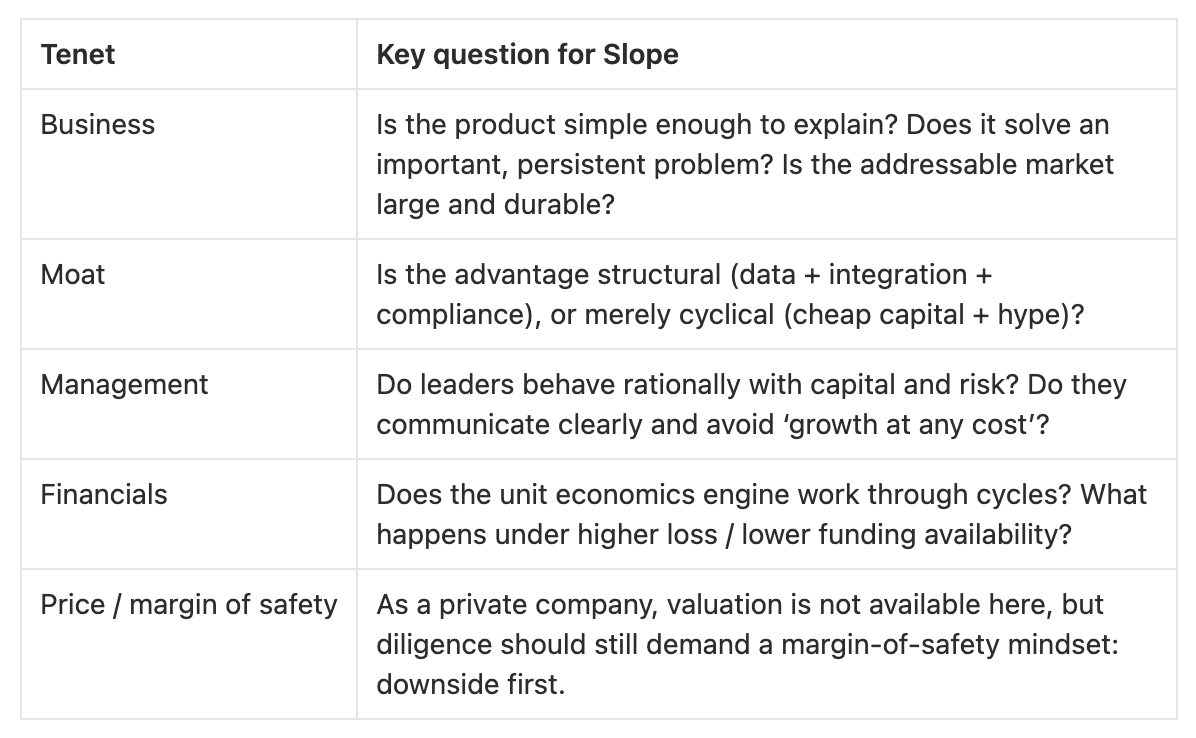

What must be true (checklist) + diligence questions

Given limited public financial disclosure, the most useful output is a checklist that connects Slope’s stated advantages to verifiable realities. This is the posture: don’t be impressed by cleverness; be impressed by what survives contact with incentives, time, and accounting.

Inversion and mental models

Zoom in on incentives, fragility, and human error under stress:

Incentives: are underwriting standards aligned between Slope, the originating bank, and distribution platforms?

Base rates: what is the historical loss rate by cohort and channel? How does it behave in downturns?

Second-order effects: does faster approval create adverse selection (good borrowers already have options; bad borrowers rush)?

Model risk: what is the monitoring/override process when the model drifts or behaves unexpectedly?

Capital allocation questions

How does Slope decide between expanding debt capacity versus strengthening equity buffers?

What return-on-capital thresholds govern partner program expansion?

Is growth constrained by underwriting confidence or by funding lines?

Diligence questions (actionable)

Portfolio performance: vintage curves (loss, delinquency, prepayment) by channel (Amazon, Samsung, etc.).

