Harvey: The Lawyer’s Exoskeleton

The automation of high-stakes thinking.

Harvey is an AI platform for legal and professional services that turns institutional knowledge and trusted sources into faster, verifiable work product. The company is positioning itself to become the ecosystem for legal work: embedded add-ins, vaults of documents, and evaluation infrastructure that makes the platform safer to rely on over time.

High Stakes, Low Leverage, Constant Context-Hunting

Legal work is a blend of high stakes and low glamour. A senior partner may spend a morning on precedent hunting, a junior associate may spend a night on diligence summaries, and everyone is haunted by the same two specters: (1) missing something important and (2) accidentally leaking something important.

The pain shows up as three operational bottlenecks:

Throughput: Document-heavy workflows (diligence, contract review, regulatory research) are limited by human reading speed.

Consistency: Firms have precedents and playbooks, but execution varies by office, team, and fatigue level.

Verification: Unlike many knowledge tasks, legal work needs provenance: ‘Where did that claim come from?’ is the job.

Incumbent approaches fall into three buckets:

Traditional legal research platforms: They excel at content, but not at synthesis across a matter’s unique documents, and they rarely live inside drafting tools.

Manual knowledge management: Precedent libraries, DMS searches, and ‘ask the person who remembers’ are slow, brittle, and hard to scale.

General-purpose LLMs: They can draft and summarize, but they are not optimized for legal reasoning, may lack citations, and are risky in regulated confidentiality environments.

The net effect is that clients push for speed and fixed-fee predictability while firms are still staffed like it’s 2006, only with more PDFs.

The Product Insight: Legal AI That Can Prove Itself

Legal AI needs to be a system: a workflow-aware interface, grounded in trusted sources, with enterprise controls, and an evaluation harness that measures what lawyers actually do. Harvey’s value proposition is compact and, in a legal context, potent:

Verifiability: Answers can be grounded in customer documents and trusted sources, with citations to support review before sharing.

Workflow embedding: Harvey is designed to live where lawyers already work: the Harvey app plus Word/Outlook add-ins and a mobile app.

Enterprise trust: Harvey emphasizes in-region processing options, SOC 2 Type II / ISO 27001 alignment, and contractual ‘no training on customer data’.

In legal, the durable advantage is a bundle of switching costs and risk management:

Data gravity: Vaults, matter workspaces, and playbooks accumulate organizational knowledge and preferences.

Governance & auditability: Security addenda, audit logs, retention controls, and clear ‘no training’ commitments become part of procurement muscle memory.

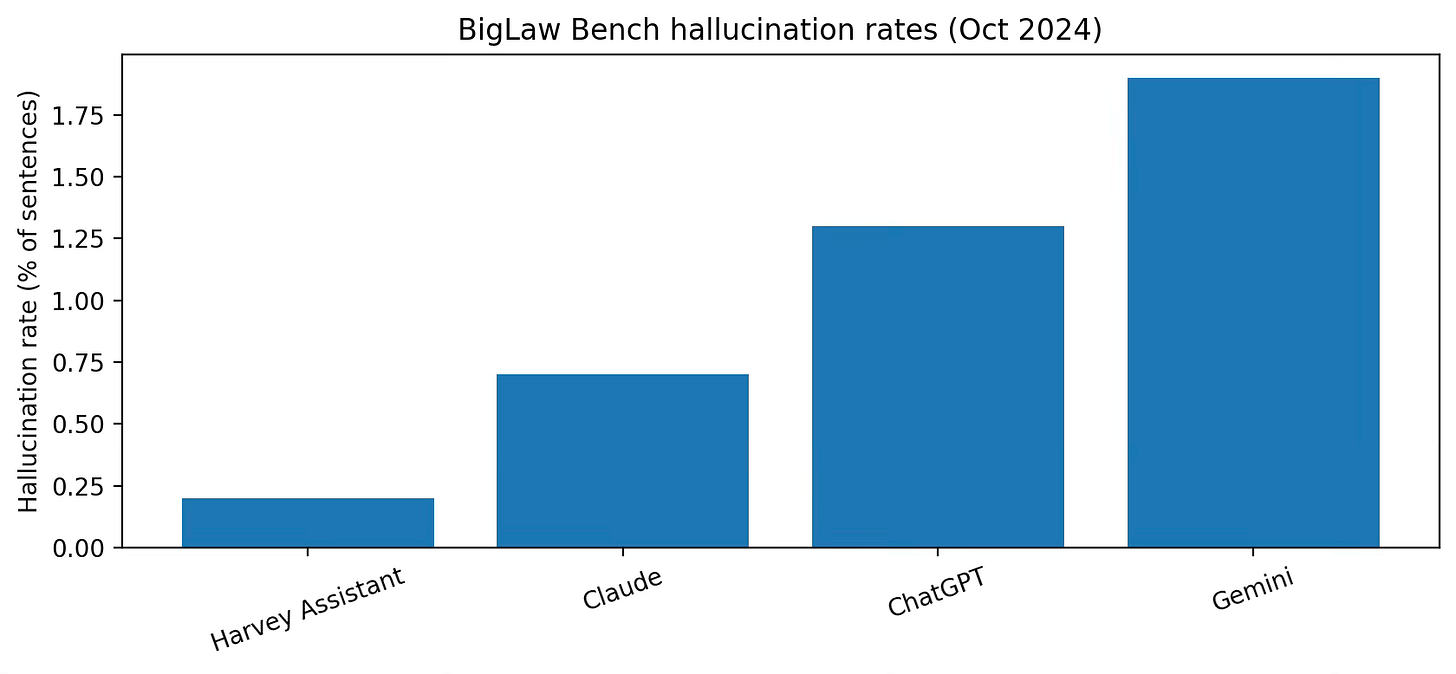

Evaluation muscle: Benchmarks like BigLaw Bench create a feedback loop for model selection and product improvements.

Harvey’s direction of travel looks like legal operating system: more integrations, more collaboration (shared spaces), deeper domain coverage (regulatory, tax), and more agentic workflows that can run multi-step tasks safely under human supervision.

