Square’s Quiet Compounding Machine

A deep dive into Block’s B2B engine: the merchant OS, the unit economics, and the real moat.

Block’s B2B engine is Square: a commerce operating system for sellers that combines payments, software, hardware, and financial services into an integrated stack. The strategic arc is to move upmarket and deeper into verticals, raise software and financial attach, and stitch Square into consumer distribution through Cash App.

Beyond payments, Square is vertically integrated across hardware, operating system, software, commerce capabilities, and financial tools, an integration meant to reduce seller complexity and increase attach.

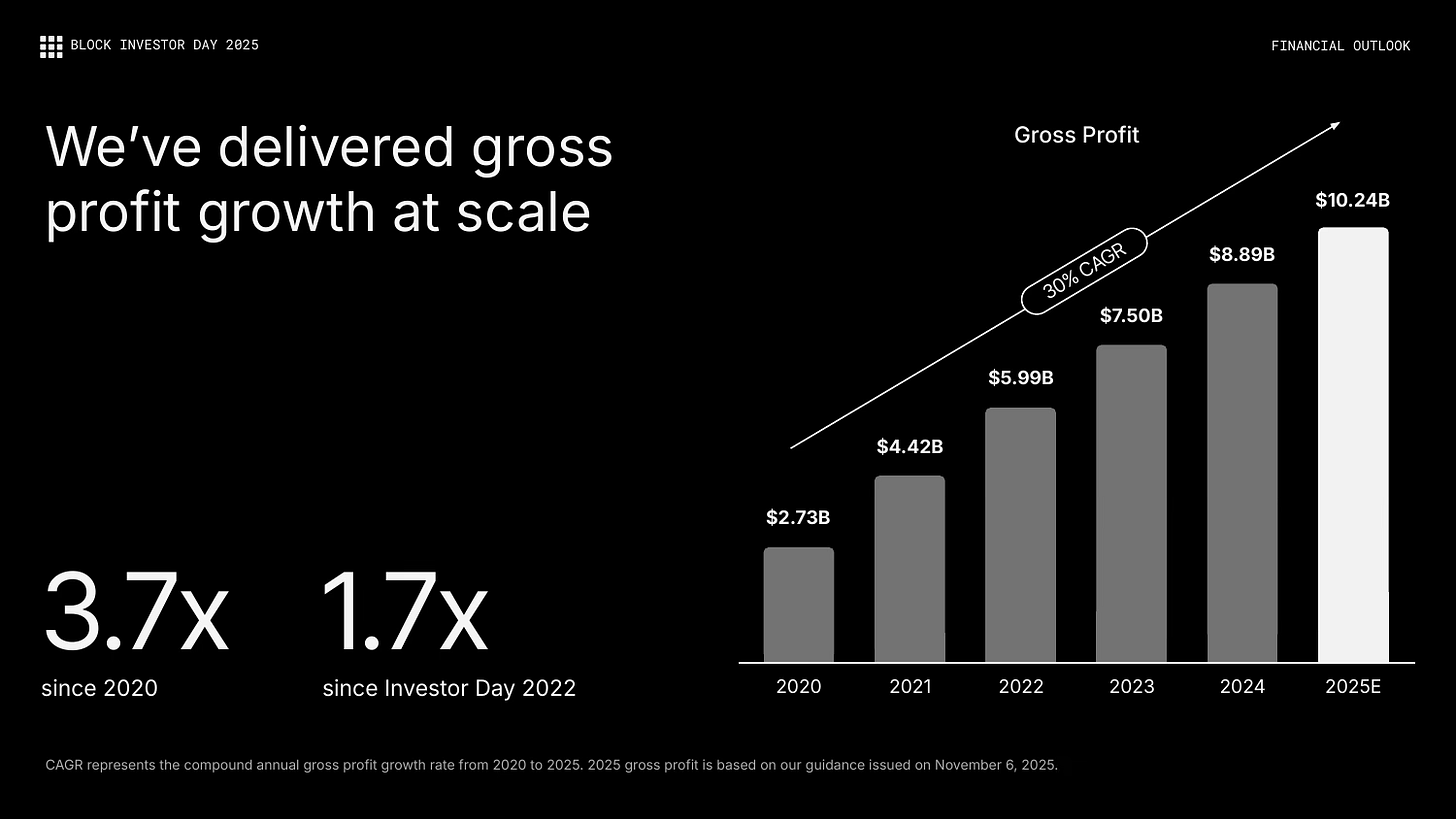

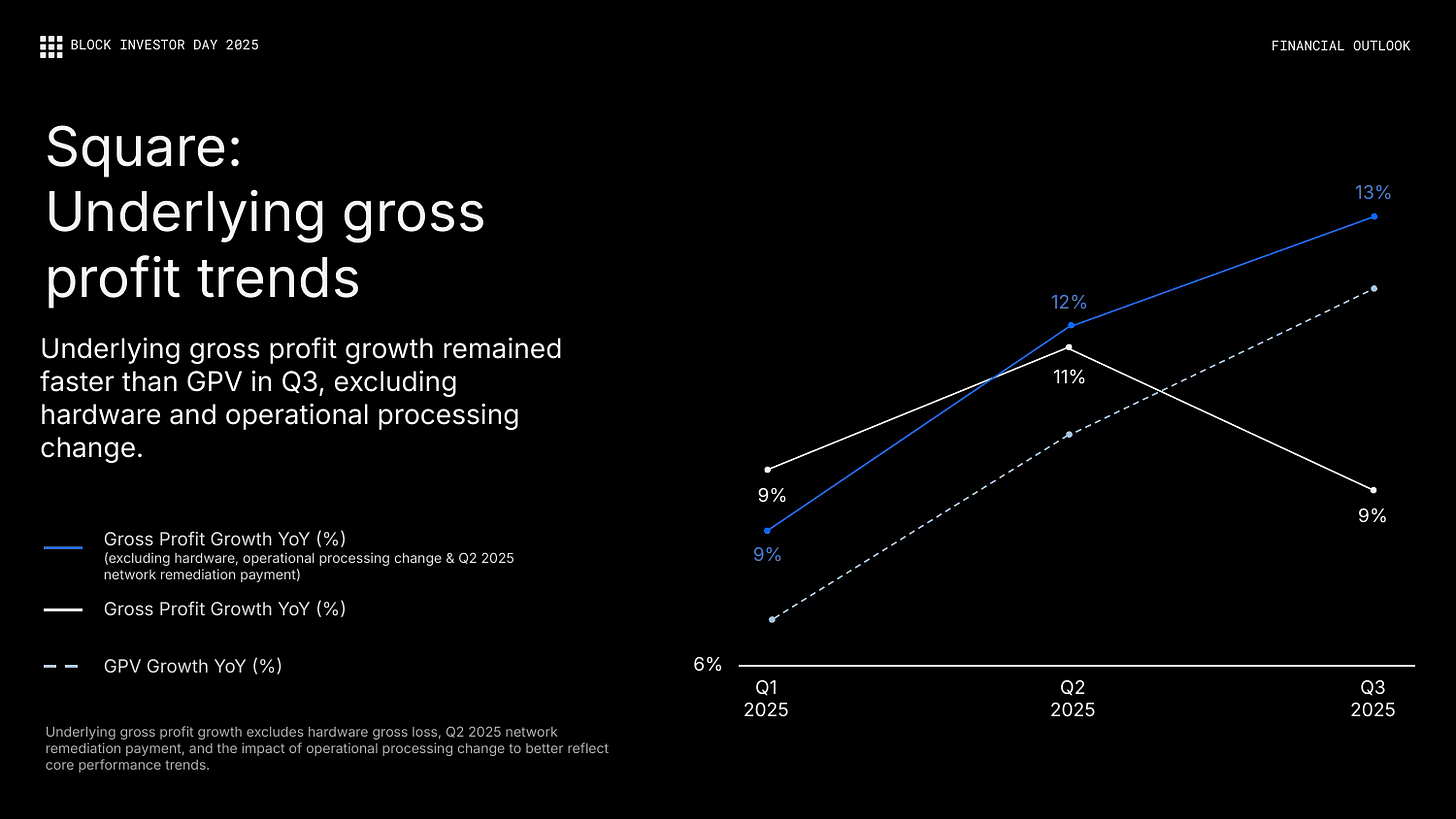

Recent growth is a blend of GPV acceleration and higher monetization through software and banking products, with international contributing a mid-teens share of Square gross profit in recent quarters.

