OpenEvidence: The New Clinical Interface

A field guide to the company remaking how clinicians retrieve and apply medical knowledge.

OpenEvidence is a medical AI platform that helps clinicians make point-of-care decisions by delivering fast, citation-linked answers synthesized from trusted medical literature.

Infinite Medical Literature, Finite Physician Time

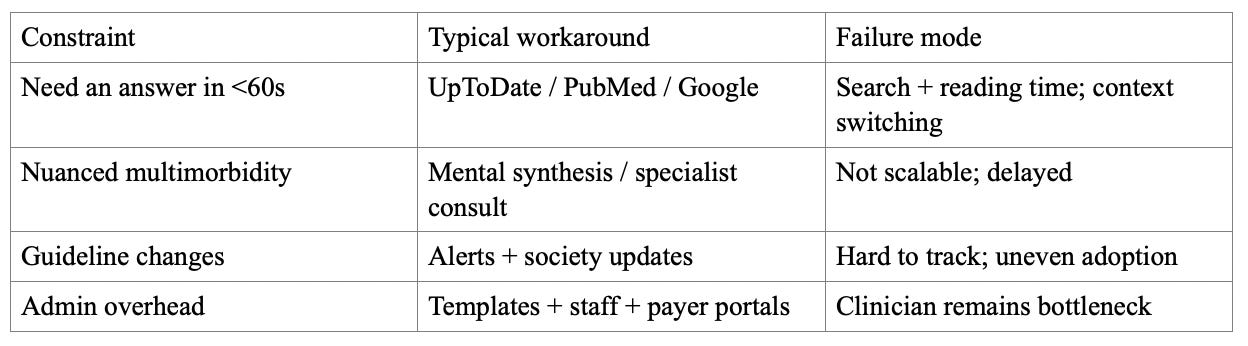

There is an exponential growth in medical knowledge and publication volume, pushing clinicians toward shortcuts and increasing cognitive load. The status quo is a patchwork: subscription references, PubMed searches, guideline PDFs, institutional pathways, and specialist consults. These are effective but often require manual searching, cross-tab synthesis, and workflow friction during a visit.

Evidence-Anchored AI Answers That Clinicians Trust

A point-of-care AI tool must make two promises at once: speed and trust. OpenEvidence’s approach is to constrain the evidence substrate (peer-reviewed sources and partnerships) and keep the citation trail visible in the output. The distinguishing combination is: (1) licensed/professional content partnerships, (2) free-to-clinician distribution (removing procurement friction), and (3) deeper agentic modes (e.g., DeepConsult) for synthesis when time allows.

If OpenEvidence becomes a daily habit during clinical moments that matter, switching costs become behavioral. Durability then depends on two compounding assets: trust (provenance) and distribution (habit frequency). The company’s direction points toward medical superintelligence via specialist routing and deeper agentic workflows, while expanding the product surface around the visit (documentation, communications, trials).

The benefit is time compression: fewer tabs, less searching, faster verification via citations, and more consistent evidence access regardless of local resources. It sits as a clinician-used application (web/app) accessed directly with NPI verification, used during office hours and at the point of care. The use cases include rapid evidence-backed answers, guideline/drug checks, deeper multi-study synthesis (agentic research), visit-time support, secure calling, and clinical trial matching.

LLMs, Verification, and the Shift to AI-Native Workflows

There is a convergence of clinician time scarcity, accelerating publication volume, and the rise of retrieval + LLM systems that can produce citeable synthesis fast enough to matter in the room. Earlier eras had either high-trust editorial products (slow to synthesize per query) or keyword search (fast retrieval, low synthesis). A point-of-care synthesis layer required capable models, affordable interactive compute, and publisher willingness to license content for AI workflows.

The category evolved from textbooks and guidelines → subscription digital references (UpToDate) → EHR pathways → early clinical NLP → today’s conversational assistants and enterprise AI features in incumbents.

Recent enabling trends include retrieval-augmented generation with citations, agent orchestration across specialized models, and clinician willingness to adopt AI tools directly, creating a new distribution wedge.