Harvey’s case studies are specific about time and cost:

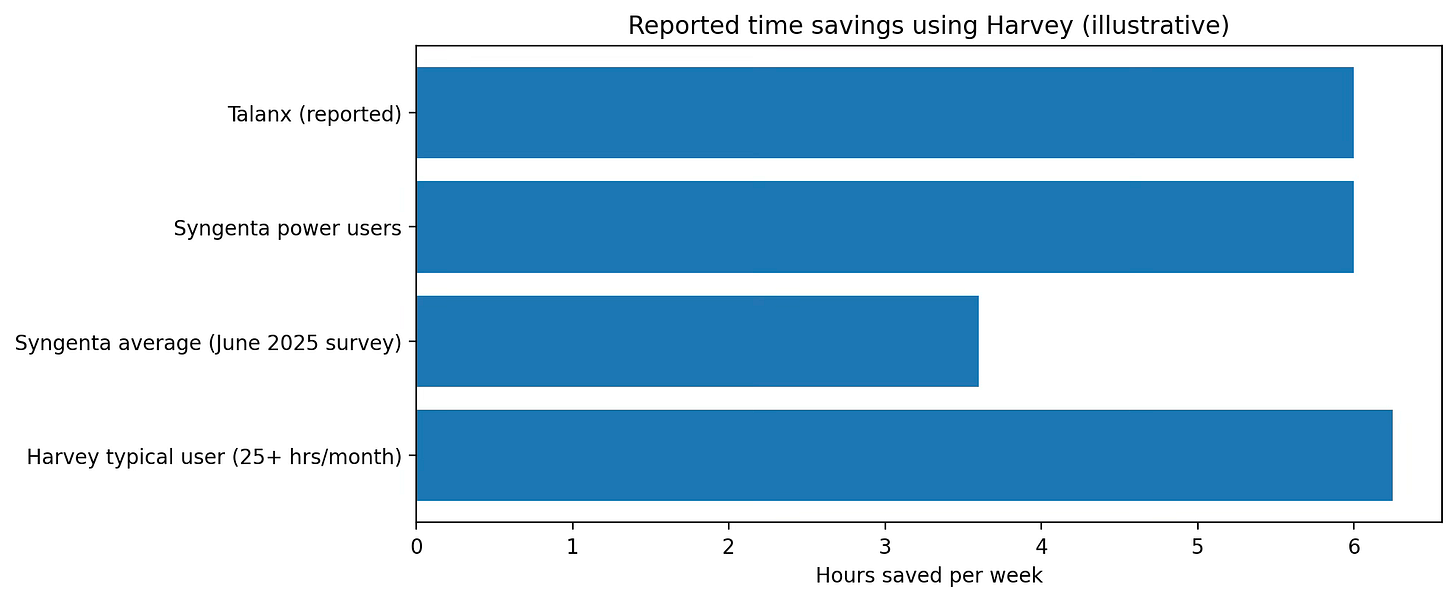

Syngenta reports 3.6 hours saved per lawyer per week on average (and 6+ hours for power users), plus $18,000 in annual productivity gains per lawyer and broad reductions in external counsel use.

Talanx reports up to six hours saved per week, with specific workflow improvements like ICT contract reviews for DORA dropping from two hours to 15 minutes, and NDA review times falling by 60%+ via playbooks in Word.

“Harvey is not only faster, but in some cases it delivers outcomes better than what we could realistically achieve in-house.”

“Harvey helps enable our vision: ‘Dedicated to enabling people and providing guidance in a fast-changing world.’ It allows our lawyers to concentrate on strategically relevant issues and ensures we stay at the forefront of change — no matter how constant it may be.”— Talanx AG legal leadership (Harvey customer story)

Harvey sits in three places:

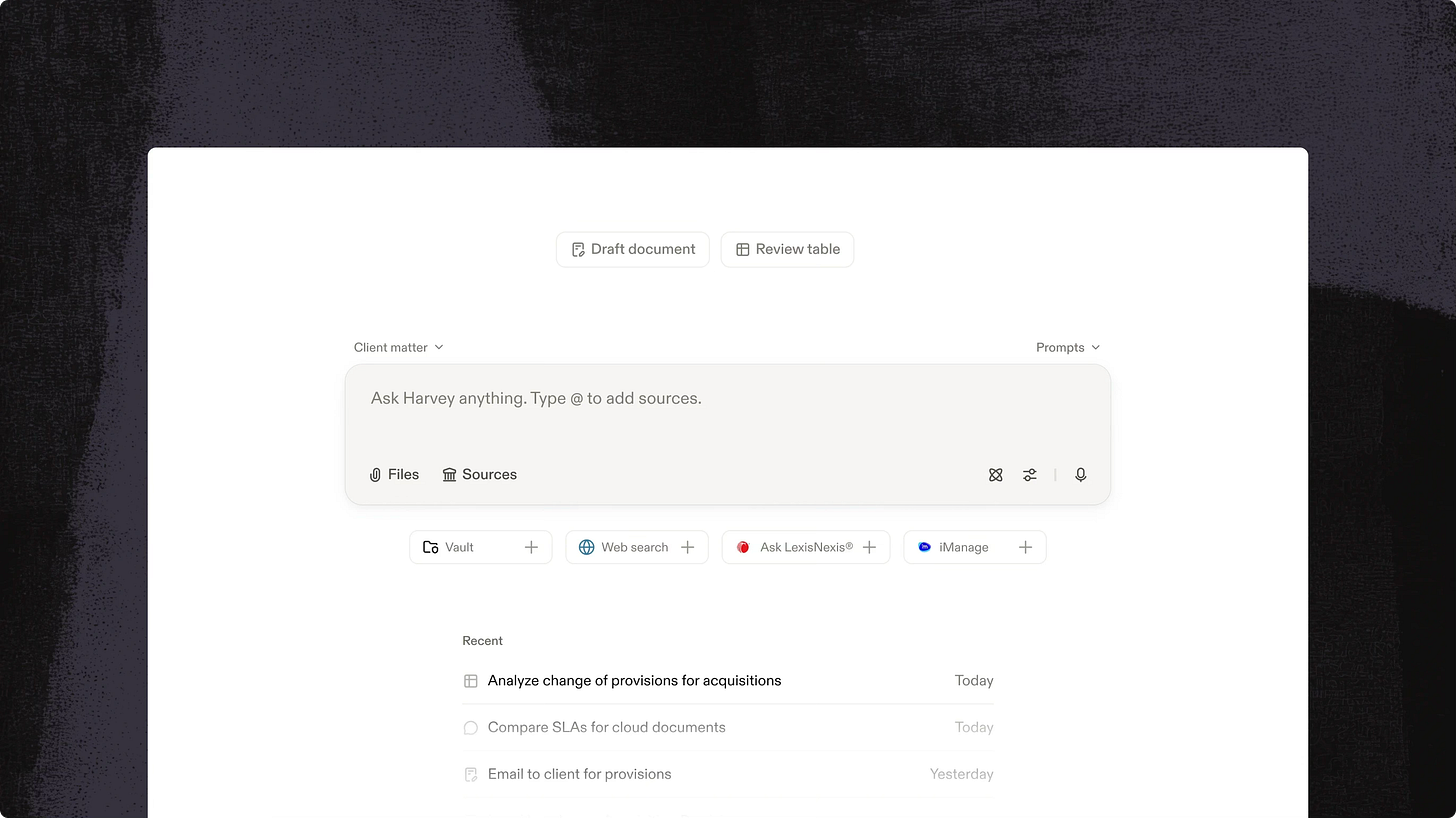

Harvey app: The core workspace for chat-style Q&A, deep analysis, and drafting.

Embedded surfaces: Word and Outlook add-ins, plus mobile for on-the-go review and drafting.

