From Rules to Reasoning: Ramp’s AI Finance Stack

Why autonomous finance is suddenly plausible.

Ramp is a financial operations platform that helps businesses control and execute spending (cards, bills, procurement, travel, and cash) while reducing waste through automation.

The Spend Chaos Tax

The customer pain is the death-by-a-thousand-cuts that happens when money leaves the company faster than understanding can keep up. Finance teams end up juggling fragmented tools across cards, expense reports, AP, procurement, travel, and cash management, which leads to duplicated data entry, mismatched policies, and slower closes. Out-of-policy spend is often only discovered after the fact, when it’s expensive to unwind and the only evidence is a receipt photo submitted three weeks late. Meanwhile, approvals turn into a bureaucracy tax: slow cycles block legitimate spending while still failing to prevent wasteful spending. As a result, month-end close gets treated like a recurring emergency instead of a continuous process, and burnout becomes the natural byproduct.

Today’s approach to managing business spend is typically piecemeal and reactive, with several notable shortcomings. Legacy expense tools built around expense reports and reimbursement workflows do help record spending, but usually only after the money has already been spent, leaving weak controls at the moment of purchase. Corporate card incumbents tend to optimize for rewards and issuer economics rather than functioning as true policy execution engines that enforce spending rules in real time. Meanwhile, point solutions in accounts payable and procurement can digitize invoices and route approvals, but they often fall short of unifying card, bill, procurement, and accounting data into a single system of record. As a result, teams frequently rely on custom integrations to stitch everything together, an approach that is costly, brittle over time, and can create vendor lock-in driven more by integration effort than by the underlying product’s value.

Put Software on the Dollar

Instead of treating spend as a reporting problem (tell me what happened), treat it as a control-and-automation problem (decide what should happen, then enforce it in real time). Ramp describes itself as a “command and control system for company finances,” unifying card issuing, approvals, payments, and accounting automation in one place.

The company puts controls right at the point of spend, allowing policies to be enforced before money leaves through mechanisms like category and vendor controls, required receipts, and approvals. It also prioritizes zero-touch automation wherever possible, aiming for fewer clicks overall. Instead of stitching together disconnected tools, it delivers one system across multiple spend surfaces, including cards, bills, procurement, travel, treasury, and accounting automation. Finally, it creates a data flywheel: billions of transactions combined with customer-specific feedback loops help models learn patterns and identify exceptions, while keeping humans firmly in control. Ramp quantifies this in terms of time saved, dollars saved, and workflow reduction.

These tools show up in a few recurring ways: organizations can support a global, multi-entity rollout. Notion, for example, reports running one unified system across 10+ countries, achieving 94% in-policy transactions and saving $1M+ annually by blocking out-of-policy spend. They can also enable a faster close and cleaner books, with Ramp’s Accounting Agent positioned to auto-code expenses in real time, sync routine spend automatically, and surface only exceptions for review. Another common pattern is AP-to-procure-to-pay consolidation, where Ramp highlights multi-product adoption across cards, bills, procurement, travel, and treasury as a key driver of value. There’s the enterprise expansion angle, with Ramp reporting thousands of larger customers and a growing base of accounts generating $100k+ in annualized revenue.

The moat is built into how people actually work: once controls, approvals, vendor records, and accounting mappings are embedded in day-to-day operations, switching costs come from having to redo processes. On top of that, bundling multiple products lowers the marginal cost of adoption because the next module is already there, ready to be turned on. The system also gets smarter with use, as it learns from policy exceptions, coding patterns, and vendor fingerprints, making it more valuable over time. Distribution through a free tier creates a broad funnel, with enterprise monetization kicking in only after the product has already demonstrated real value.

The same automation primitives: policy, context, vendor identity, and accounting semantics, can then be applied to procurement, budget enforcement, collections, and forecasting, inching closer to self-driving money.

Why This Only Works in the 2020s

Corporate cards and expense tools traditionally lived in separate worlds: issuers controlled underwriting and rewards, while software vendors handled reporting, and although integrations existed, they were often brittle and slow. True real-time enforcement also depends on modern APIs spanning banks, ERPs, HRIS systems, and identity providers, capabilities that have only become table-stakes over the last decade. And the real last-mile challenge was understanding: before modern machine learning, reliably inferring intent from a merchant string and a blurry receipt photo was too error-prone to automate decisions with confidence. Payments rails got more programmable, finance teams got more distributed, and ML/LLMs got good enough to act on messy real-world transaction data.