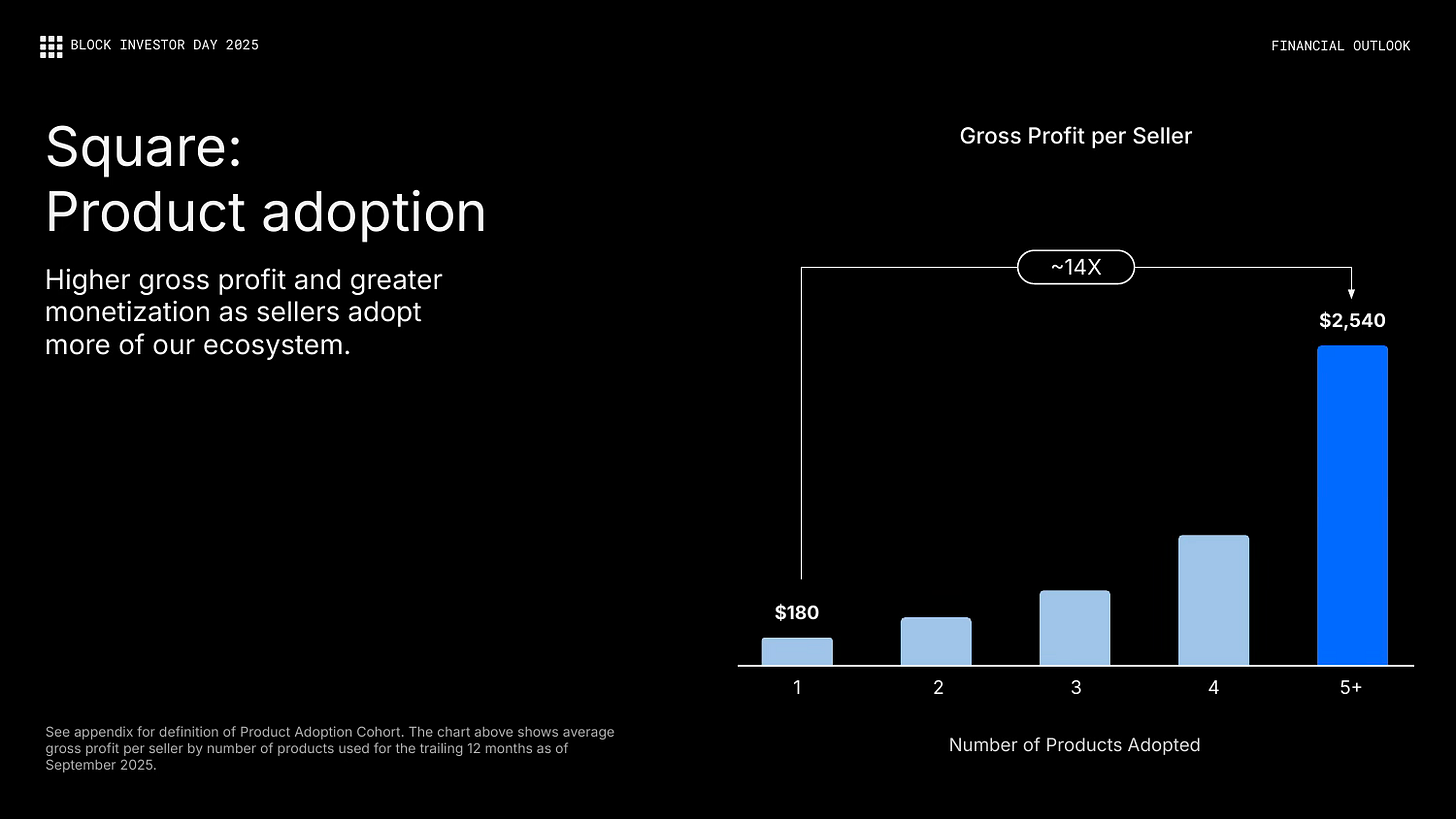

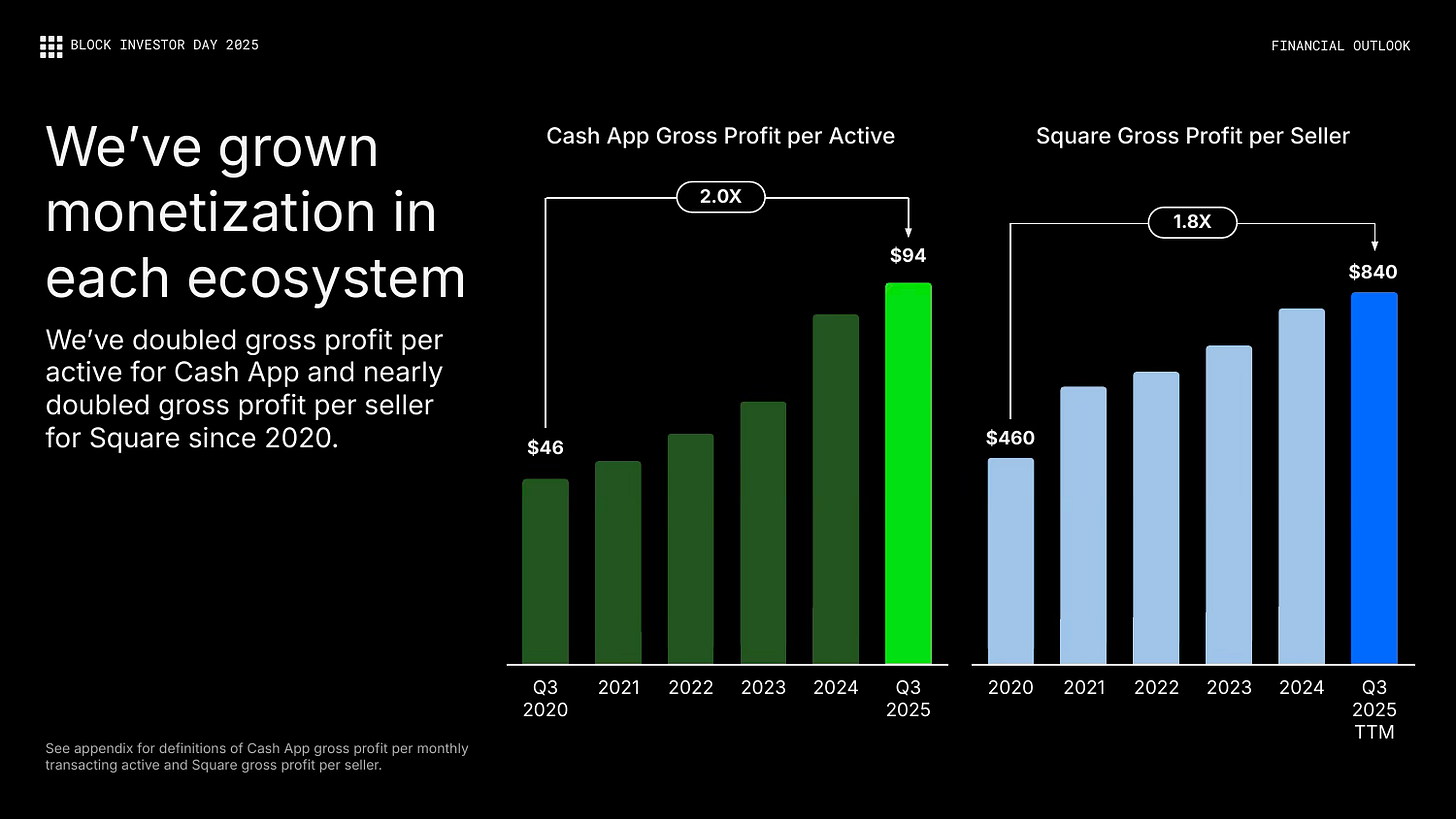

The core economic bet: as sellers adopt more Square products, gross profit per seller rises meaningfully; Investor Day materials show a step-function for multi-product cohorts.