Connected knowledge: Vault plus connectors to trusted sources and systems (e.g., DMS, content providers) depending on deployment.

Common workflows Harvey highlights include:

Diligence and contract analysis (summaries, clause extraction, issue lists)

Regulatory and case-law research with cited sources

First-draft memos and client communications

Playbook-driven reviews (e.g., NDAs) embedded in Word

Compliance-heavy document reviews at scale (e.g., DORA-related ICT contracts)

Why This Works Now (and Didn’t in 2016)

The underlying models crossed a capability threshold, and the legal market crossed a willingness threshold. The vacuum existed for decades. The reason it stayed empty is that law needs three things at once: language fluency, deep context, and reliability, and previous generations of NLP (natural language processing) were brittle. You could get keyword search or rule-based clause extraction, but not a system that can draft, reason, and explain itself in plain English. A compressed timeline:

1990s–2010s: document management systems (DMS), keyword search, and manual knowledge management.

2010s: specialized legal tech (eDiscovery, contract analytics) using narrower ML models.

2022 onward: large language models make synthesis and drafting practical at scale, triggering the legal AI assistant wave.

The recent trends that make Harvey possible

Model capability: LLMs can now perform multi-step reasoning and produce coherent, structured work product suitable for first drafts.

Enterprise deployment patterns: Large firms are now willing to deploy AI if the platform offers governance: SSO, audit logs, retention policies, and contractual data controls.