The evolution of expense management has moved from paper receipts to digitized expense reports, then to rule-based automation, and now toward increasingly autonomous, agent-driven workflows. In parallel, fintech has shifted from single-product tools to multi-product finance platforms that treat spending as both transactions to process and a rich dataset to analyze and act on.

Several recent trends also make Ramp’s approach possible: payments have become a massive, data-rich substrate and are increasingly digitized, with ACH network value reaching $93T in 2025. At the same time, global payments remain a giant revenue pool even as growth rates fluctuate. Business travel is also rebounding, and re-complicating T&E policy enforcement, with global business travel spend forecast at $1.57T in 2025. Ramp’s own research products suggest the company has enough transaction breadth to publish macro reports and AI adoption indices.

The Prize: The Spend Stack

Ramp sells to finance leaders who are accountable for spend control, audit readiness, and a faster close. In practice, that includes SMB and startup operators, like founders or heads of finance, who need basic controls and quick reconciliation; mid-market finance teams looking to consolidate point solutions across cards, accounts payable, procurement, and travel; enterprise finance organizations that require multi-entity and global coverage alongside deep ERP integrations; and accounting firms or fractional CFOs who manage finance operations on behalf of multiple clients.

Some of Ramp’s customers include Shopify, Anduril, Figma, Notion, Cursor, and Vercel.

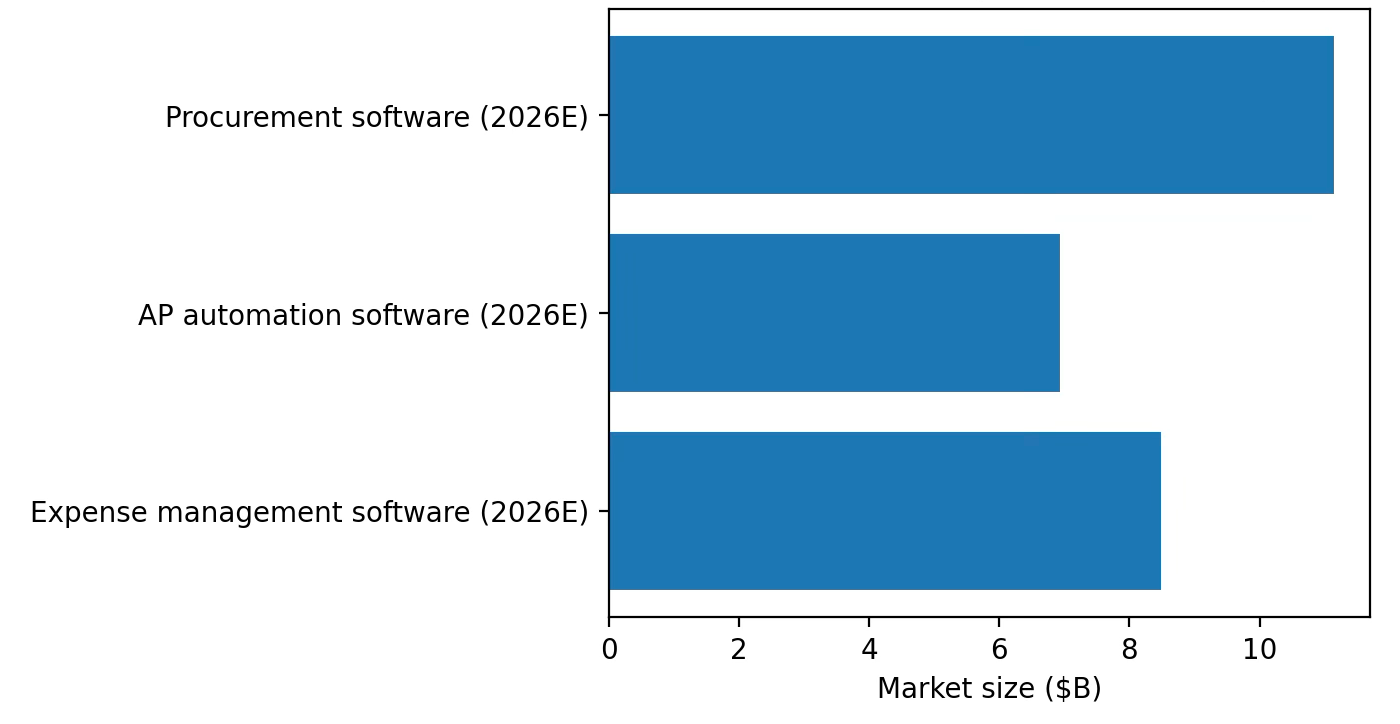

There are (at least) two ways to think about Ramp’s total addressable market (TAM). One is the software TAM: the combined set of spend management, expense, accounts payable (AP), and procurement software markets that Ramp bundles together and aims to consolidate into a single platform. The other is the payments TAM: the revenue pool tied to moving money, things like interchange, payment processing fees, and float or yield-bearing products that earn returns on balances.

