How Coinbase Makes Money | 2026-01

Coinbase is a regulated access layer between traditional money and the cryptoeconomy. When markets get busy, it earns tolls on trades. When customers park balances (especially USDC), it earns a yield-like spread. Around those, it sells services that look more like financial infrastructure: custody, staking, prime brokerage, and developer rails.

Revenue map

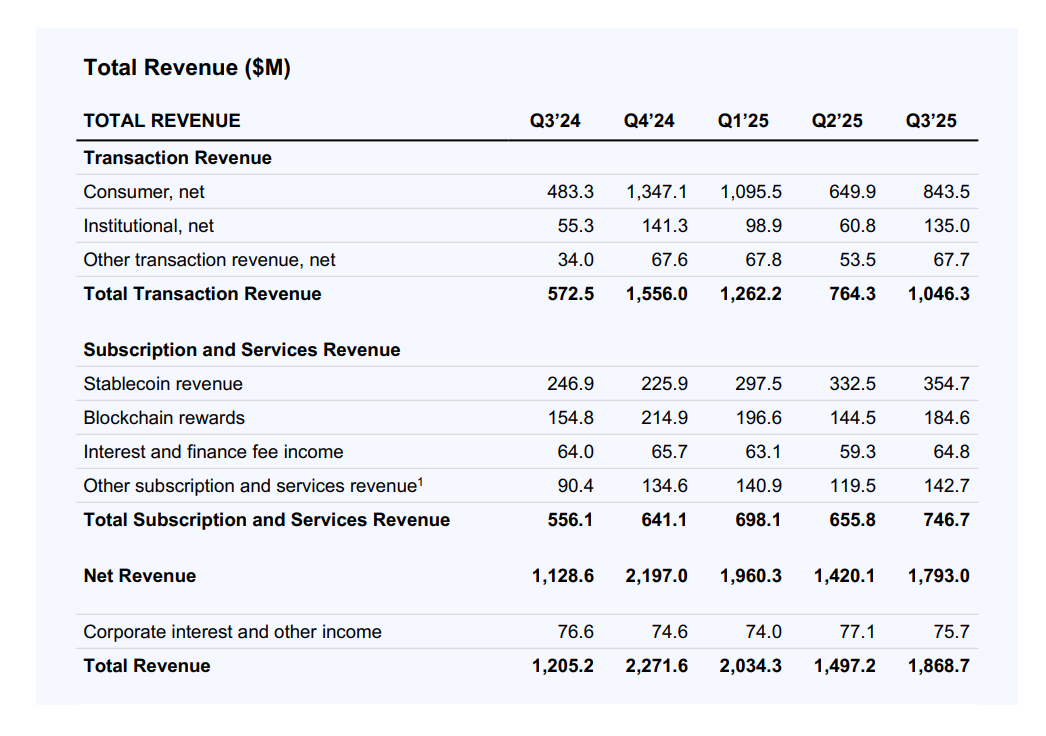

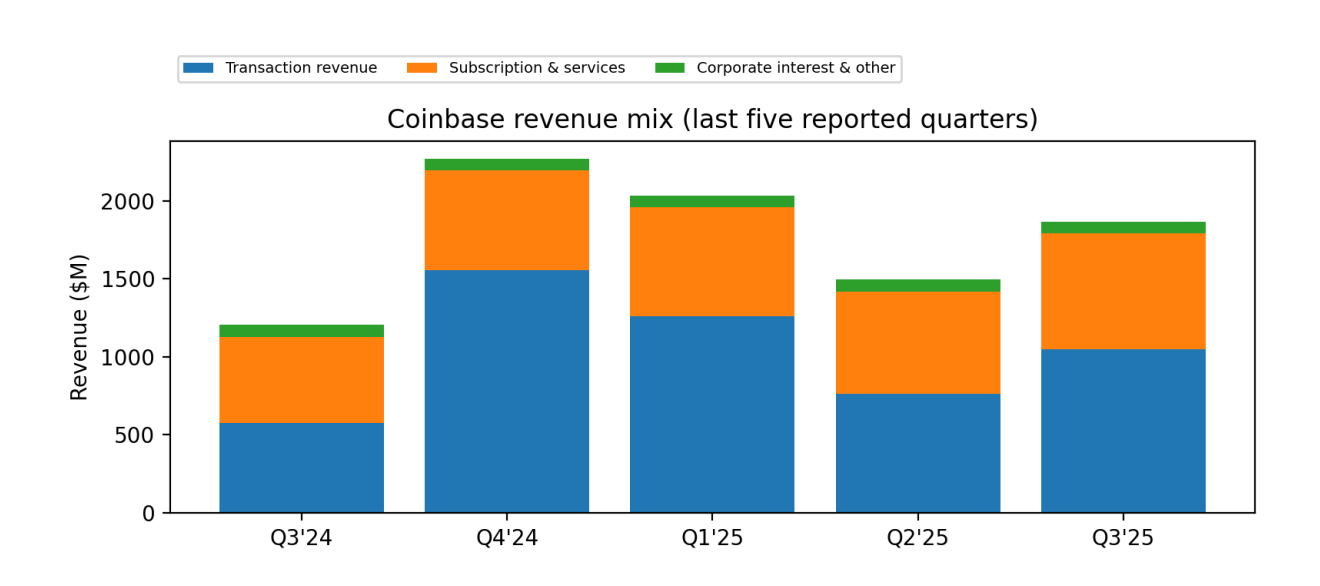

Coinbase main drivers are under transaction revenue and subscription services. The first bucket is the headline, but the second is the strategic bet: make the company less dependent on bursts of trading volume.