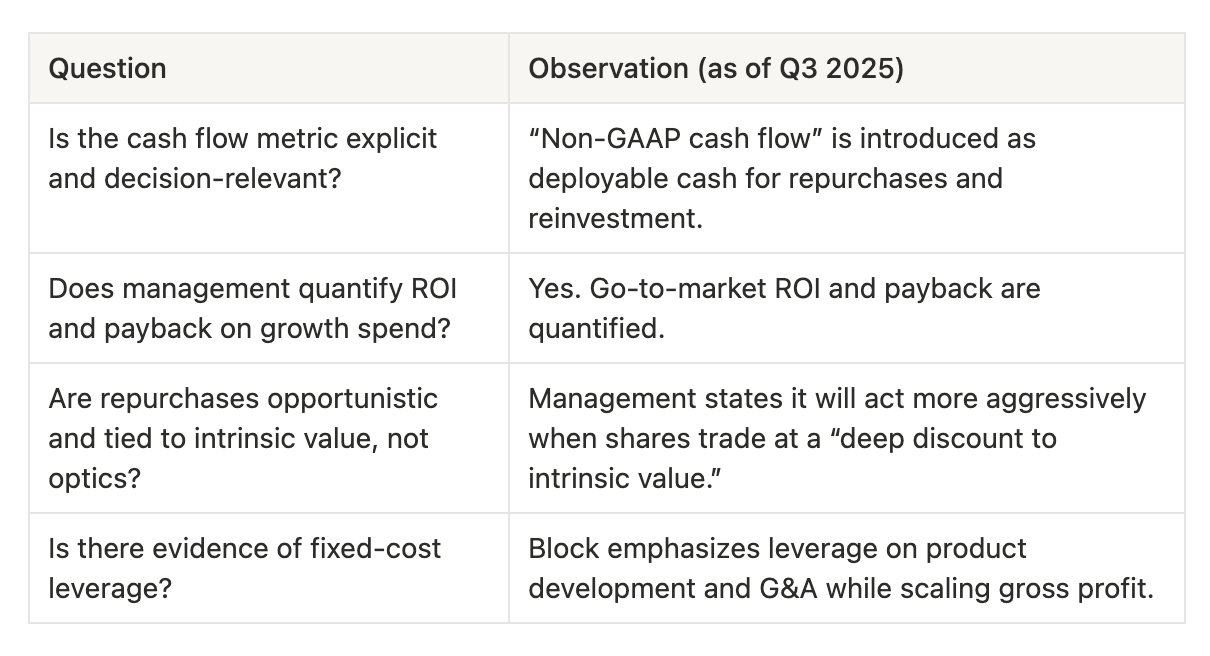

Distribution is being treated like an ROI-driven machine. Square quantifies payback periods and ROI for go-to-market investments, an explicit posture for a fintech.

Capital allocation is becoming more Outsiders-like: explicit priorities (invest, repurchase, strengthen balance sheet) and a willingness to scale repurchases when shares are viewed as below intrinsic value.

Defining B2B at Block: what Square is (and isn’t)

Block has two primary ecosystems: Square and Cash App. Square is the seller-facing ecosystem, Block’s B2B business, while Cash App is consumer-facing.

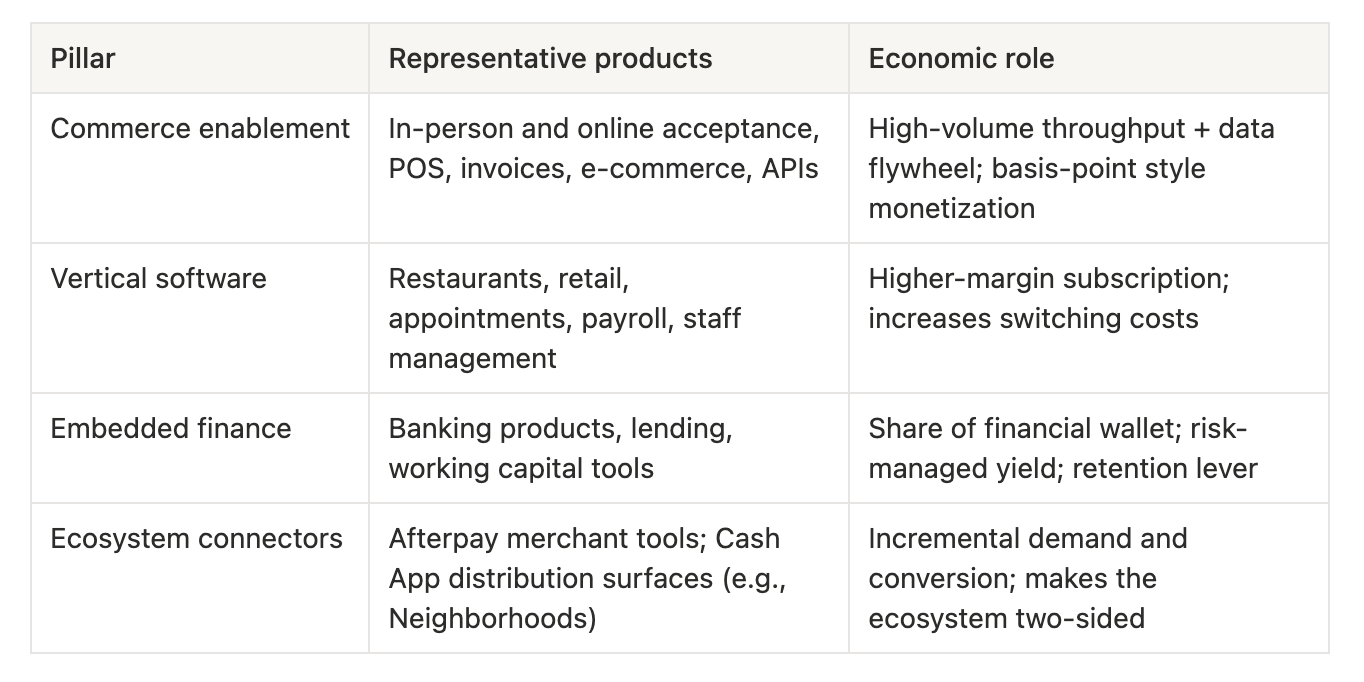

From a product taxonomy perspective, Square’s B2B stack clusters into four pillars:

Square’s ambition is to be the default system of record for commerce, not a point solution that can be swapped out over a weekend.