Summing these three markets alone yields ≈ $26.56B in 2026 global software TAM (and excludes travel management, vendor risk tools, ERP modules, etc.). Payments TAM is structurally larger; Nacha reports ACH value of $93T in 2025 (across all ACH use cases). McKinsey estimates a multi-trillion-dollar global payments revenue pool. Ramp’s slice depends on which rails it monetizes and how pricing pressure evolves.

Start with the denominator: the Census Bureau reports ~5.9M U.S. employer firms (reference year 2023). Not all of these firms are good fits for a multi-module finance platform. A reasonable bottom-up SAM focuses on firms where (a) spend is meaningfully delegated and (b) formal controls exist, often correlated with 20+ employees. Pew summarizes the distribution among ~6M small businesses with employees: about 8% have 20–99 employees and ~1% have 100–499. That implies roughly ~540k businesses in the 20–499 employee band. Using Ramp’s disclosed scale as a coarse proxy: as of Nov 2025 Ramp reported >$1B in annualized revenue and >50,000 customers. That implies an average annualized revenue per customer of roughly $20,000. Bottom-up SAM (very rough): if the 20–499 employee segment (~540k firms) were monetized at the current implied average, that is ≈ $10.8B of annualized revenue opportunity.

The serviceable obtainable market (SOM) ultimately depends on competitive dynamics and how well you execute, but one simple scenario looks like this: if you reach 10% penetration of the 20–499 employee segment over five years, roughly 54,000 firms, while your average revenue per account (ARPA) grows modestly due to increasing multi-product adoption and a higher mix of enterprise customers, you could plausibly land in the range of about $1B–$2B+ in annualized SOM revenue from this segment alone, with additional upside coming from larger enterprises and international expansion.

The load-bearing uncertainty is not the denominator (number of firms) but monetization per firm under competitive pressure.

The Battlefield: Brex, Banks, and ERP Gravity

Ramp competes in a messy arena where who counts as a competitor depends on which module you’re looking at: in direct spend platforms it runs up against Brex, Navan (travel + expense), Airbase, and Divvy (Bill); in legacy expense and T&E it competes with SAP Concur, Expensify, and American Express corporate programs (and bank commercial cards); in AP automation and bill pay it overlaps with Bill.com, Coupa, Tipalti, AvidXchange, and ERP-native AP modules; in procurement and vendor management it faces Coupa, SAP Ariba, ERP procurement tools, and specialized CLM/TPRM vendors; and in treasury and cash management it’s compared against bank portals, money market and sweep products, and fintech cash management tools.

Ramp’s public posture points to a playbook that concentrates on shipping quickly, bundle more surfaces of spend, and use product efficiency to fund growth. The win wedge starts with cards plus expense as the core distribution surface, then expands laterally into adjacent workflows like AP, procurement, travel, and treasury. Along the way, AI can be used to drive down marginal servicing costs: fewer support tickets per user, less time spent on reviews, and those savings can be recycled straight back into the product. Finally, Ramp can push upmarket into enterprise by deepening ERP integrations and expanding global issuing, while still keeping a healthy self-serve funnel running in parallel.