A Wedge Into U.S. Clinicians and the Spend That Follows Their Decisions

Two buyer groups define the market: (A) clinicians (end users) and (B) life sciences / healthcare advertisers (economic buyers). The opportunity spans clinical decision support and HCP-focused marketing channels.

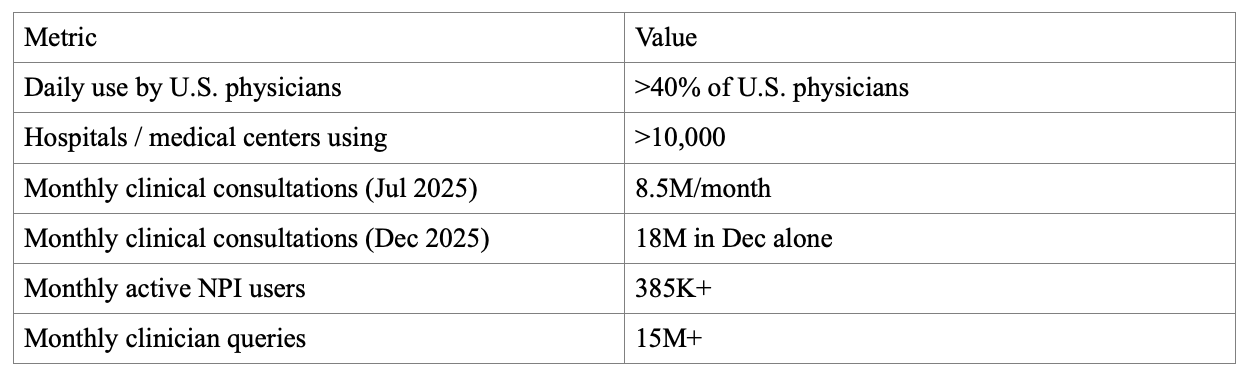

A free-to-clinician, ad-supported medical answer engine creates a new channel that doesn’t map cleanly onto subscription reference markets. The platform targets NPI-verified U.S. clinicians. The advertising site reports 385K+ monthly active NPI users, 15M+ monthly NPI-verified clinician queries, 75% usage during office hours, and 20% month-over-month growth.

Customers on the supply side: content partners e.g., NEJM Group; AMA/JAMA. On the demand side: life sciences advertisers seeking point-of-care reach and measurement.