How Square makes money: revenue streams and unit economics

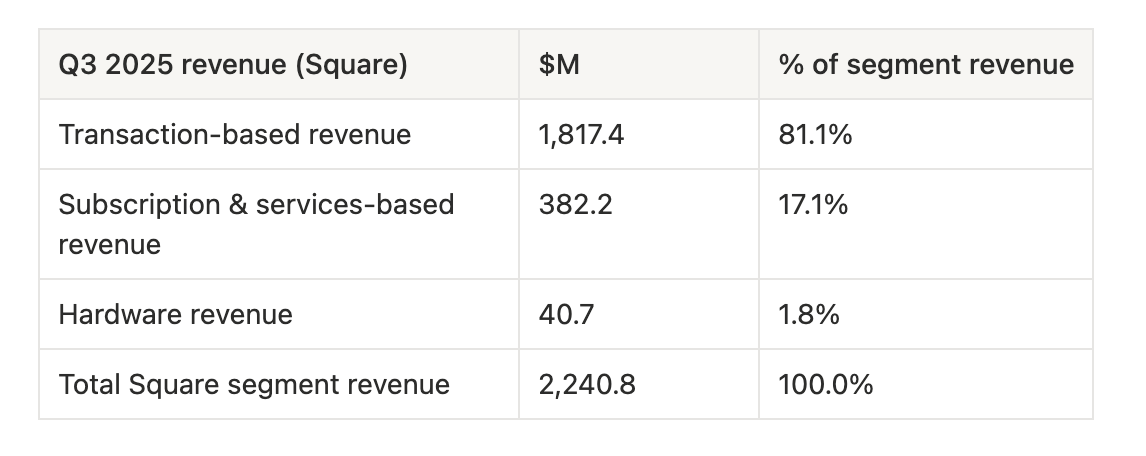

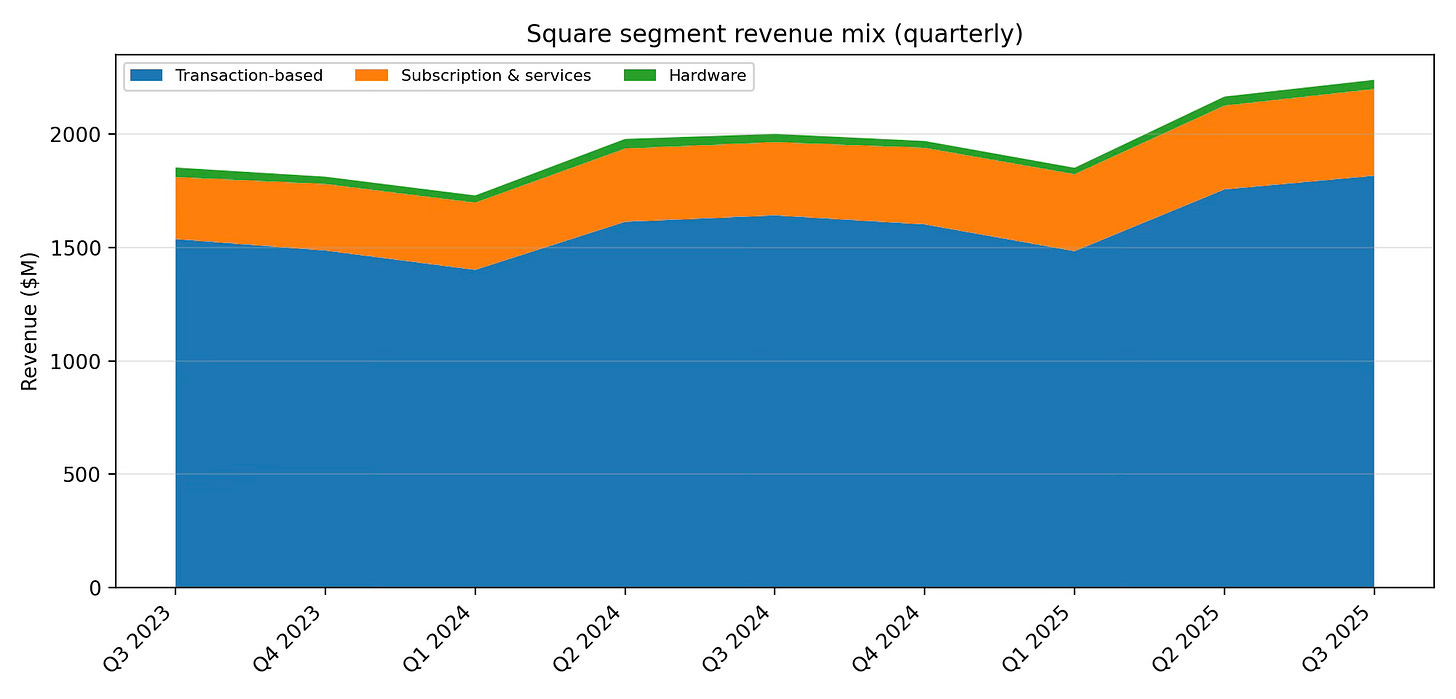

Square’s reported revenue is a mix of (a) transaction-based revenue tied to GPV, (b) subscription and services-based revenue tied to software and service attach, and (c) hardware revenue.