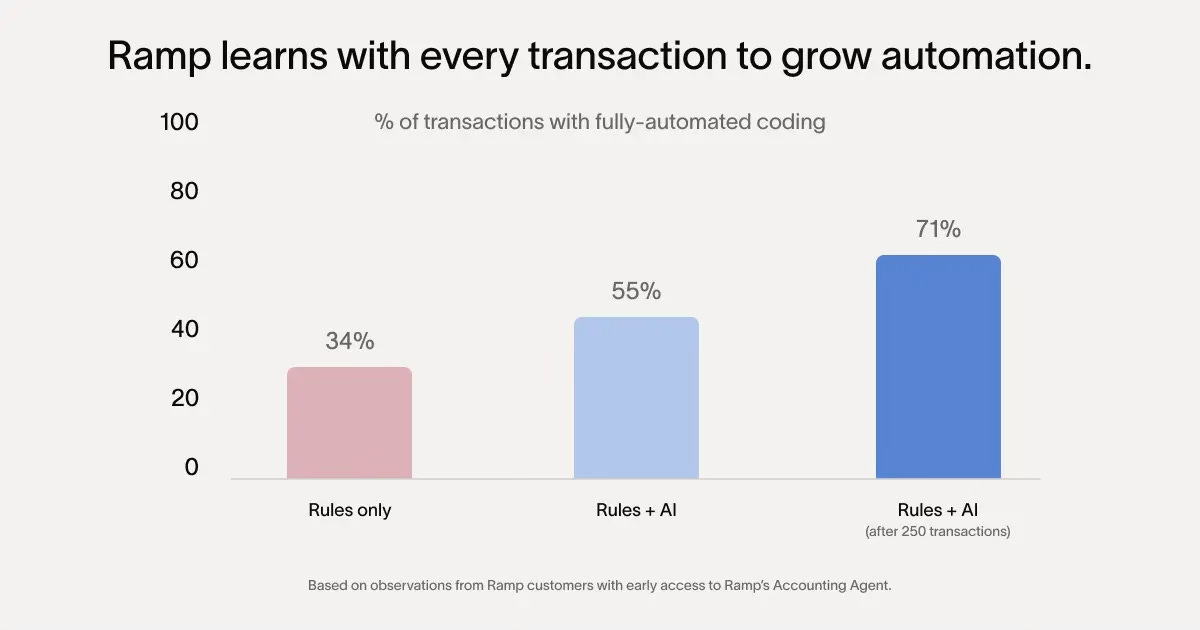

Ramp’s competitive advantages are reinforced by several evidence-backed signals: it benefits from scale and multi-product adoption, reporting more than 45,000 customers as of August 2025 and stating that over half use two or more products across its five product lines. It also leans into a strong control-and-savings narrative, with customers having saved over $10B and 27.5 million hours (as of August 2025). On the enterprise side, Ramp highlights meaningful traction, reporting 1,700 customers contributing $100k+ in annualized revenue in August 2025 and 2,200 by November 2025. The company’s speed and automation focus is reflected in its Accounting Agent, which is positioned to shift coding and review into real time, with Ramp reporting 90%+ accuracy and 3.5× more auto-coding than legacy tools.

The most durable advantage here is workflow ownership. If Ramp becomes the place where spend gets requested, approved, paid, reconciled, and audited, then competitors must displace a system.

Inside Ramp: Cards, AP, Travel, Procurement, Treasury, Agents

Ramp’s product suite spans five primary lines plus the automation glue that ties them together:

corporate cards and expense management (including physical and virtual cards, spend controls, and receipt capture)

bill payments and accounts payable (covering invoice intake, approvals, and payment execution across multiple payment rails)

procurement (with intake workflows, purchase order creation, and three-way matching, sold as an add-on)

travel booking with built-in T&E policy enforcement;

treasury/cash management (including an investment account and FDIC-insured cash options, designed to integrate with accounts payable workflows)