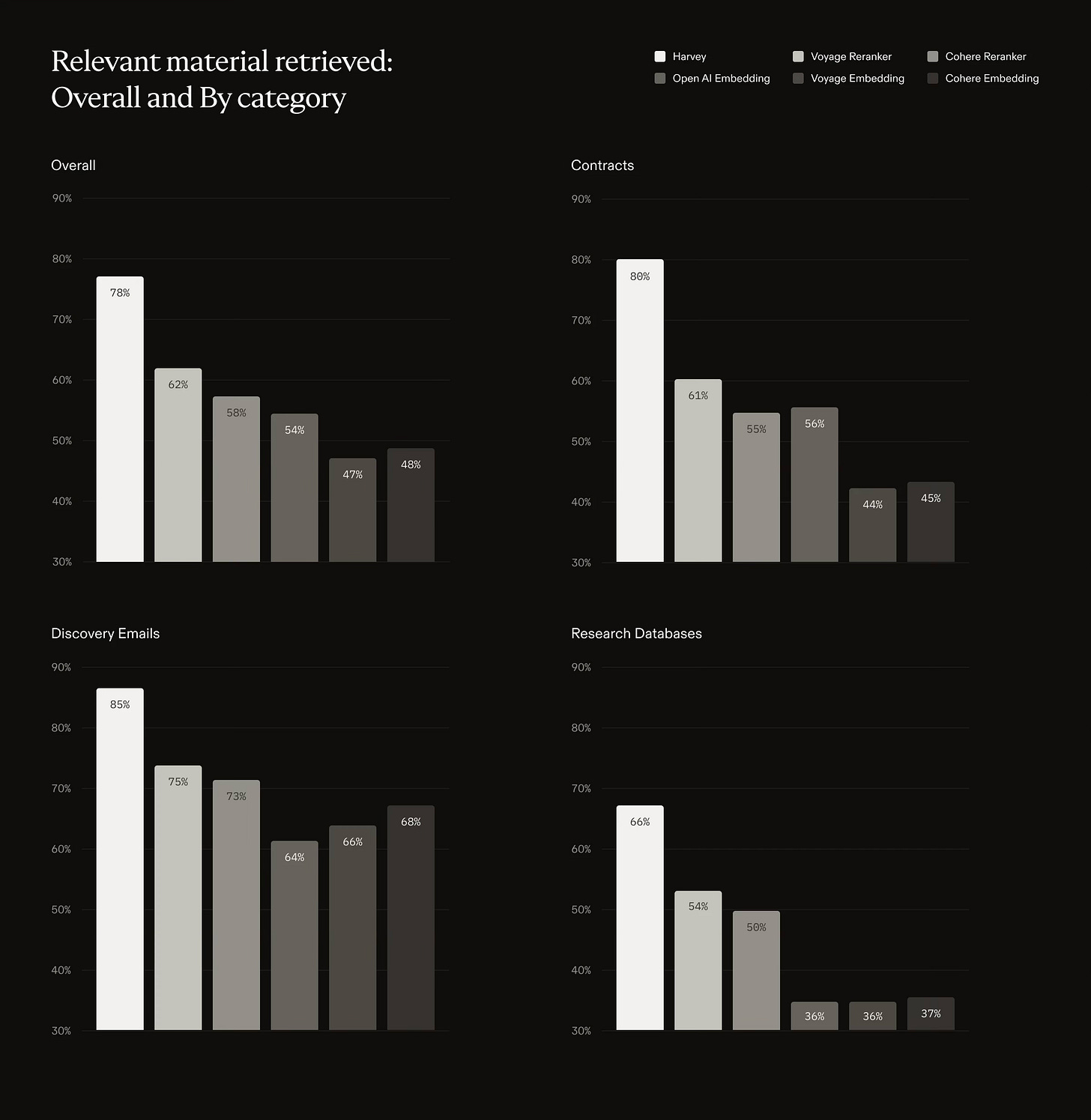

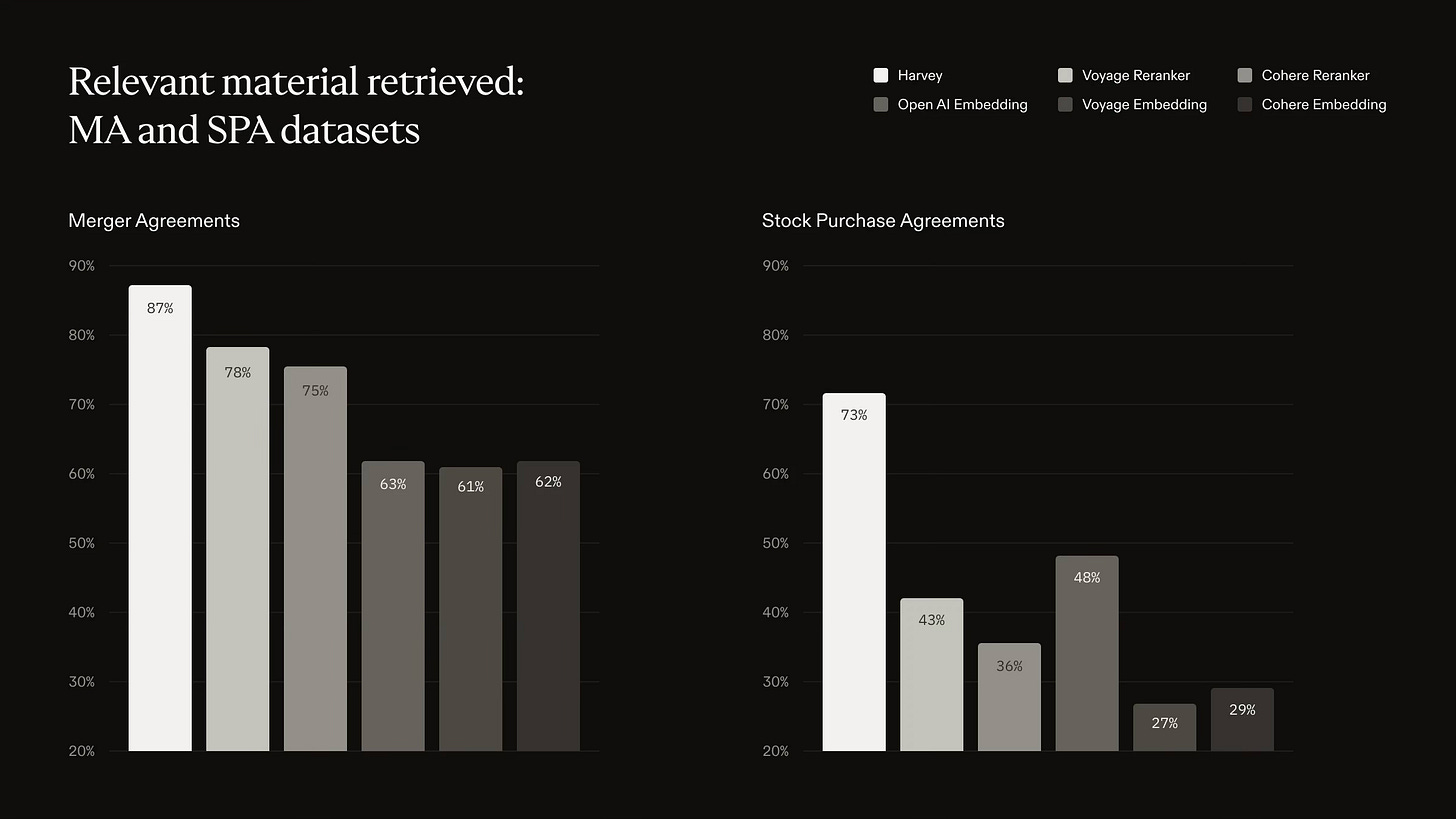

Evaluation culture: Benchmarking has become a competitive necessity; Harvey publishes BigLaw Bench as a quantitative evaluation framework.

Harvey backs the ‘evaluation culture’ point with BigLaw Bench publications, including work on hallucination rates across model systems.

The Market: Enormous Spend, Slow Change, Sticky Customers

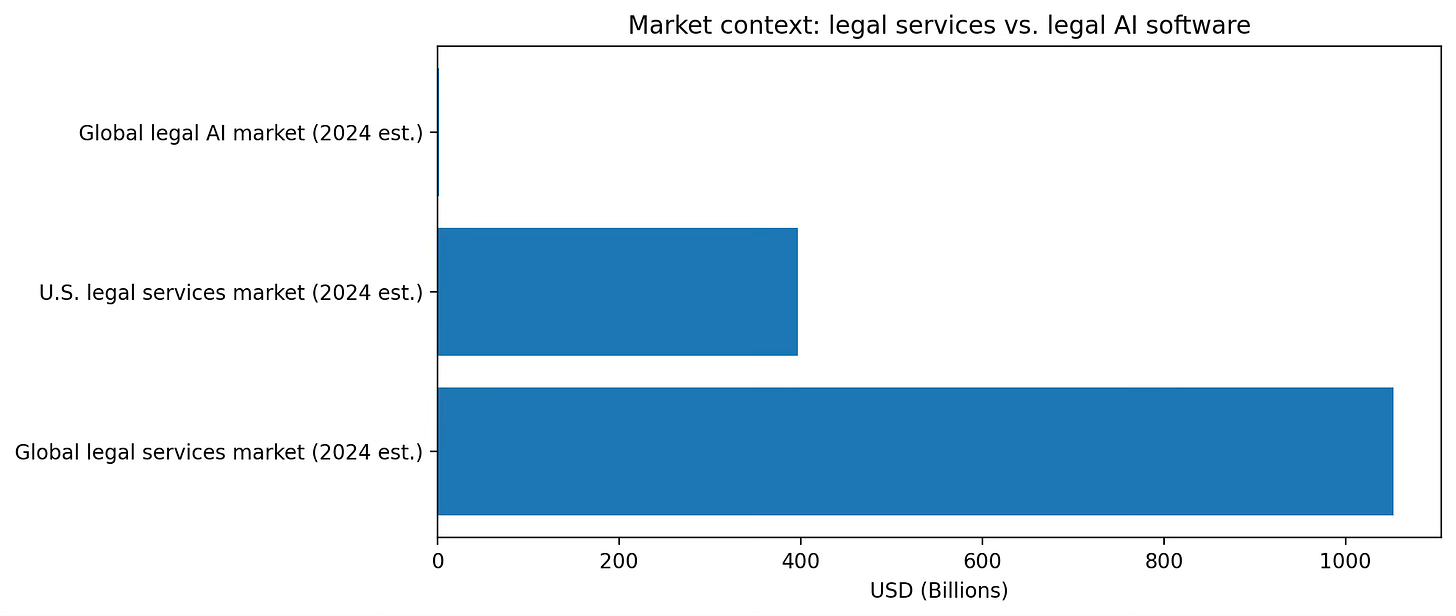

Harvey’s core customer is the organization that does high-stakes, document-intensive professional work: large law firms, in-house legal teams at major enterprises, and adjacent professional services groups (e.g., consulting and tax). Legal AI platform is part category, part invented market. The incumbents sell content (research databases) or point solutions (eDiscovery, contract review). Harvey is carving out the platform layer that sits above content and connects to internal knowledge.

Harvey highlights a mix of AmLaw firms and global enterprises. Examples include: Vinson & Elkins, Deutsche Telekom, Reed Smith, PwC UK, O’Melveny, Bridgewater, KKR, A&O Shearman, Dentons, and Procter & Gamble. Companies that have the following profile:

High stakes: Errors carry reputational and financial consequences; trust and verification are non-negotiable.

High volume: Teams handle large volumes of contracts, discovery, filings, and communications.

Security procurement: Vendor reviews include SOC/ISO controls, data residency, and contractual commitments.

If you define TAM as software spend on legal AI, Grand View Research estimates the global legal AI market at $1.45B in 2024, growing to ~$3.90B by 2030 (17.3% CAGR).