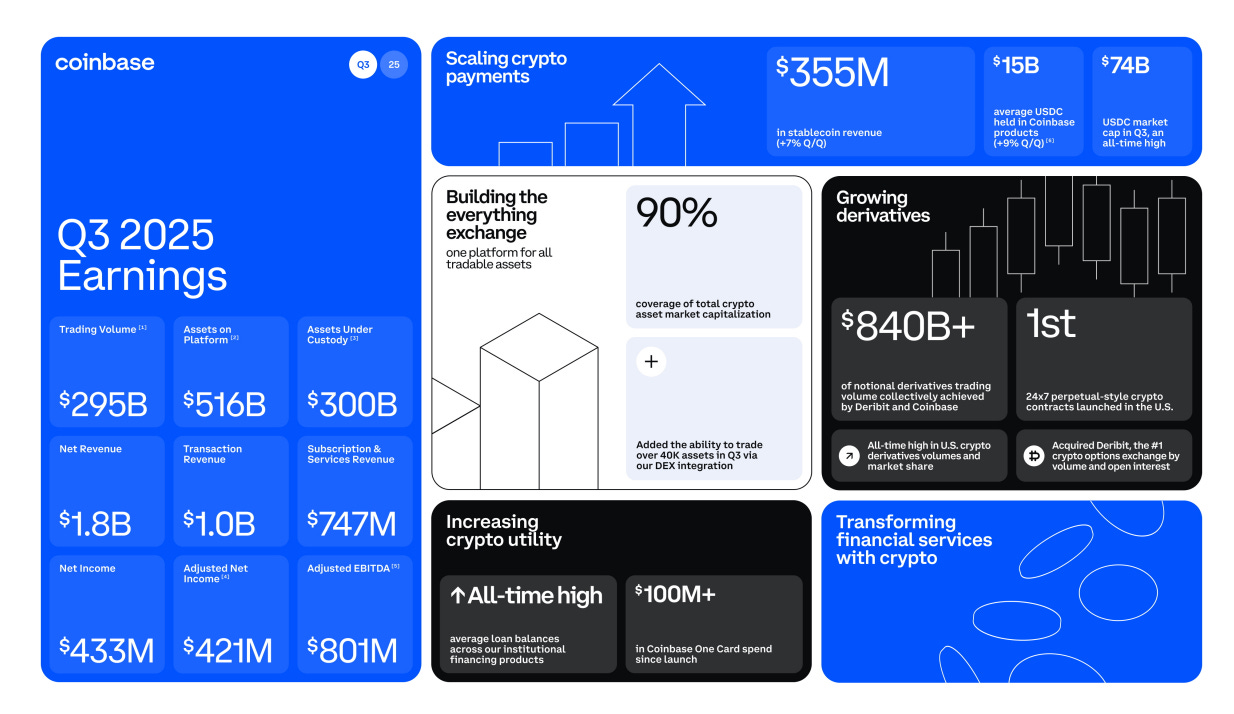

Transaction revenue is still the largest line item in Q3 2025. Second, subscription and services is $747M in Q3 2025, or 42% of net revenue per, which is why stablecoin economics matter.

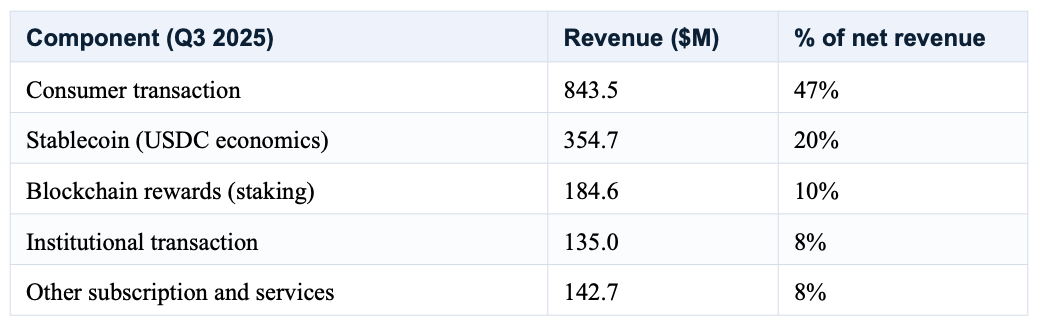

In Q3 2025, nearly half of net revenue came from consumer trading tolls. But the second-biggest contributor was stablecoin revenue, which behaves more like a balance + rate product than a trading product. That mix is why interest rates matter in a way that surprises people who think Coinbase is just an exchange.