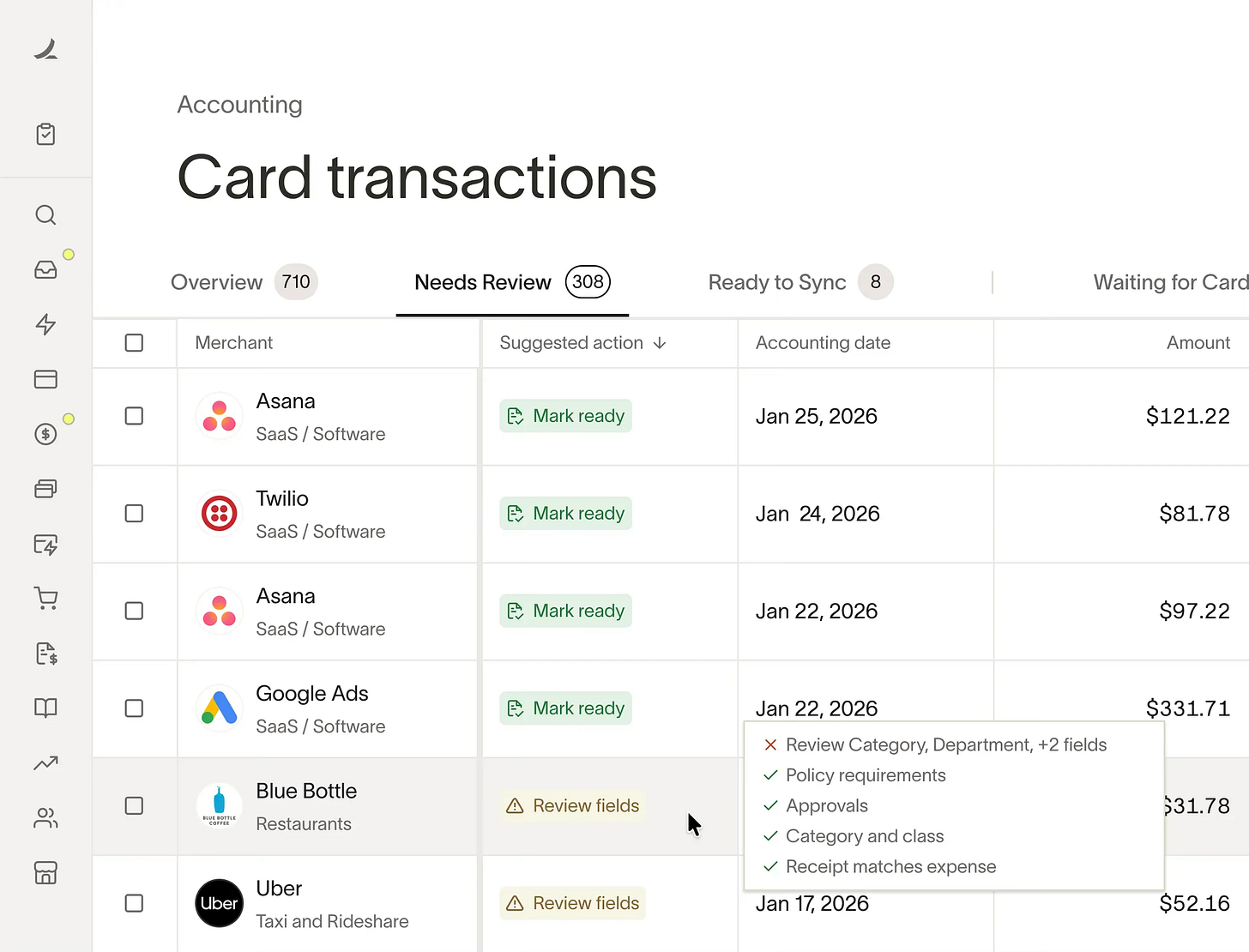

Layered across all of this is accounting automation, featuring ERP integrations and agents that help with coding, review, and synchronization.

The product takes the form of a web app that serves as a finance control plane, complemented by mobile workflows for employees to handle tasks like receipt capture, reimbursements, and approvals. It also extends into chat and other native surfaces, such as SMS or Slack, so employees can submit expenses and respond to policy prompts right where they already work.

Architecture-wise, publicly observable disclosures suggest the platform issues cards through partner banks under Visa licensing, with multiple issuers listed depending on the specific card product and geography. A unified transaction layer sits across both card spending and bill payments, allowing the system to apply consistent controls, enrich transaction data, and map activity cleanly into accounting. On top of this, agent-like automation, covering tasks such as coding, review, fraud checks, and approval recommendations, operates on transactions in real time, routing exceptions to humans when something needs judgment or escalation.

Defensibility lies in three compounding assets. First is a proprietary, aggregated layer of transaction context: merchant identity and categorization, policy decisions and outcomes, and rich receipt metadata, that becomes more accurate and valuable as it scales. Second is a customer-specific semantic layer for accounting: GL mappings, departments/classes, and custom fields that continuously improve through user feedback, making the system increasingly tailored and harder to replicate in each environment. Third is the workflow graph itself, where every approval, exception, and resolution is captured as both training data and operational knowledge, steadily encoding how the organization actually runs and turning day-to-day processes into a durable advantage.