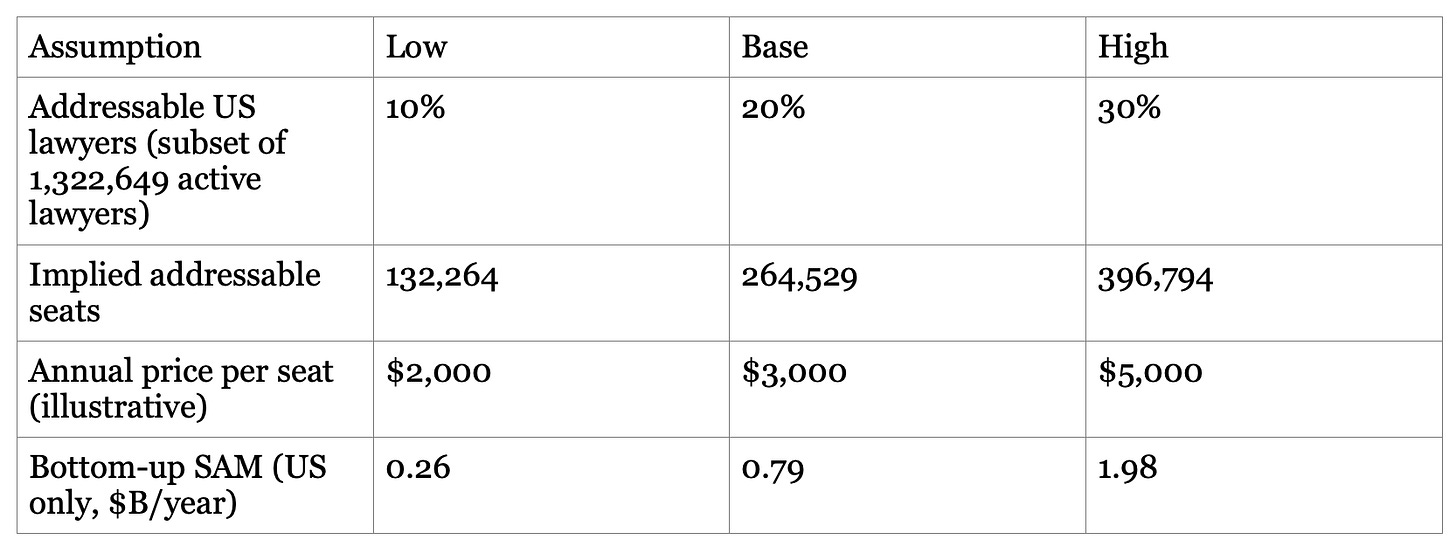

A bottom-up SAM is necessarily assumption-driven because Harvey’s pricing is not public. Here’s a transparent way to do it:

This SAM is conservative in one sense (U.S. only) and aggressive in another (it assumes a meaningful fraction of the profession becomes paid, active seats). If you extend to the global lawyer population (IBA cites 12M+ lawyers globally), the ceiling rises, but procurement and language/legal-system localization become the real constraints.