Transaction revenue

Coinbase’s most intuitive business is brokerage: customers buy, sell, and convert crypto; Coinbase charges for the privilege. Transaction fees are either a flat fee or a percentage of the value of each transaction. On the consumer product, Coinbase also charges a spread.

Two different fee engines

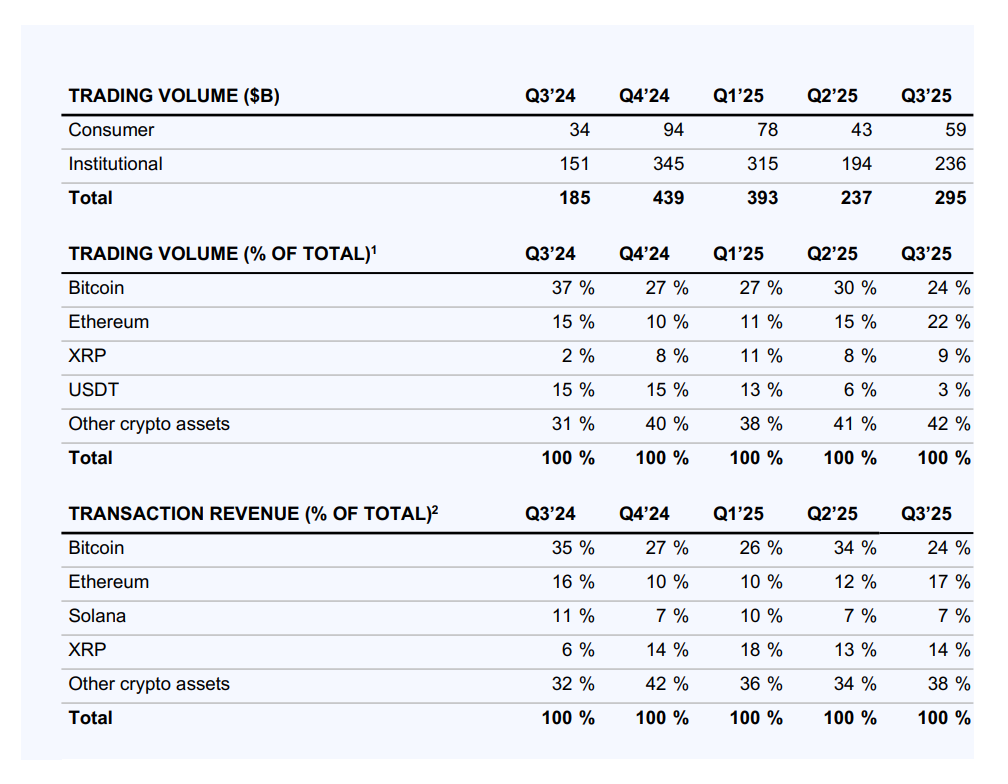

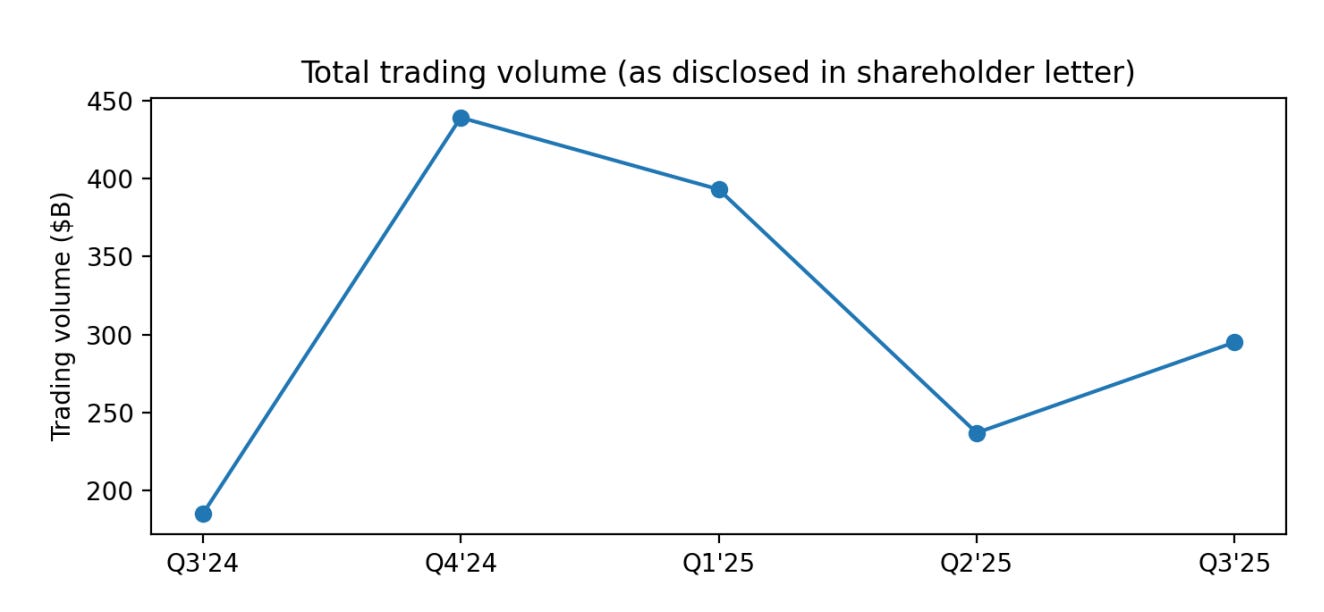

Retail (consumer) is higher take rate, lower volume. Institutional is lower take rate, much higher volume. This is why Coinbase’s revenue can rise even when it 'underperforms' a market volume index: the mix matters (asset mix, product mix, and customer mix).