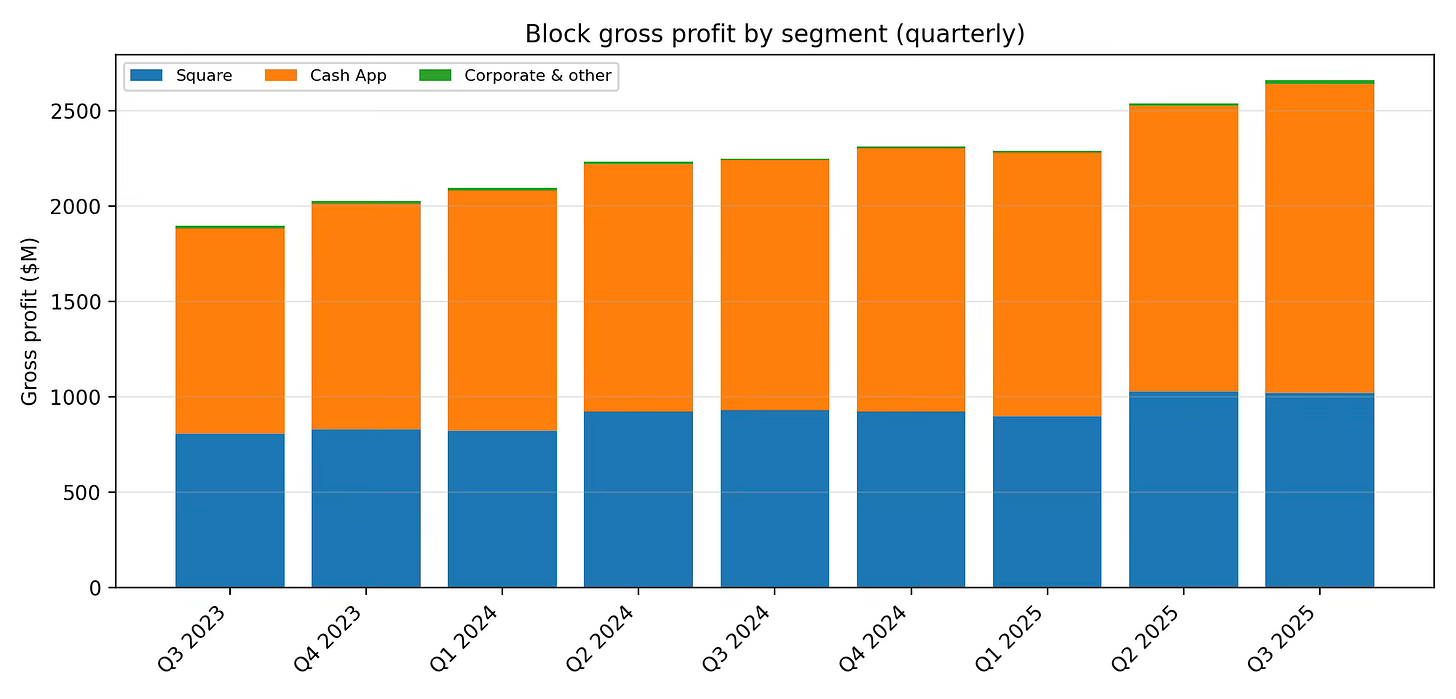

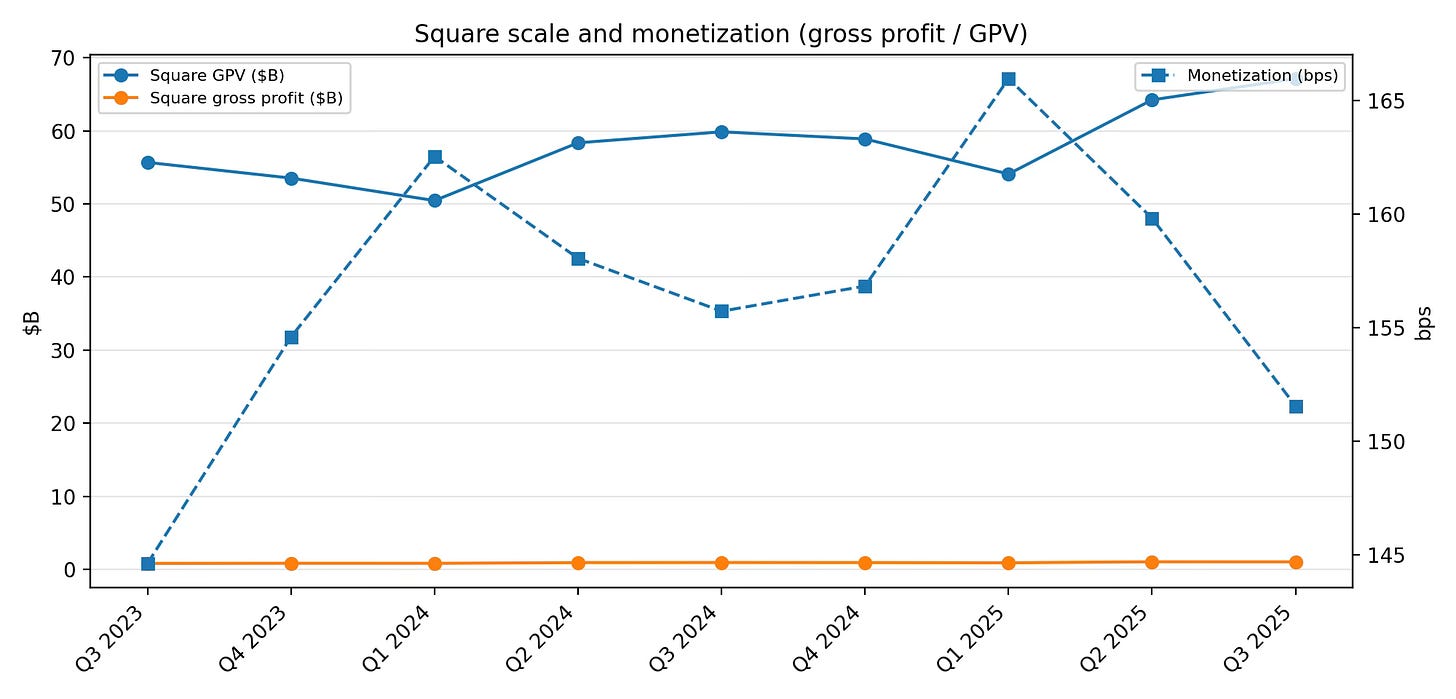

Gross profit is the cleaner lens than revenue for Square because it strips out pass-through costs. Across the last nine reported quarters (Q3 2023 to Q3 2025), Square gross profit has sat around ~$0.8B to ~$1.0B per quarter, while GPV has ranged from ~$50B to ~$67B.

Distribution and operating leverage: scaling the machine

Payments businesses often die by commoditization. Square’s counter-move is to treat distribution as a controllable, ROI-measurable system, then pour more fuel into the parts that compound.

Two implications follow. First, Square’s growth is no longer framed as purely product-led; it is product-led plus repeatable customer acquisition. Second, management is signaling discipline: if payback stretches and ROI compresses, the throttle should ease.

Operating leverage shows up most clearly in incremental margins and in the company’s willingness to talk about efficiency as a design constraint.

Competitive advantage: moats, switching costs, and network effects

Square competes in an arena where the raw ingredients: card networks, processors, and commodity hardware, are accessible to many players. Its durable advantage has to come from system-level integration and the accumulated friction of switching.

In the Q3 2025 shareholder letter, Block makes a strong claim about this integration:

We believe we are the only company that designs the hardware… and financial tools for sellers.

— Block Q3 2025 Shareholder Letter

The strongest interpretation is not that each component is unique; it is that the interfaces between components become the moat. Once Square is the system of record: transactions, catalog, customer relationships, inventory, staff, and cash flow, every additional module is easier to adopt, and every competitor has to sell a rip-and-replace story.

A Buffett-style way to phrase the moat question is: where do increasing returns show up? Square’s version is subtle: it is the compounding value of unified commerce data and unified workflows.