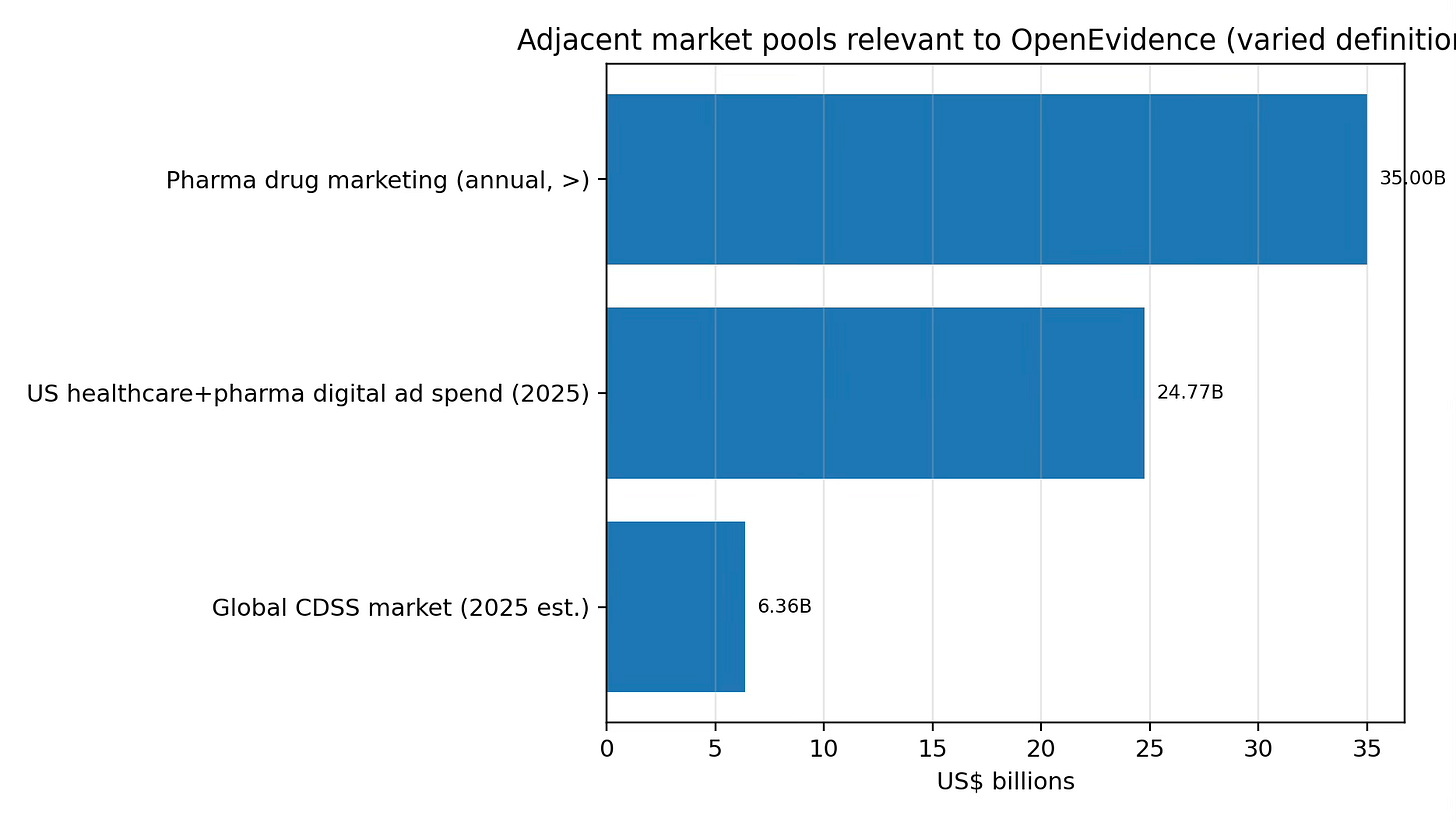

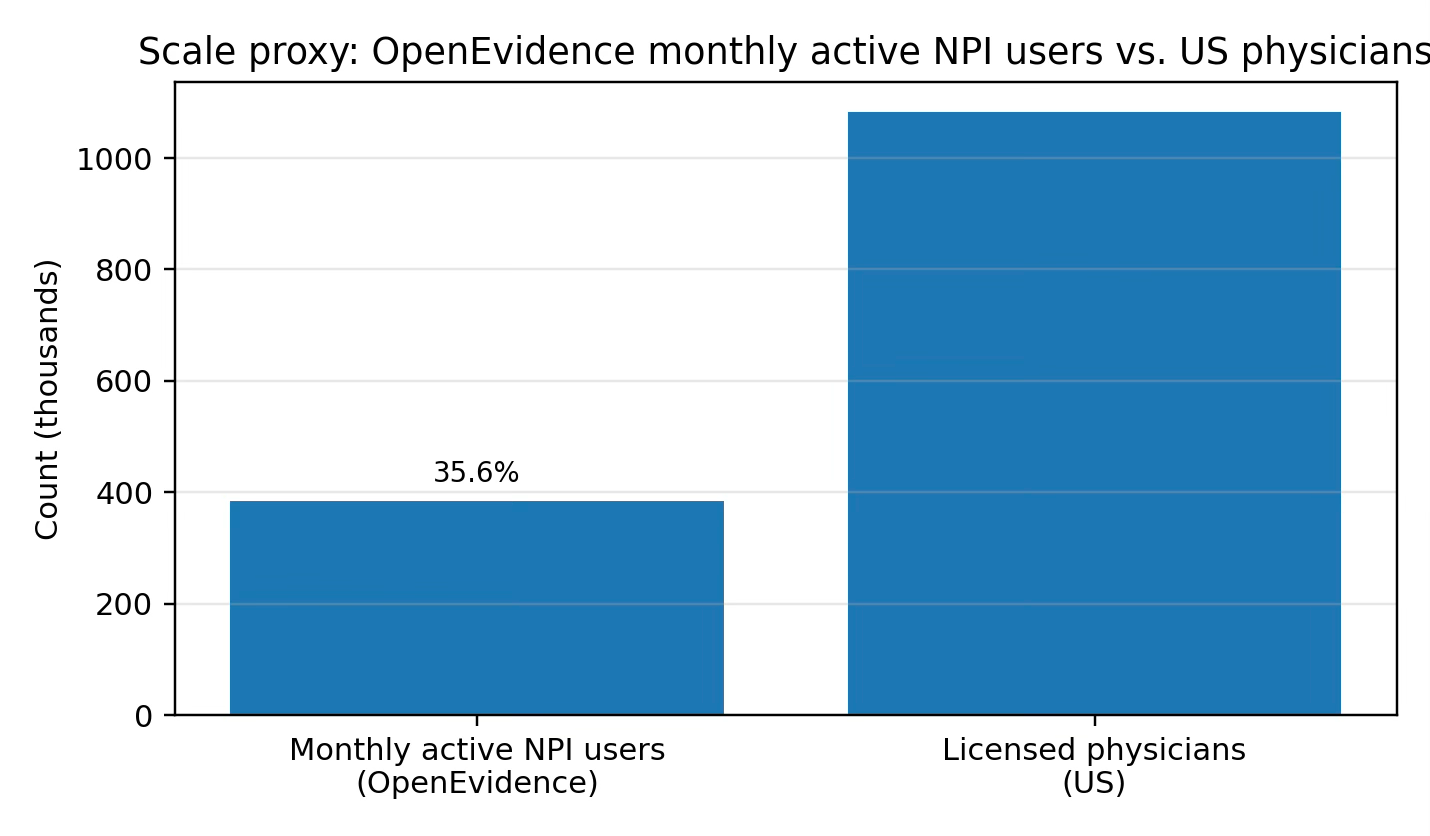

Two TAM anchors: (1) U.S. healthcare+pharma digital ad spend ($24.77B in 2025), and (2) total pharma drug marketing spend (reported as >$35B/year). These are broad pools; OpenEvidence would target a subset tied to HCP clinical moments. The SAM starts with inventory. As of Feb 2026, the ads site reports 15M+ monthly clinician queries. If 20% of queries can responsibly carry an impression, that is 3M impressions/month. At an illustrative $150 CPM, that is ~$0.45M/month or ~$5.4M/year for one format; SAM grows with additional formats and fill rates subject to policy/regulatory constraints. A practical SOM proxy is current penetration. With 385K+ monthly active NPI users reported, OpenEvidence has large-scale clinician reach. Relative to 1,082,187 licensed physicians (FSMB), this is ~35.6% as a rough proxy (MAU includes non-physician NPIs).

Generic AI, Legacy Reference Tools, and the Trust Gap

Direct competitors include clinical reference/CDSS platforms (e.g., UpToDate). Adjacent: physician networks/media (e.g., Doximity). Indirect: generalist LLMs and the baseline workflow of manual searching and institutional pathways.

The implied plan is to win clinicians directly (free product, habit formation), then deepen trust (licensed content + citations), then expand workflows and monetization. Emphasized advantages include: (1) distribution, (2) provenance via trusted sources and partnerships, (3) medical-domain specialization, and (4) specialist/agent architecture.

From Search Bar to Clinical Operating System

The product is delivered as a clinician-facing SaaS product with native mobile distribution; access is positioned as free for verified clinicians. Features include Core search+answers; DeepConsult for deeper synthesis; and workflow extensions (Visits, Dialer, Clinical Trial Matching) that expand into the visit and associated admin tasks.

Development roadmap:

Dec 2024: OpenEvidence 2.0. Expanded into administrative tasks

Jul 2025: DeepConsult. Agentic, longer-form synthesis for deeper research.

Aug 2025: Visits. Visit-time support and note assistance.

Dec 2025: Dialer. HIPAA-secure calling and workflow integration.