Coinbase discloses a mix shift that is strategically logical but economically mixed: it attributes a lower average blended fee rate to changes in the mix of Trading Volume from Simple to Advanced trading, as well as growth in Trading Volume from Coinbase One users. Nudging users into cheaper, more order-book style products and subscriptions could improve retention and trust but compresses per-dollar fees.

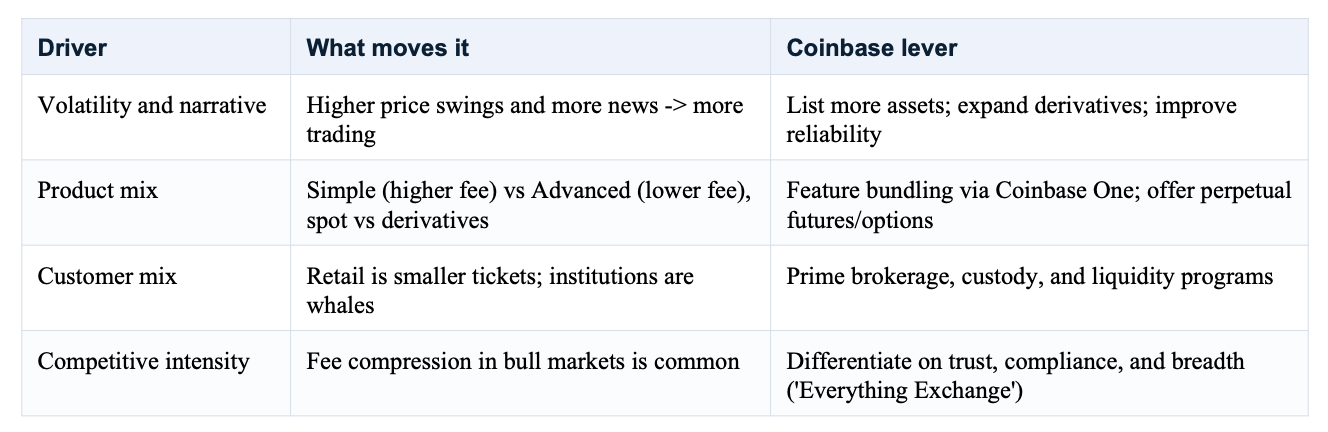

What makes transaction revenue swing

A simple model is Trading Volume x Take Rate. Volume is driven by volatility, narrative intensity, and market structure. Take rate is driven by product mix and competition.

In practice, Coinbase is running a risk transformation business: converting market volatility into fee income, and converting idle balances into yield-like revenue. That is why the company spends so much effort diversifying into derivatives and subscriptions.

Subscription and services: balances, yield, and infrastructure

This bucket is where Coinbase is trying to become more through-cycle. It contains stablecoin revenue (mostly USDC economics), blockchain rewards (staking), interest and finance fee income, and other services (custody, subscriptions, and more).