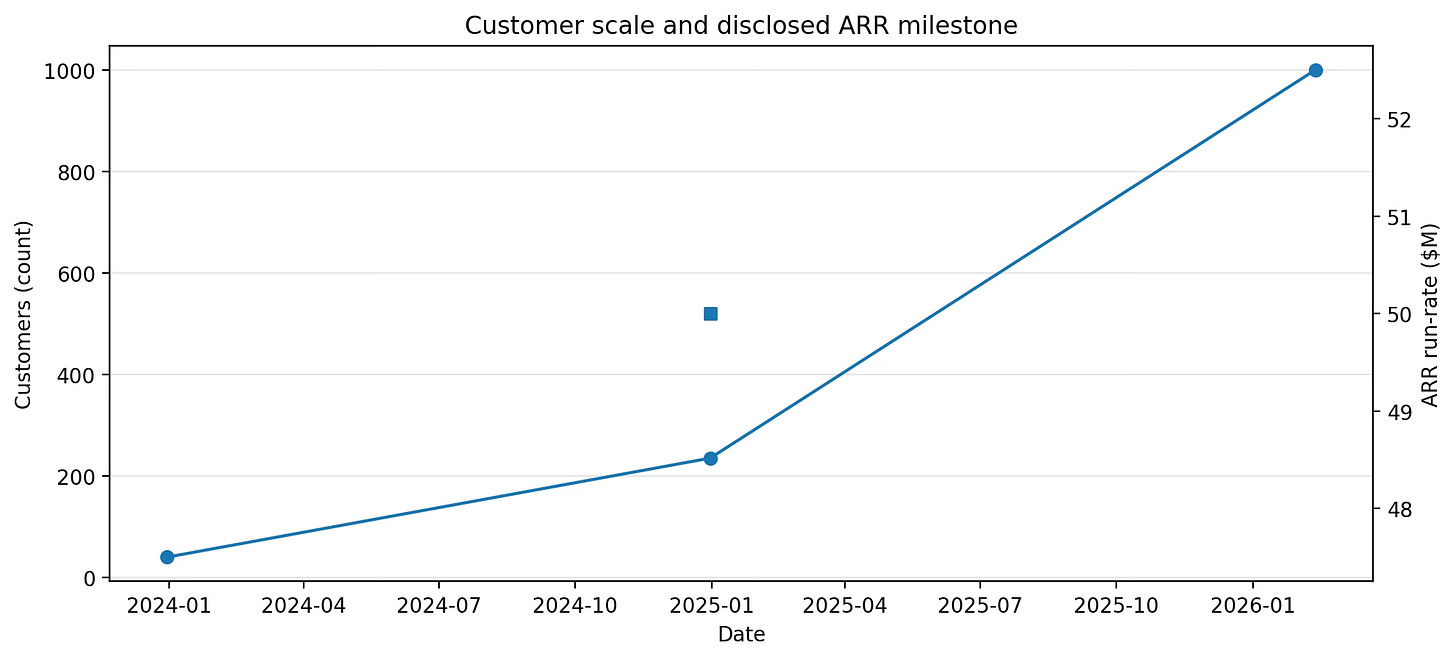

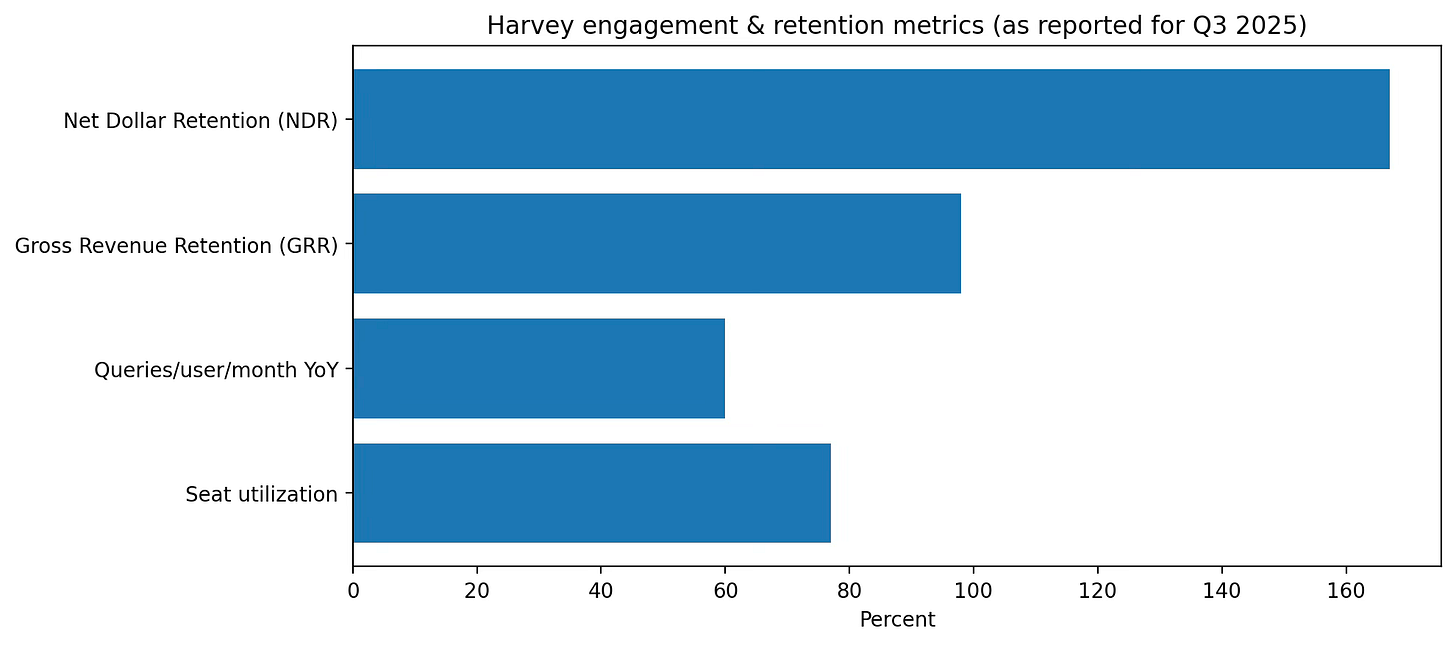

SOM is what Harvey can realistically win in the next ~3 years. The cleanest disclosed anchor is Harvey’s own reported scale and economics: over 1,000 customer organizations and 100,000+ professionals using the platform, plus 98% gross revenue retention and 167% net dollar retention (Q3 2025).

On the financial side, Harvey disclosed a run-rate ARR of $50M by the end of 2024, with 235 customers across 42 countries at that time. That implies an average of ~$213K run-rate ARR per customer in that snapshot (a rough average across very different customer sizes).

The Arena: General Models, Legal Databases, and Workflow Ownership

The competitive set is crowded and oddly shaped (as all good software markets are).

Direct competitors (legal AI platforms)

Thomson Reuters: CoCounsel Legal and Westlaw Advantage (AI-powered research and drafting tied to TR content).

LexisNexis: Lexis+ AI (with Protégé) for drafting, research, summarization, and document analysis grounded in LexisNexis content.

vLex: Vincent AI (assistant built around vLex’s global content library).

Specialized contract / CLM AI: Ironclad AI, Evisort/Workday, etc. (adjacent, often focused on contracts rather than full legal workflows).

Indirect competitors / alternatives

General-purpose enterprise LLM suites (ChatGPT Enterprise, Microsoft Copilot, Google Gemini) used with internal policies and heavy human review.

DIY internal tools (law firms building private copilots on top of their own DMS and a model API).

Traditional workflows: paralegals, junior associates, and external counsel still doing the work manually.

Harvey’s plan to win is to be the trusted default for high-stakes legal work:

Win procurement: Make security and data control a product feature (in-region hosting, audits, contractual no-training).

Win workflow: Embed in Word/Outlook/mobile and integrate with the customer’s existing systems.

Win outcomes: Publish and use evaluation frameworks (BigLaw Bench) to improve quality and reduce risk.

Win expansion: Drive usage deep enough that firms expand seats and departments (reflected in high NDR).

Harvey’s competitive advantages:

Trust posture: Explicit commitments around data control, audits, and model training; plus regional hosting options.

Model system + evaluation: BigLaw Bench and related work create a measurable advantage in selecting and tuning model systems for legal tasks.

Platform breadth: Assistant + Vault + Knowledge + Workflows + Ecosystem (embedded surfaces).

Customer proof: Scale signals (100,000+ professionals; 1,000+ organizations; 50 AmLaw 100 firms) and case-study ROI.

Inside the Machine: Assistant, Vaults, Workflows, and the Data Flywheel

Harvey’s platform is organized into a set of products that map onto how legal work actually happens:

Assistant: Chat-style Q&A, deep analysis, and drafting with citations and exportable work product.

Vault: Document storage and bulk analysis; the ‘matter memory’ layer.

Knowledge: Cross-domain research (legal, regulatory, tax) and synthesis.

Workflows: Pre-built and custom workflows; playbooks; automation for repeatable tasks.

Ecosystem: Embedding (Word/Outlook/mobile) and integrations to bring Harvey into daily tools.

At a high level: the user interacts via the app or add-ins; Harvey routes the request through a model system; the system grounds responses in connected sources (customer docs, knowledge bases, licensed content) and returns an answer with citations, subject to customer controls (SSO, audit logs, retention).

Harvey publishes benchmark results, including studies of retrieval quality (how well a system finds relevant material before answering). Below are official charts from Harvey’s BigLaw Bench retrieval publication.

Harvey’s roadmap is best inferred from their product updates and the direction of announced capabilities. The Q3 2025 update emphasizes accelerating platform engagement, expanding features, and global expansion; the 2026 launches emphasize governance and enablement (Responsible Business Program, Harvey Academy). A practical near-term roadmap would then be:

More embedded workflow surfaces (add-ins, mobile) and deeper integrations (DMS, email, content providers).

More workflow automation and playbook tooling to standardize routine reviews.

More evaluation and safety instrumentation (benchmarks, audits, governance programs).

More collaboration features (shared spaces) that make Harvey part of both internal work and client–firm interaction.

How Harvey Makes Money (and Why Expansion Is the Whole Game)

Harvey is building an enterprise SaaS engine: land with a pilot, expand to firmwide adoption, then expand across departments and geographies. The retention metrics Harvey reports (98% GRR, 167% NDR in Q3 2025) are the signature of that playbook working.

Harvey appears to sell annual enterprise subscriptions (often multi-year) with seat-based and/or usage-based components, sold directly to firms and enterprises. The platform nature (multiple modules, integrations, governance) also suggests meaningful services revenue for deployment and change management, though this is not publicly itemized.

Harvey does not publish list pricing. One way to sanity-check implied pricing is to use disclosed ARR and customer counts. Harvey reported a $50M run-rate ARR by the end of 2024, with 235 customers at that time, implying an average of roughly $213K run-rate ARR per customer in that snapshot. Actual contracts likely vary widely (from mid-sized firms to global enterprises).

Without cohort-level disclosure, we also can’t compute true LTV. But the combination of high gross retention (98%) and strong net retention (167%) implies that customers stay and expand. In SaaS terms, that’s the kind of ‘negative churn’ Buffett would approve of, because it creates compounding without heroic new-logo effort.