Feb 2026: Clinical trial matching. Trial search/matching feature.

Development roadmap. If distribution is already strong, the next battleground is workflow integration and governance: audit trails, evaluation harnesses, specialty-specific agents, and institutional integrations that do not slow the core consumer-like workflow.

Free to Clinicians, Paid by Industry, and Built for Scale

Free-to-clinician distribution paired with advertising monetization. The model tries to treat point-of-care intent as scarce inventory that can be monetized without charging the clinician. The company is ad-supported, and highlights building out advertising infrastructure (including the Amaro acquisition). Clinician access is positioned as free; advertiser pricing is not publicly disclosed.

Diligence should focus on CPMs for verified HCP inventory, campaign minimums, renewal rates, and whether measurement approaches satisfy brand/regulatory needs.

Clinician acquisition is direct-to-user; advertiser monetization is an enterprise sales motion (campaign design, measurement, relationship management).

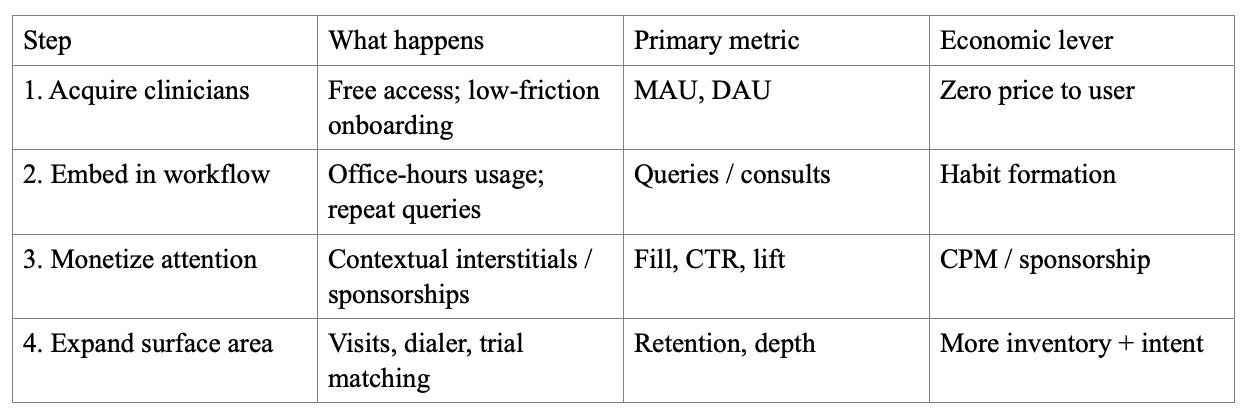

Sales funnel mechanics:

Financials

The company reached $100m in annual revenue. Publicly reported funding rounds: Series A $75M at $1B; Series B $210M at $3.5B; Series C ~$200M at ~$6B; Series D $250M at $12B. These imply ~$735M in disclosed capital across 2025–Jan 2026, excluding earlier seed/angel capital.

Cash flow diligence should prioritize: inference cost per query, compute cost per DeepConsult run, licensing costs, and sales payback for advertisers. The ad-supported model is attractive only if gross margin survives scale.

From Answers → Actions → Specialist Systems (Medical Super‑Intelligence as a Roadmap)

A plausible best case is that OpenEvidence becomes a default interface layer between clinicians and medical evidence: always-on, specialty-aware, integrated into the visit, and capable of producing verifiable synthesis with audit trails, monetized as a premium point-of-care distribution channel for life sciences plus workflow adjacencies (documentation, communications, trial access). An operating-system-level knowledge layer, with provenance and governance strong enough to survive real clinical scrutiny.

Risks to the vision

Model performance convergence. Generalist models may catch up; defensibility must come from workflow, trust, evaluation, and distribution alongside model quality.

Incentive conflicts. Ad-supported monetization must be governed so the economic buyer cannot distort clinical truth.

Regulatory and liability pressure. As AI use becomes more clinically consequential, demands for validation, logging, and accountability will rise.

Publisher/licensing dynamics. Partnerships are an advantage but may become a negotiating and cost center over time.