Stablecoin revenue (USDC): the balance-sheet-like engine

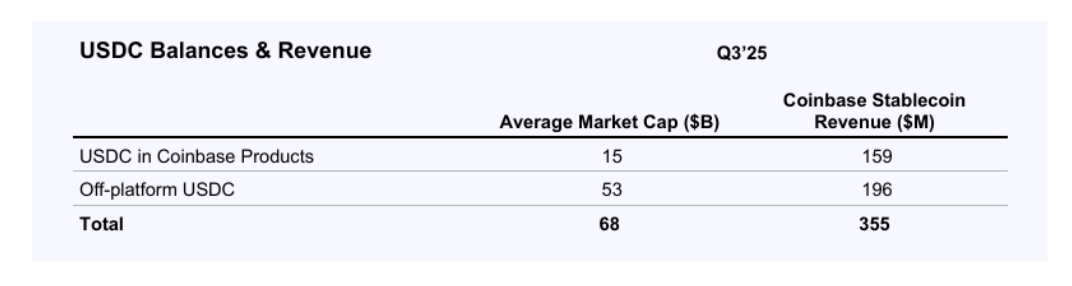

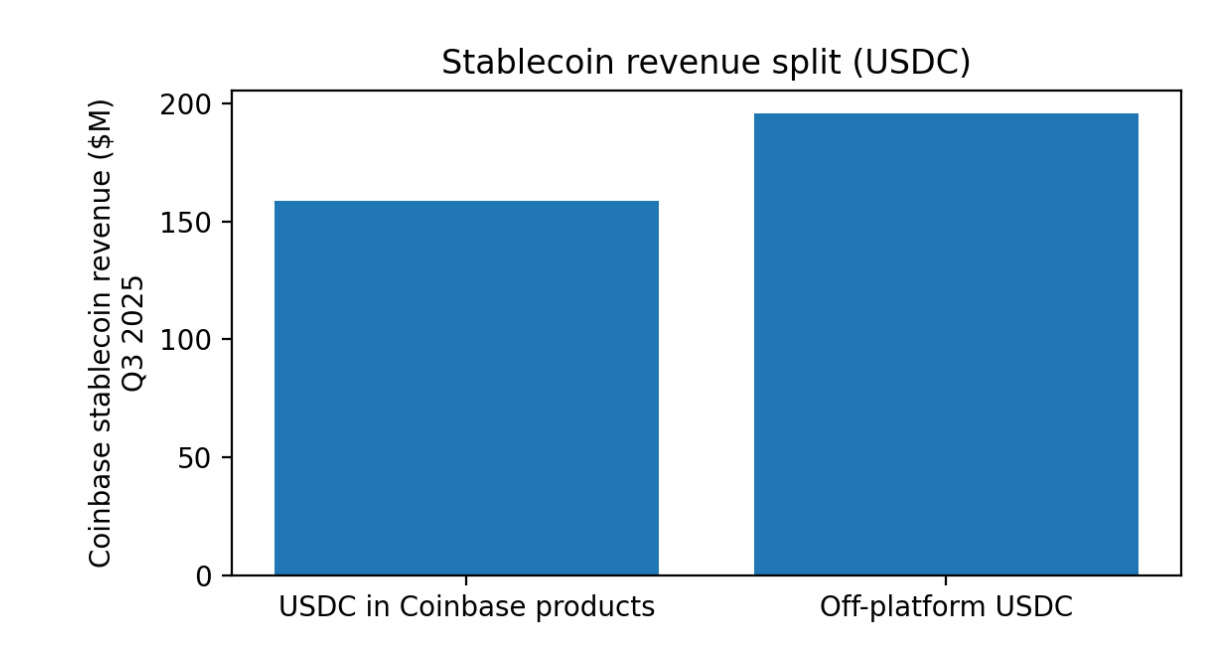

In Q3 2025, Coinbase reported stablecoin revenue of $355M, split into two sources: USDC held inside Coinbase products and USDC held off-platform.

Stablecoin revenue is tied to USDC balances and interest rates: Coinbase attributes increases to higher average USDC balances and decreases to lower average interest rates. Part exchange, part bank-like net interest logic, when rates are high, USDC balances throw off meaningful revenue. When rates fall, that tailwind fades.

Blockchain rewards (staking): take-rate on protocol inflation

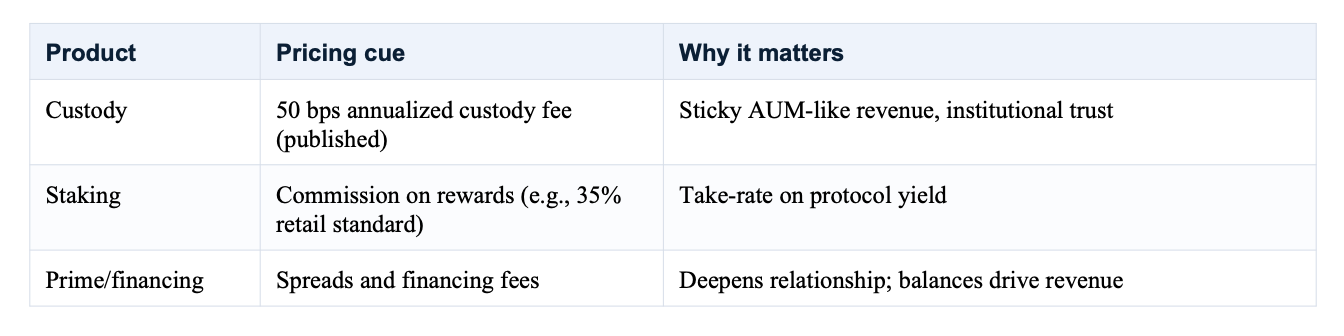

Coinbase’s staking business collects a commission on rewards paid by underlying networks. They take a 35% standard commission based on the rewards received. Coinbase sells ease, security, and compliance; in exchange it takes a cut of protocol rewards.