Sales & distribution model

Direct enterprise sales: Large firms and enterprises with procurement, security review, and multi-stakeholder buying committees.

Land-and-expand: Pilots and use-case wins lead to firmwide rollouts (e.g., Corrs Chambers Westgarth).

Partnership distribution: Alliances with content providers and platforms can reduce friction and increase time-to-value.

Examples of customer wins and expansions cited by Harvey include:

Corrs Chambers Westgarth (firmwide rollout, Feb 2026).

Syngenta (global legal program with time and cost impact).

Talanx (compliance and contract review improvements; Word playbooks).

Latham & Watkins, Blue Owl, Clayton Utz, Duane Morris, Willkie Farr & Gallagher, Devon Energy, McGuireWoods, Cox Enterprises.

The Team

Harvey was founded by Winston Weinberg (CEO) and Gabriel Pereyra (Co-founder). The company’s narrative emphasizes building a ‘professional class’ platform, which shows up in two ways: (1) hiring for enterprise-grade security and reliability, and (2) building an enablement layer (customer success, training, academy) that treats adoption as a product.

We value deliberate action over ivory tower intellectualization.

Internally, we refer to it as “taking the square root of the weather.” When you’re moving as fast as we need to, we need to be able to check the weather, move forward, and avoid wasting time overanalyzing items that are not mission-critical.— Harvey values (Company page, ‘Decisiveness’)

The investor roster is also a signal about network and go-to-market leverage: Harvey lists Sequoia, Kleiner Perkins, GV, OpenAI Startup Fund, Coatue, Andreessen Horowitz, and EQT among its backers.

The Numbers: What’s Public, What’s Implied

“In 2024, we saw 4x annual recurring revenue (ARR) growth and expanded from 40 customers to 235 customers in 42 countries, including the majority of the top 10 US law firms.”

“This investment will enable us to continue improving our platform, scaling agentic workflows, building out integrated enterprise use cases, and growing our team.”17— Harvey Series D announcement (Feb 12, 2025)

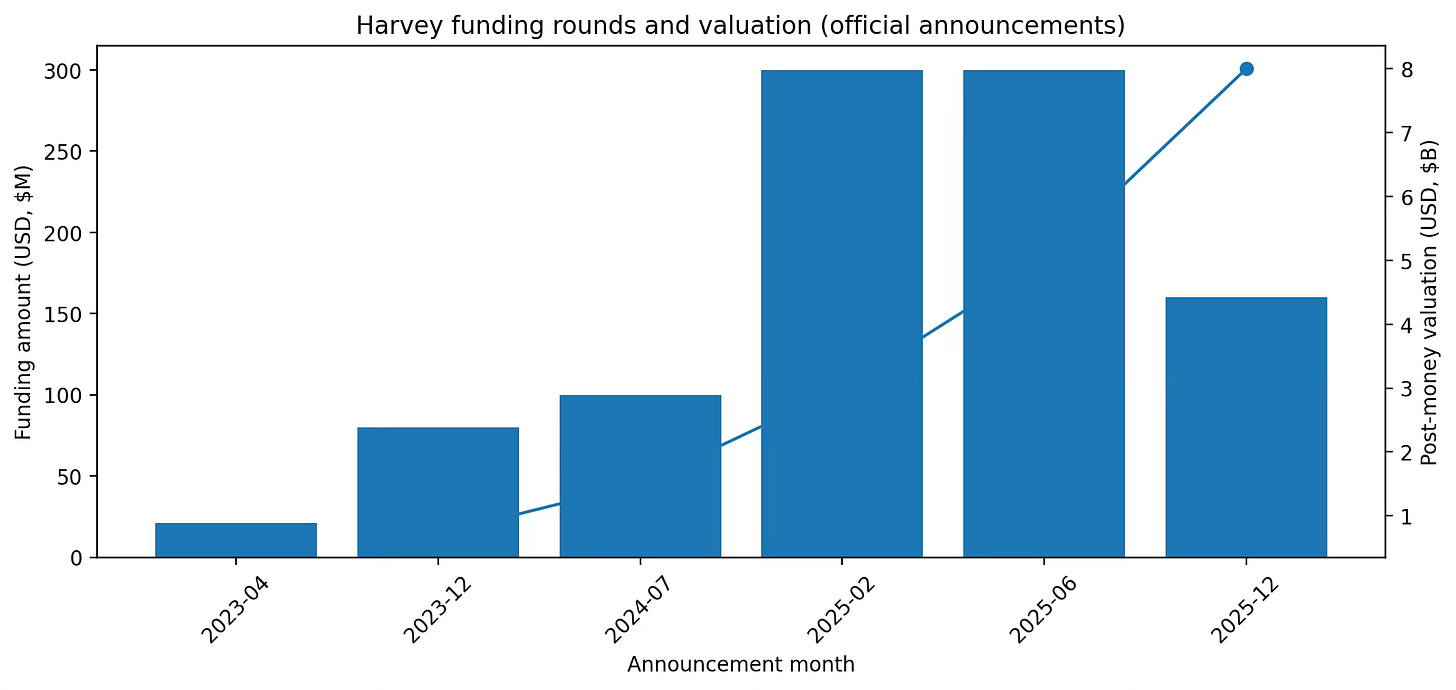

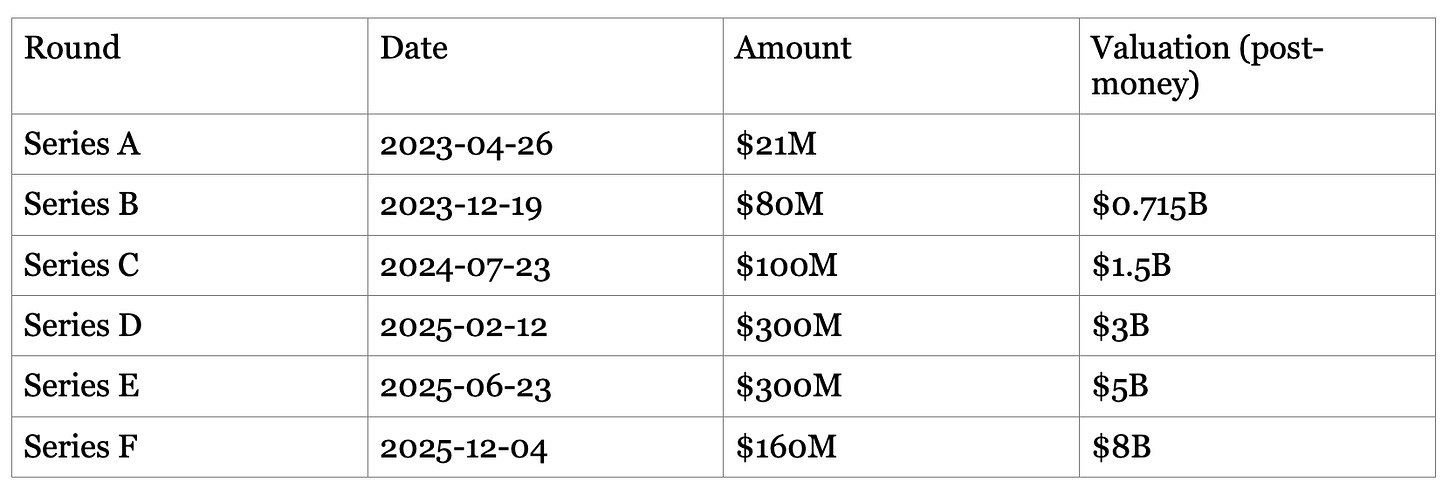

By summing announced rounds, Harvey has disclosed at least $961M raised across Series A–F (Apr 2023 through Dec 2025), with disclosed valuations rising from $715M (Series B) to $8B (Series F).