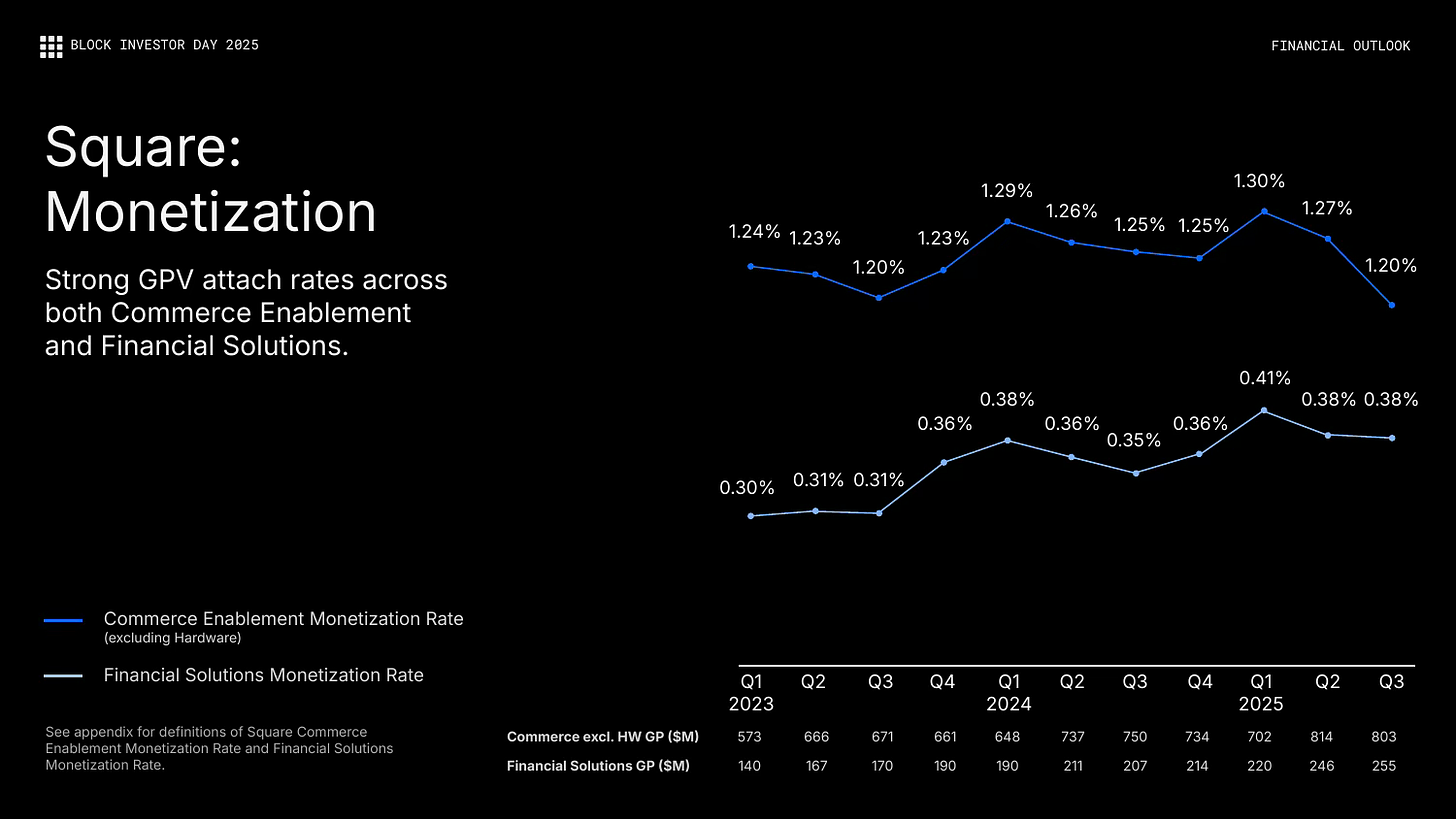

Monetization remains in a relatively tight band. What you would expect from a payments-heavy base. The lever for margin expansion is therefore not a dramatic repricing of payments, but a greater mix of subscription and financial solutions.

Strategy and product roadmap: verticals, AI, and ecosystem connections

Block’s recent Square narrative can be summarized as: serve sellers better, automate more of their day, then connect sellers to consumers.

Vertical depth (especially restaurants)

Restaurants are a proving ground because they are workflow-heavy: ordering, inventory, staffing, procurement, and payments converge.

Two-sided distribution: Neighborhoods + Cash App

Neighborhoods on Cash App is strategically interesting because it moves Square from a seller tool to a seller tool with embedded demand.

If this works, it creates a reinforcing loop: Cash App users discover and transact with Square sellers → sellers see incremental revenue → sellers adopt more Square tools → better seller experience improves retention and acquisition.

Capital allocation and the Outsiders test

The Outsiders is blunt: long-term shareholder outcomes diverge most when capital allocation diverges. Block is explicit about a capital allocation hierarchy: invest, repurchase, optimize balance sheet.

This posture is not costless. Buybacks are only a value creator if the business is compounding and the shares are meaningfully undervalued. But it does suggest an orientation toward per-share value, not just empire size.

Outsiders checklist (applied to Square / Block)

Risks and failure modes

Munger’s inversion is useful here. Rather than listing generic fintech risks, focus on a few kill shots, failure modes that would alter the unit economics or the compounding loop.

Payments commoditization outpaces attach

If competitive pricing pressure forces take-rate compression while software and financial attach fails to rise, Square’s gross profit per GPV can drift down.

Upmarket push increases complexity faster than value

Larger sellers are higher volume but also higher demands: integrations, uptime, enterprise-grade support. If the product and service layer lags, churn and reputational drag follow.

Credit cycle stress in embedded finance

Lending and BNPL have pro-cyclical loss dynamics. If underwriting and servicing fail to adapt, losses can overwhelm spread income and distract management.

Two-sided bets fail to reach critical mass