Other subscription and services: bundling the relationship

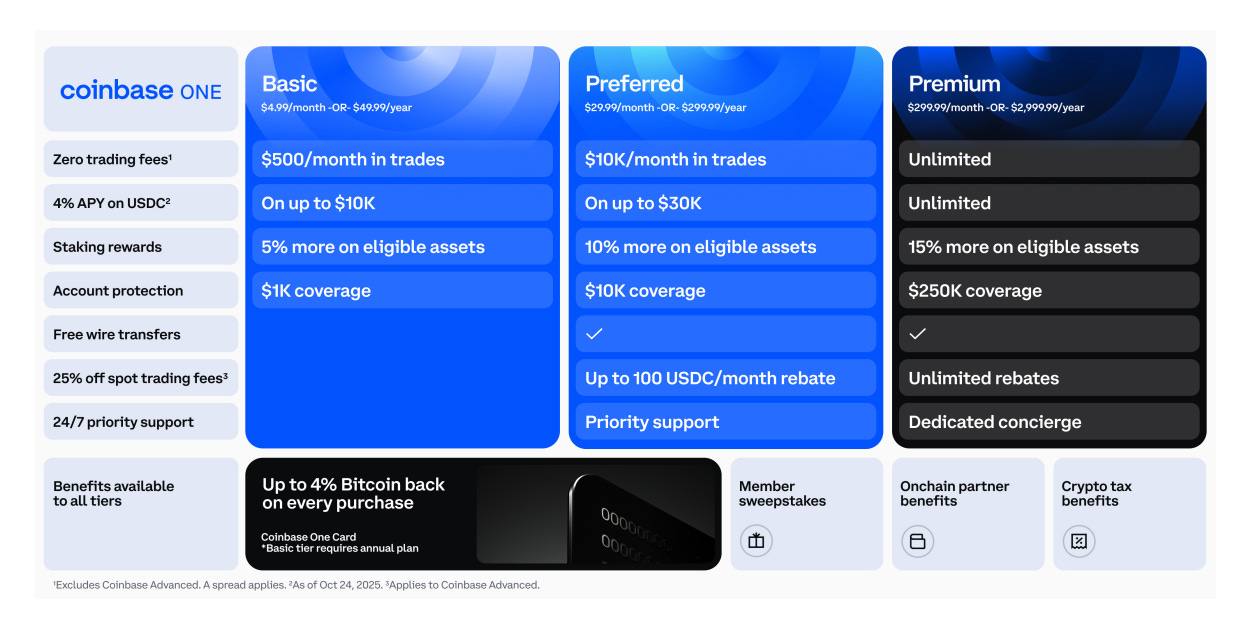

This line item includes products like Coinbase One. Coinbase attributes growth here primarily to growth in the number of paid Coinbase One subscribers.

Bundling is a move from tollbooth to relationship. It makes revenue less spiky, but it also forces a shift in economics: discounted-fee bundles push monetization toward balances, services, and cross-sell rather than per-trade tolls.

