Airwallex Deep Dive | 2026-01

Airwallex is building a horizontally integrated, regulation-heavy “financial operating system” for globally active businesses: multi-currency accounts, FX, cross-border transfers, payment acceptance, cards/spend management, billing, and embedded finance APIs. Their pitch is not subtle: they’re replacing slow, fragmented legacy rails with their own infrastructure, “borderless, real-time, and intelligent.”

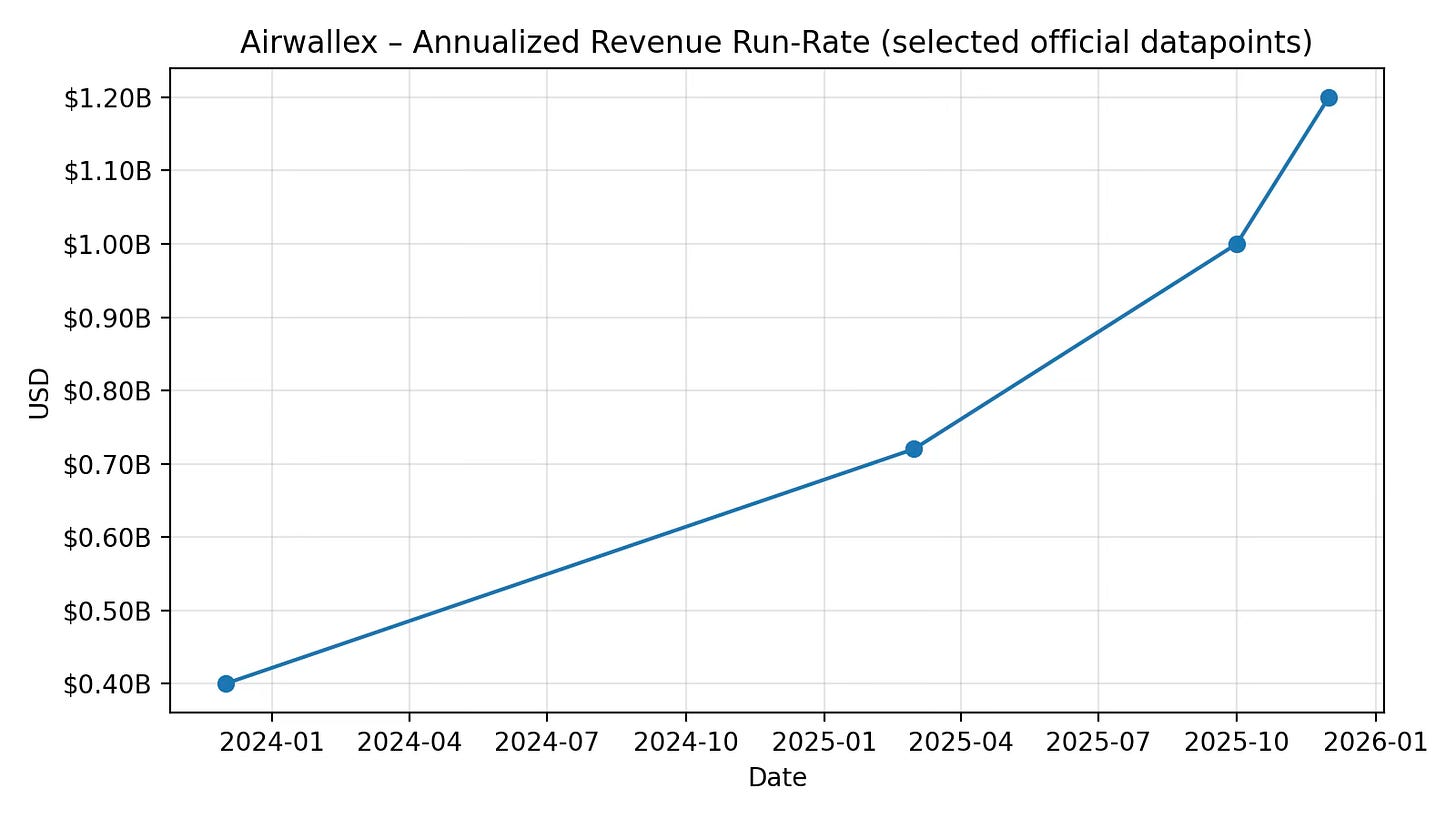

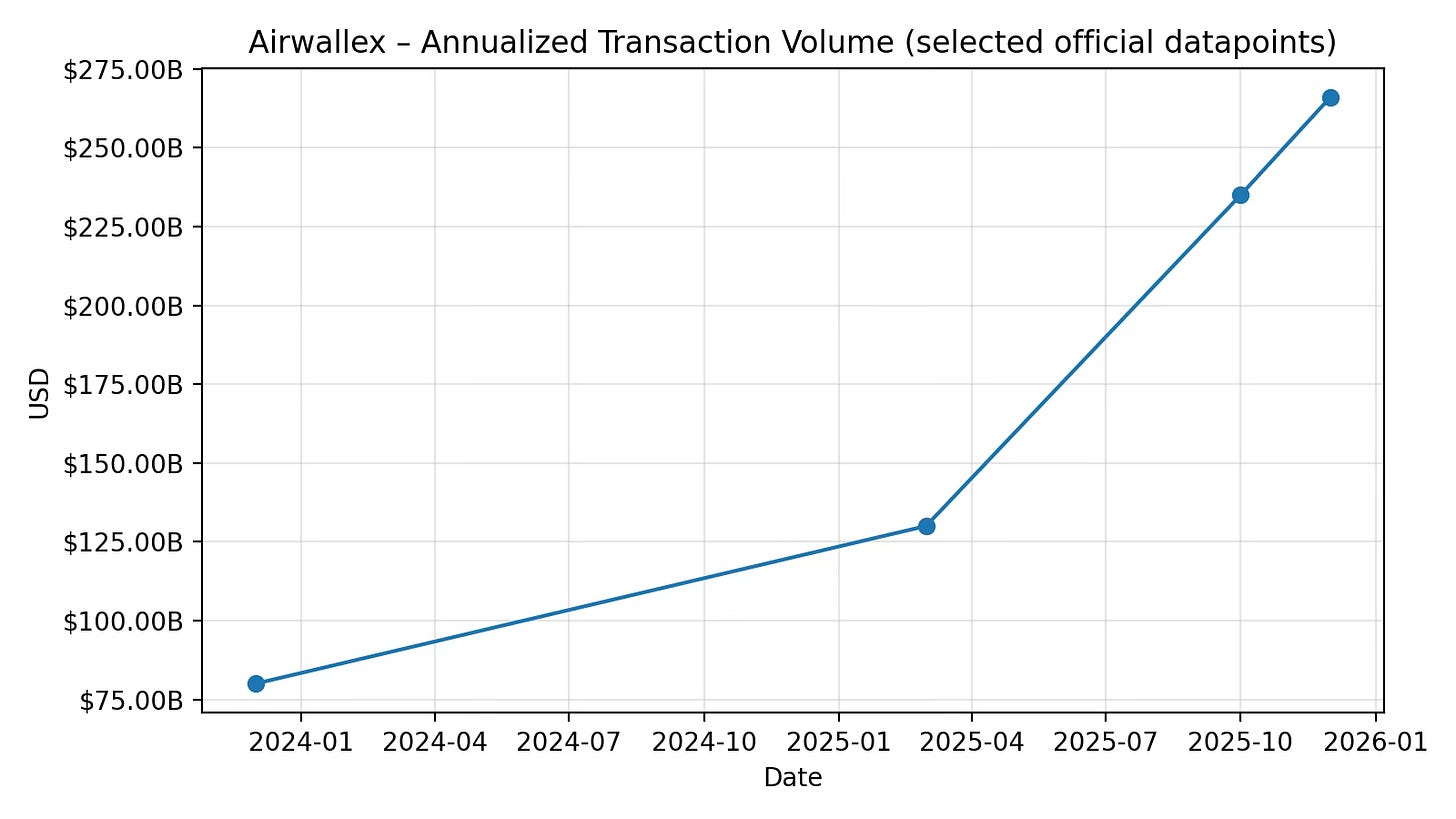

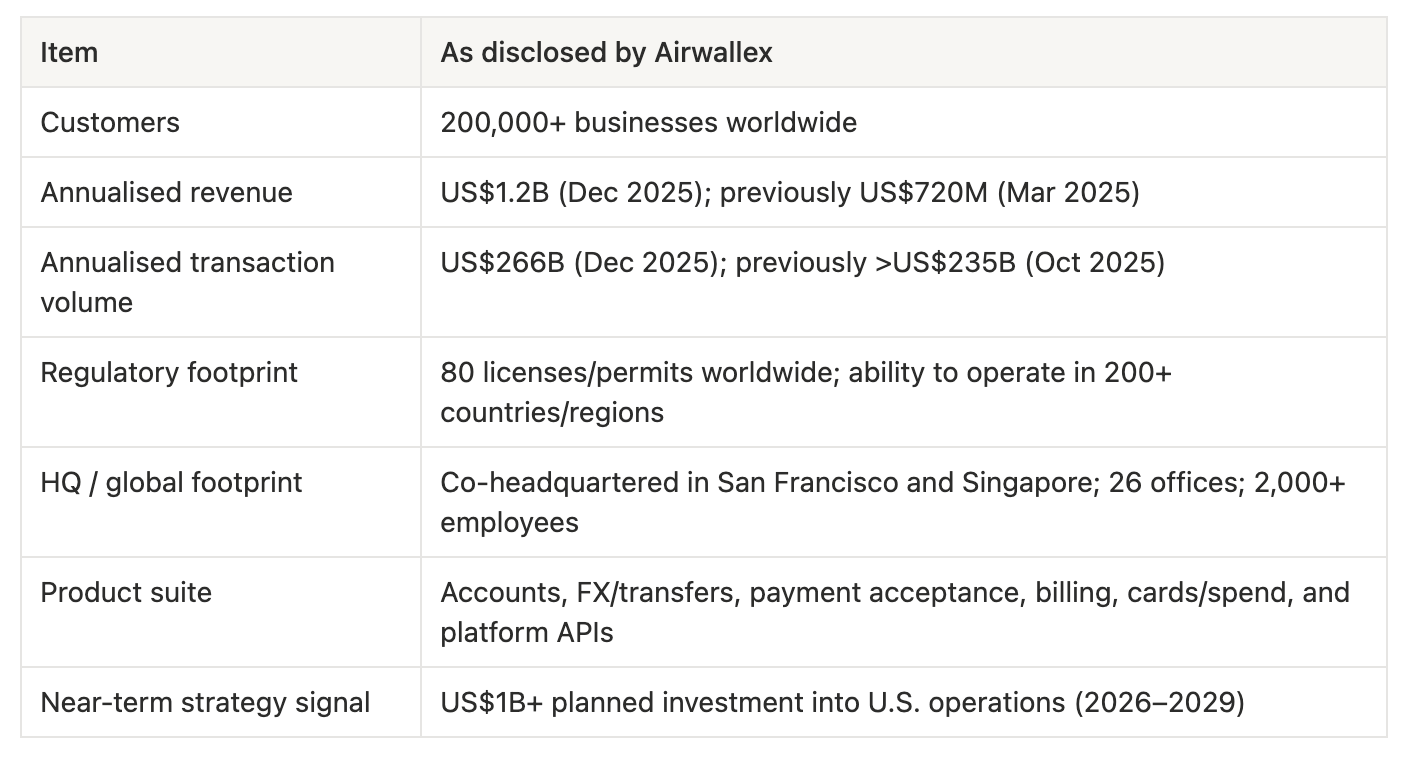

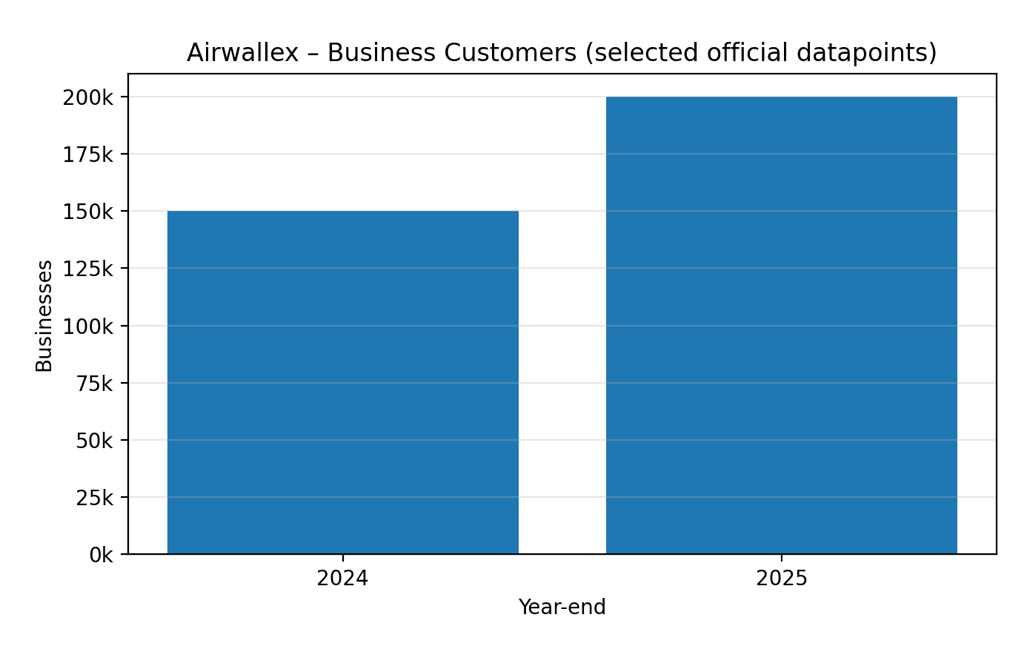

The company looks like an unusually serious attempt to industrialize the messy parts of global money movement. The headline numbers in late 2025 are big: US$1.2B annualised revenue and US$266B annualised transaction volume (Dec 2025), and 200,000+ customer businesses.

The investment case, however, is less about growth curves and more about whether Airwallex can turn a broad product suite into a durable moat while staying ahead of regulators and fraudsters. The AUSTRAC-ordered external audit (Jan 2026) is an immediate stress test of that claim.