In 2025, Ramp focused on broadening its core suite by expanding into areas like procurement, travel, and treasury, while also pushing further into enterprise use cases and strengthening global coverage; it also highlighted strong Bill Pay growth and increasing multi-product adoption. Looking ahead to 2026, Ramp appears to be leaning harder into autonomous accounting, positioning its Accounting Agent to enable more real-time workflows such as coding transactions, syncing data, handling accruals, and supporting reconciliation. Beyond these milestones, the longer-term trajectory points to deeper ERP integrations (in the Workday/Oracle tier), more robust multi-entity and international issuing capabilities, and a wider set of agent-driven functions spanning accounts payable, controller workflows, and accounting operations.

Getting Paid to Save You Money

Ramp’s model is classic fintech-meets-SaaS: monetize the movement of money (payments economics) while selling software that reduces the cost and risk of moving that money. The combination is powerful because software both creates and protects the payment volume.

Ramp has five product lines and emphasizes customer savings and time recovered as the core return.

Ramp’s publicly listed pricing uses a freemium model with multiple paid tiers and optional add-ons.

The Free plan costs $0 per user per month and includes core corporate card functionality alongside expenses and accounts payable (AP) features, though with usage limits.

The Plus plan is priced at $15 per user per month, plus a platform fee, and is positioned around AI-powered automation capabilities.

For larger organizations, Ramp offers an Enterprise tier with custom pricing that typically covers advanced integrations, global card issuing, and implementation services.

Procurement is available as an add-on for customers on either the Plus or Enterprise plans.

In addition to these published prices, Ramp’s primary revenue streams can be inferred from common fintech and corporate spend-management economics: interchange and other payment monetization from card usage, subscription and platform fees tied to premium automation and enterprise features, and treasury-related economics such as net interest margin or revenue-share arrangements, subject to regulatory constraints and company disclosures.