Neighborhoods (or similar connectors) could remain a niche feature: valuable for PR, immaterial for economics.

Regulatory and network-rule shocks

Payments and lending exist inside dense rulebooks. Sudden changes can reprice economics or force product redesign.

The common thread: Square’s moat is a bundle of small frictions: data, workflow, distribution, and financial integration. If that bundle unravels, the business reverts toward a commodity processor.

Sources:

Block Q3 2025 Shareholder Letter (PDF, Nov 6, 2025)

https://s29.q4cdn.com/628966176/files/doc_financials/2025/q3/Block_3Q25_Shareholder-Letter.pdfBlock Form 10-Q for quarter ended September 30, 2025 (PDF)

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001512673/58ec2fec-b451-41f7-9f69-bc4e9354c93c.pdfBlock Form 10-K for year ended December 31, 2024 (PDF)

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001512673/bc6dab01-b430-4b1d-ac7b-0e6b96903592.pdfBlock Investor Day 2025 – Financial Outlook (PDF)

https://block.xyz/documents/block-investor-day-2025-financial-outlook.pdfBlock Investor Day 2025 – Full Transcript (PDF, corrected transcript dated Nov 19, 2025)

https://block.xyz/documents/block-investor-day-2025-full-transcript.pdfSquare press: Introducing Neighborhoods on Cash App (Oct 8, 2025)

https://squareup.com/us/en/press/neighborhoods-by-cash-appSquare press: Square Releases delivers for restaurants (Oct 8, 2025)

https://squareup.com/us/en/press/square-releases-food-beverageBlock IR news: Square Brings Bitcoin to Main Street (Oct 8, 2025)

https://investors.block.xyz/investor-news/news-details/2025/Square-Brings-Bitcoin-to-Main-Street-With-First-Integrated-Payments-and-Wallet-Solution-for-Local-Businesses/default.aspxBlock IR news: Square AI gains new intelligence capabilities (Oct 8, 2025)

https://investors.block.xyz/investor-news/news-details/2025/Square-AI-Gains-New-Intelligence-Capabilities-Providing-Deeper-Business-and-Neighborhood-Insights-to-Square-Sellers/default.aspxBlock Historical Financial Information (XLSX, Q3 2025)

https://s29.q4cdn.com/628966176/files/doc_financials/2025/q3/Historical-Financial-Information_3Q25-Block.xlsxBlock IR overview page (shows latest quarter listed as Q3 2025 at time of access)

https://investors.block.xyz/overview/default.aspxSquare official LinkedIn company page (About section)

https://mx.linkedin.com/company/joinsquare?trk=ppro_cprofEmployee post: Adam Redd on LinkedIn re: Square Releases Vol. 2 (Oct 2025)

https://www.linkedin.com/posts/adamredd_releases-vol-2-2025-activity-7381793090455482368-GsFK