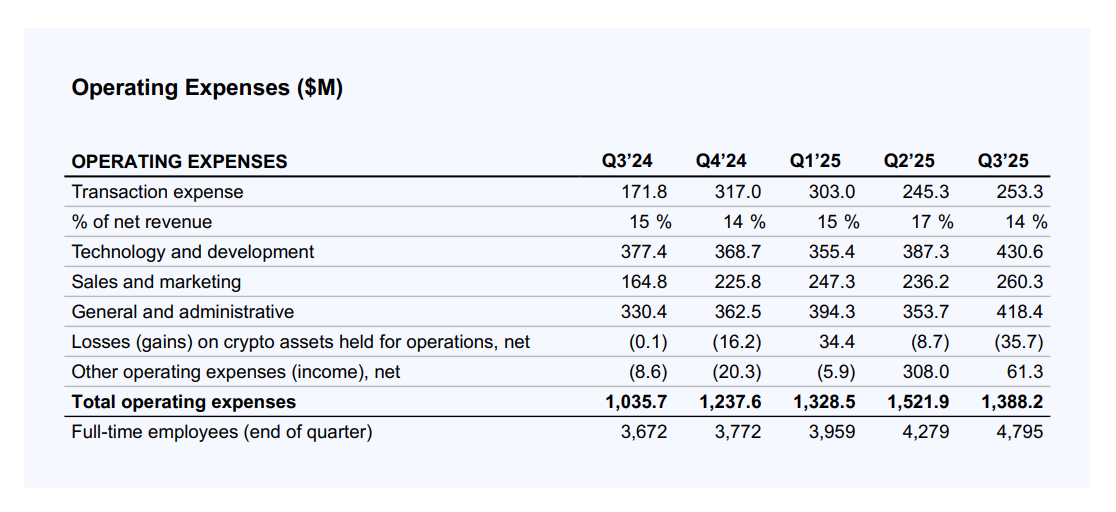

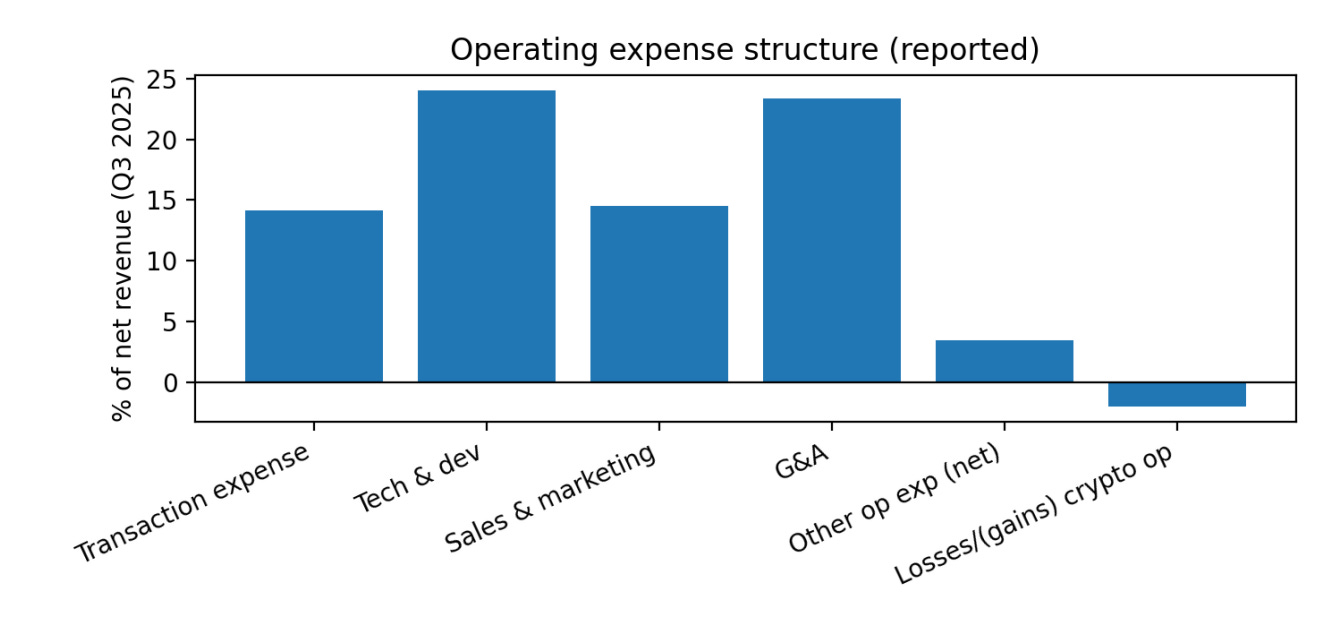

Costs: how much of the toll is kept

Coinbase’s cost structure mixes variable costs (transaction expense) with large fixed-ish costs (technology, compliance, and general administration). That combination produces operating leverage: in active markets, profits can ramp quickly; in quiet markets, fixed costs loom.

Coinbase breaks transaction expense into items like rebates and commissions, payment processing, and transaction reversal losses. Crypto businesses are unusually vulnerable to systems that are easy to cheat. Coinbase pays for the opposite: identity verification, monitoring, customer support capacity, and legal work. Some of that spend is defensive, but it also underwrites the premium brand with institutions.

Balance sheet and capital allocation

Exchanges often look like pure transactional businesses, but Coinbase carries a balance sheet that matters. It holds significant cash and cash equivalents, earns interest, and chooses how to deploy capital (buybacks, acquisitions, investments).

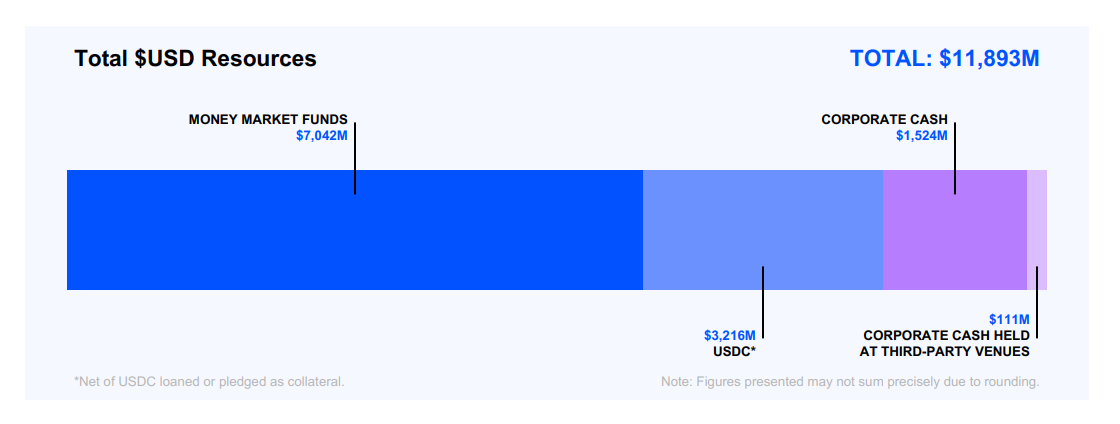

Coinbase highlighted scale: it ended Q3 with $11.9 billion in USD resources. That is strategic option value: the ability to withstand shocks, outspend on security, and buy assets when the cycle turns.

Coinbase described a share repurchase authorization approved in October 2024 and increased in October 2025, including expanding scope to include a portion of long-term debt.

Custody and institutions: pricing trust

Custody is another way Coinbase monetizes trust. Coinbase lists an annualized custody fee of 50 bps. That is classic financial infrastructure pricing: low basis points, high notional.

Derivatives and the Everything Exchange

A large chunk of Coinbase’s 'make money' story is breadth. Their ambition: build “The Everything Exchange,” a one-stop venue for spot, derivatives, options, and eventually other asset classes.