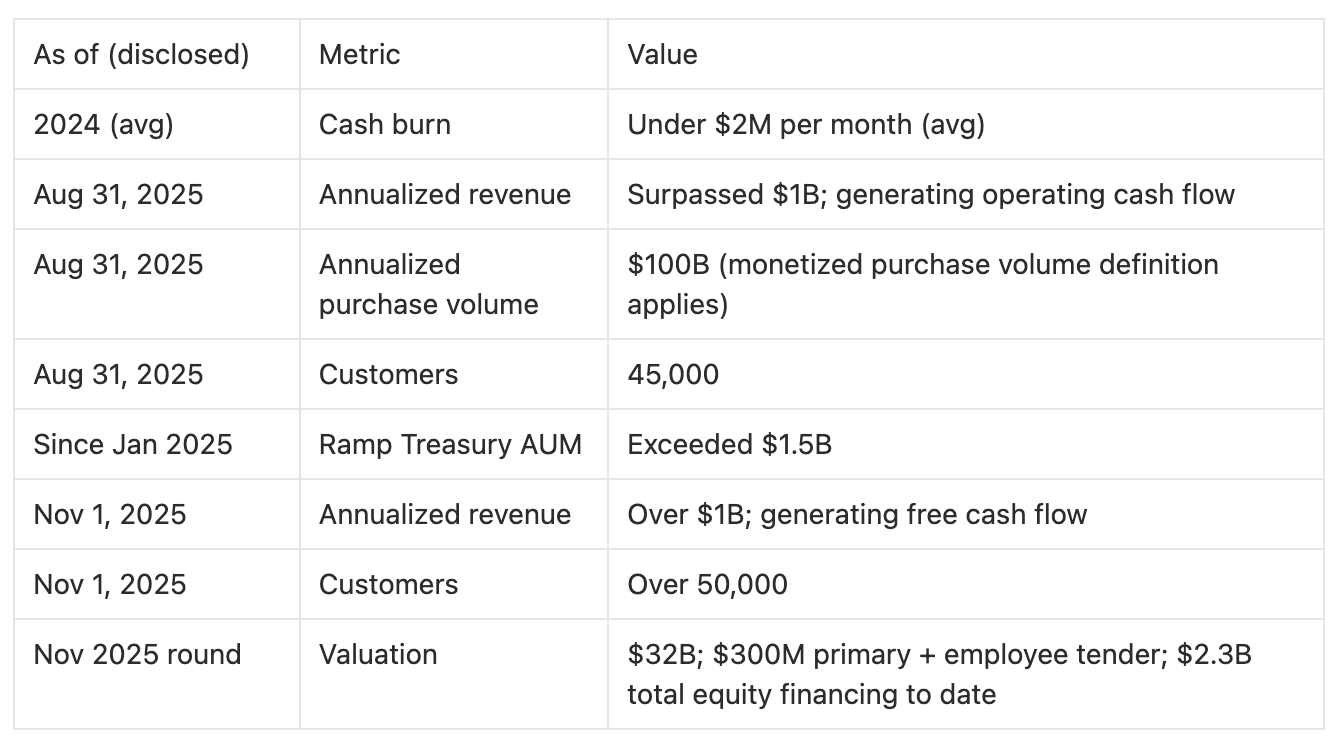

On a blended basis across SMB and enterprise, dividing more than $1B in annualized revenue by roughly 50,000 customers suggests revenue per customer on the order of ~$20k per customer per year. We can also infer a clear enterprise floor: if 2,200 customers generate $100k+ in annualized revenue, that cohort alone contributes at least $220M in annualized revenue. From there, any LTV estimate remains highly sensitive to retention and, especially, net revenue expansion, yet the fact that Ramp reports more than half of its customers using two or more products implies expansion via multi-product adoption is likely a structural driver of LTV.

The sales and distribution model combines product-led and sales-led motions to match customers’ needs as they scale. For smaller teams, a self-serve approach offers a free tier and guided onboarding to drive product-led growth and reduce adoption friction. For enterprise customers and more complex deployments, such as those requiring ERP integrations or supporting multi-entity and global operations, a sales-led motion is paired with implementation services to ensure successful rollout. The model also expands reach through channel partnerships, including accounting firms, private equity and VC partners, and services providers as key partner categories.

Examples of Ramp’s customer base and sales pipeline include Notion (for global spend management), Vanta (for faster close processes), and the City of Ketchum (for public-sector compliance), along with other organizations highlighted in Ramp’s published case studies. Additional press-release logos and customer mentions have also featured recognizable names such as CBRE, Shopify, and Anduril, among others.

Financials

Ramp has disclosed operating cash flow generation (Aug 2025) and free cash flow generation (Nov 2025), which implies some form of profitability at scale even if accounting profit is influenced by growth investments.

On the equity side, the company reports $2.3B in total equity financing to date (as of November 2025). In terms of customer funds, Ramp has also disclosed that Ramp Treasury surpassed $1.5B in assets under management since January 2025. That figure reflects client assets rather than Ramp’s own cash, and those funds may be held with third-party custodians or broker-dealers rather than sitting directly on Ramp’s balance sheet.

Where the details get murkier is on the issuer and credit side. The economics of a corporate charge card business inherently involve underwriting, credit controls, and some form of credit-risk management, but Ramp’s specific balance sheet exposures, such as how receivables are financed, where risk is ultimately retained, and the precise structure of any issuing or credit arrangements—are not publicly laid out in a granular way.

In terms of cash flow, GIC reports that Ramp’s average burn rate stayed below $2 million per month in 2024, which points to disciplined cost control even before reaching a $1 billion run-rate. Separately, Ramp indicated that it began generating operating cash flow by August 2025 and achieved free cash flow generation by November 2025. The key drivers behind these cash-flow shifts are likely tied to growth in payment volume, the structure and generosity of incentives and rewards, underwriting performance, and how efficiently the company can deliver servicing and support, particularly the extent to which automation keeps costs from rising in step with customer and transaction growth.

The Endgame: Autonomous Finance

If all goes well, Ramp in five years will continue to look a lot less like a corporate card company and more like the operating system for business spend, where policy, payment, and accounting semantics are unified and increasingly autonomous.

A plausible snapshot of what finance operations could look like in 2031: Real-time close becomes the default: most routine spending is coded, approved, and posted automatically. Humans shift their attention to what actually benefits from judgment: exception handling, control design, and strategic decision-making. Procure-to-pay stops feeling like a chain of disconnected steps and instead runs as one continuous workflow, moving smoothly from intake to approval to purchase order to payment to reconciliation, with vendor risk checks and pricing intelligence embedded directly into the flow rather than bolted on afterward.

In this world, multi-entity and global operations are treated as first-class requirements. Local card issuing, taxes, and reimbursement rails are managed as configuration: flexible, standardized, and repeatable, rather than bespoke projects that have to be re-invented for every country or subsidiary. Over time, Ramp’s dataset evolves into a kind of finance intelligence layer: benchmarks, anomaly detection, and forecasting that get more accurate as the system scales, while still respecting privacy boundaries. And the platform’s scope expands beyond spend into working-capital decisions: when to pay, where to hold cash, and how to optimize vendor terms, starting to resemble automated capital allocation infrastructure for the modern CFO.