On operations, Harvey disclosed a $50M run-rate ARR by end of 2024, with 235 customers across 42 countries at that time.

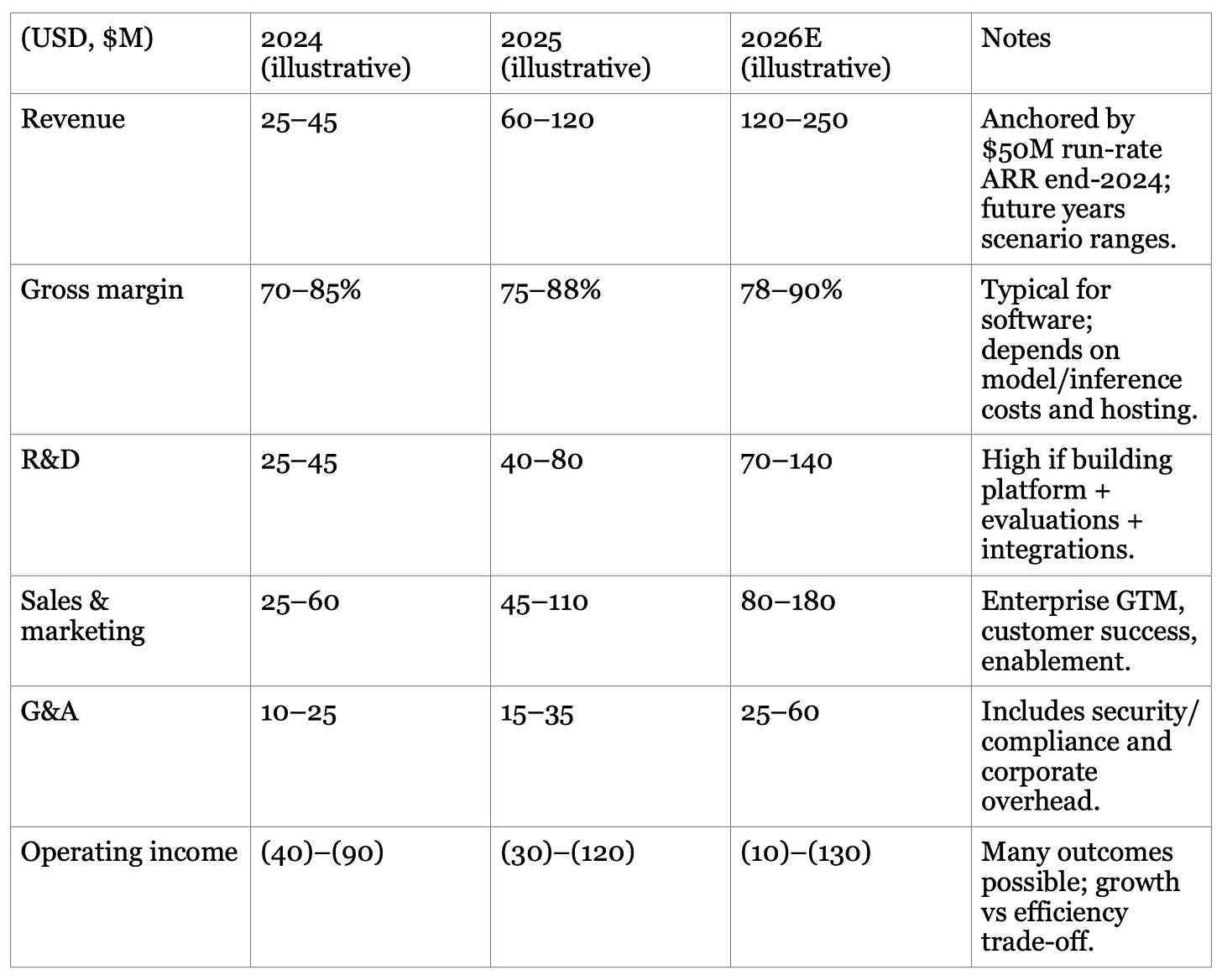

Harvey has not published a full P&L. Below is an illustrative framework for how to think about the P&L of an enterprise SaaS platform at Harvey’s stage.

Why show a range? Because the right mental model here is probability. Operators make decisions under uncertainty and continuously update with evidence.

Harvey has not published a balance sheet. What we can say with confidence is that the company has significant funding capacity (>$900M disclosed across rounds), and it emphasizes enterprise procurement readiness (security audits, compliance). Illustrative balance sheet framing (what matters for a private SaaS platform): cash runway, deferred revenue, and (if present) capitalized software development costs. The key strategic question is whether the company can fund model and platform costs while keeping pricing aligned with customer ROI.

Financing cash flows are visible via funding rounds. Operating and investing cash flows are not disclosed. In early-stage enterprise software, the dominant ‘real’ cash flow item is usually operating burn (headcount + infrastructure), funded by equity rounds until the business reaches self-funding.

One hint at unit economics is the combination of high retention and strong engagement: seat utilization of 77% and queries/user/month up 60% YoY suggest customers are using what they buy, often a prerequisite for expansion and long-run payback.

The Five-Year Bet: From Copilot to Operating System

If Harvey executes, the 2031 version of the company is the legal execution layer, a platform that:

Understands a firm’s precedents and playbooks as living systems (versioned, auditable, and automatically applied).

Runs multi-step workflows (diligence, compliance reviews, research) with human-in-the-loop checkpoints and matter-level audit trails.

Connects to the organization’s full knowledge graph (DMS, email, precedent bank, content providers) while respecting permissions and residency.

Becomes the interface where clients and firms collaborate on documents securely (shared spaces).

Extends beyond law into adjacent professional services where the same pattern holds: high stakes, document-heavy work, and extreme sensitivity.

The risk, of course, is that the category collapses into features inside incumbents (research platforms and office suites) or that model providers commoditize the platform layer. Harvey’s counter is to deepen trust + workflow fit + evaluation, building a moat out of procurement, habit, and measurable quality.

If we took Harvey away from our staff, there’d be a riot.

— Bivek Sharma, Chief AI Officer, PwC UK