Base: monetization beyond brokerage

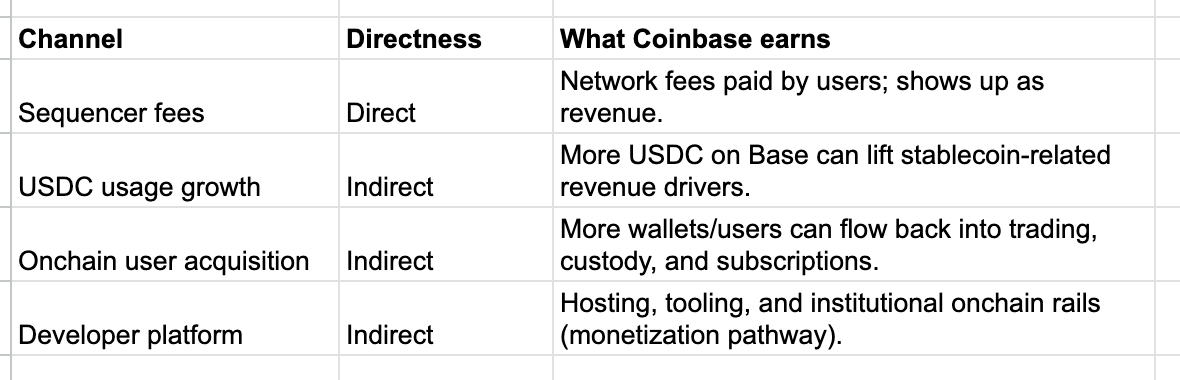

They monetize Base through sequencer fees, plus indirect monetization through USDC usage and other services.

Moat and fragility: is it wonderful or cyclical?

The moat candidates

Trust and security: custody plus brand; a long-lived asset in a space where hacks are existential.

Regulatory posture: licenses and compliance capabilities that institutions and governments require.

Liquidity and breadth: more assets plus more instruments (derivatives).

Distribution: consumer app + institutional channels + developer platform.

Balance sheet resilience: large USD resources enable survival and opportunism.

The fragility candidates

Cyclicality: transaction revenue rises and falls with trading volume and sentiment.

Fee compression: as users migrate to Advanced and subscriptions grow, blended fee rates can decline.

Rate exposure: stablecoin and interest income depend on short-term rates.

Regulatory uncertainty: rules can enlarge or shrink the addressable market.

Regulation and strategy

Coinbase explicitly frames policy as part of its strategy: it says it will advocate for responsible rules to make crypto benefits available. Coinbase notes it has spent a lot of time investing in policy and getting regulatory clarity, and that this is growing the TAM of crypto.

Durability test

If you squint, Coinbase has two businesses stapled together. One is the cyclical exchange. The other is an emerging financial-infrastructure layer (USDC, custody, staking, Base, payments). The question is whether the second becomes large enough that, in Buffett terms, time becomes a friend rather than an enemy.

The scoreboard into 2026

As of Jan 25, 2026, the latest full set of filed results is for Q3 2025 (quarter ended 9/30/25). Coinbase has announced it will release Q4 and full-year 2025 results on Feb 12, 2026.

Trading volume and fee rate: volume up with fee-rate down is the 'Advanced + subscription' transition.

USDC balances (on and off platform): the best single predictor of stablecoin revenue, together with rates. [

Interest-rate direction: Coinbase says higher rates increase interest and stablecoin revenue; declines reduce it.

Derivatives adoption: more instruments per user typically means higher engagement and better retention.

Subscription penetration (Coinbase One): Coinbase wants to reduce reliance on trading fees as a single monetization.

Base monetization: sequencer fees plus indirect effects (USDC usage, custody, trading).

Sources

Coinbase Investor Relations (About Coinbase). https://investor.coinbase.com/home/default.aspx

Coinbase Global, Inc. Form 10-Q for quarter ended Sept. 30, 2025 (transaction fees and spread). https://s27.q4cdn.com/397450999/files/doc_financials/2025/q3/a869e9e6-7bef-461f-ae28-5a688f86bcb8.pdf

Coinbase Global, Inc. Form 10-Q for quarter ended Sept. 30, 2025 (revenue tables; fee-rate mix shift; stablecoin drivers). Same URL as [2].

Coinbase Q3 2025 Earnings Call Transcript (Investor Relations PDF). https://s27.q4cdn.com/397450999/files/doc_financials/2025/q3/Q3-25-Earnings-Call-Transcript.pdf

Coinbase Global, Inc. Form 10-Q for quarter ended Sept. 30, 2025 (risk factor disclosures on interest-rate sensitivity and USDC/stablecoin revenue). Same URL as [2].

Coinbase Help Center: Coinbase pricing and fees disclosures - crypto (spread; staking commission). https://help.coinbase.com/en/coinbase/trading-and-funding/pricing-and-fees/fees

Coinbase Q3 2025 Shareholder Letter (Investor Relations PDF; revenue tables; USDC balances and revenue table; USD resources). https://investor.coinbase.com/files/doc_financials/2025/q3/Q3-25-Shareholder-Letter.pdf

Coinbase Custody pricing page (custody fee). https://www.coinbase.com/custody/pricing

Coinbase press release: Date of Fourth Quarter and Full Year 2025 Financial Results (Jan 16, 2026). https://investor.coinbase.co m/news/news-details/2026/Coinbase-Announces-Date-of-Fourth-Quarter-and-Full-Year-2025-Financial-Results/default.aspx