Unit economics: take rate / net interest margin, CAC (if applicable), servicing cost, expected loss, contribution margin.

Facility terms: key covenants, advance rates, triggers, and concentration limits.

Compliance: adverse-action process, audit trails, model documentation, and third-party risk management.

Data rights: what happens if Plaid, Amazon, or another key data feed changes terms or access?

Competitive resilience: which competitors can replicate the workflow (platform incumbents) versus the model (domain data)?

If Slope can answer these with clean data and conservative framing, the business begins to look like a compounding machine: integration-driven distribution feeding a data flywheel, producing better underwriting, producing more distribution. If it cannot, the same flywheel becomes a centrifuge.

Sources

Slope website (home) — https://www.slopepay.com/

Slope website (company/about) — https://www.slopepay.com/company

Slope product page: Embedded Capital — https://www.slopepay.com/products/embedded-capital

Slope product page: SlopeScore — https://www.slopepay.com/products/slopescore

Slope Tech licenses page — https://www.slopepay.com/licenses

Slope blog index — https://www.slopepay.com/blog

Slope case study: top U.S. bank SlopeScore pilot — https://www.slopepay.com/blog/top-us-bank-slopescore-case-study

Slope blog: SMB cash flow underwriting — https://www.slopepay.com/blog/state-of-business-cashflow-lending

Slope blog: OpenAI token award — https://www.slopepay.com/blog/slope-openai-token-award

Slope blog: Amazon press-release copy — https://www.slopepay.com/blog/slope-amazon-press-release

Slope blog: Amazon sellers line-of-credit program — https://www.slopepay.com/blog/slope-amazon-sellers

Slope case study: Neato — https://www.slopepay.com/case-studies/customer-neato

Slope case study: GenCare — https://www.slopepay.com/blog/gencare-case-study

Slope case study: Kanso Worldshop — https://www.slopepay.com/blog/walmart-kanso-worldshop-case-study

Slope blog: Alibaba partnership (press release copy) — https://www.slopepay.com/blog/alibaba-slope

Business Wire press release: funding round (Jul 17, 2024) — https://www.businesswire.com/news/home/20240717100691/en/Slope-AI-Led-B2B-Payments-Platform-Secures-%2465-Million-Strategic-Equity-and-Debt-Funding-Provided-by-J.P.-Morgan-and-Others

Business Wire press release: SlopeScore launch (Oct 7, 2025) — https://www.businesswire.com/news/home/20251007368878/en/Slope-Launches-SlopeScore-The-Cashflow-Score-for-Businesses

Business Wire press release: Samsung partnership (Nov 18, 2025) — https://www.businesswire.com/news/home/20251118180852/en/Slope-and-Samsung-Bring-Net-6090-to-Samsung-Business-Checkout-Powered-by-Real-Time-AI-Underwriting

Business Wire press release: Elite partnership (Oct 28, 2025) — https://www.businesswire.com/news/home/20251028413596/en/Elite-and-Slope-Partner-to-Provide-AI-Powered-Pay-Later-in-Legal

SEC Form D for Slope Tech, Inc. (filed Dec 2021) — https://www.sec.gov/Archives/edgar/data/1882129/000188212921000002/xslFormDX01/primary_doc.xml

LinkedIn post by Slope employee Keyi (Sophie) Wang (Dec 2025) — https://www.linkedin.com/posts/keyi-sophie-wang_im-thrilled-to-share-that-slope-has-officially-activity-7406746427407695872-kHMr

LinkedIn post by Slope (Samsung partnership) — https://www.linkedin.com/posts/slope-tech_were-excited-to-announce-our-partnership-activity-7396597739624701952-cKRb

LinkedIn post by Lawrence Lin Murata (Apr 2025) — https://www.linkedin.com/posts/lawrencelm_the-fastest-way-to-grow-originations-and-activity-7321218869044346882-q7Wh