Company snapshot

Airwallex’s own ARR Growth Trajectory chart below is the most candid single visualization they publish: it frames the business like a SaaS compounder with a payments engine attached instead of a payment processor with a dashboard attached.

Regulatory perimeter

Payments platforms compete on product and on regulatory standing. In practice, a license is the company’s right to keep operating while it iterates. Airwallex highlights regulation prominently, including via a public help-centre explainer on how it is licensed and regulated.

This matters for the moat thesis because (a) regulation slows copycats, and (b) each incremental country adds compliance and operational complexity that tends to reward incumbents.

What Airwallex sells

The product

Airwallex positions itself as a unified platform: global accounts to hold and move money, payment acceptance to collect it, FX to convert it, cards and spend tools to distribute it, and APIs to embed the whole system inside other software products. In the Paynuri announcement, Airwallex lays the suite out in three clean buckets: Global Business Accounts, Payments, and Spend, with Billing and platform APIs sitting adjacent.

This “stack” framing matters because it changes where the economics come from. A single-feature cross-border transfer tool tends to be priced like a commodity. A workflow system that sits in the middle of treasury, billing, payouts, and expense management tends to be priced like an operating system: sticky, expandable, and hard to rip out once it’s wired into finance and engineering.

The customer: global-first businesses

Airwallex’s narrative repeatedly returns to a specific customer: a modern business that sells, hires, pays, and collects across borders from day one. Their thesis: legacy systems weren’t built for a fast, global world, so Airwallex is building new ones.

In this world, the competitor is another fintech, and the customer’s internal spreadsheet plus a pile of bank portals. That sounds like a weak opponent until you watch how long ugly systems survive when they’re good enough.

The economics

A practical revenue model map

Airwallex’s reported revenue metrics are run-rate/annualised (not audited GAAP/IFRS group numbers). Still, the shape of the model is legible:

Payments acceptance: merchant acquiring fees, plus value-adds around authorization, routing, and local methods.

FX and transfers: spread/fees on conversion and cross-border movement (often the first wedge product).

Accounts and treasury: fees for account services, local collection, payout rails, and premium features.

Cards and spend: interchange economics plus SaaS-like pricing for spend controls and expense workflows.

Platform / embedded finance: API-driven pricing, often tied to volume and feature tiering.

The strategic wager is that the blended margin and LTV improve as customers adopt multiple products. Airwallex points to this directly: “Approximately half of Airwallex’s customer base now uses multiple products,” highlighting product expansion as a growth engine.

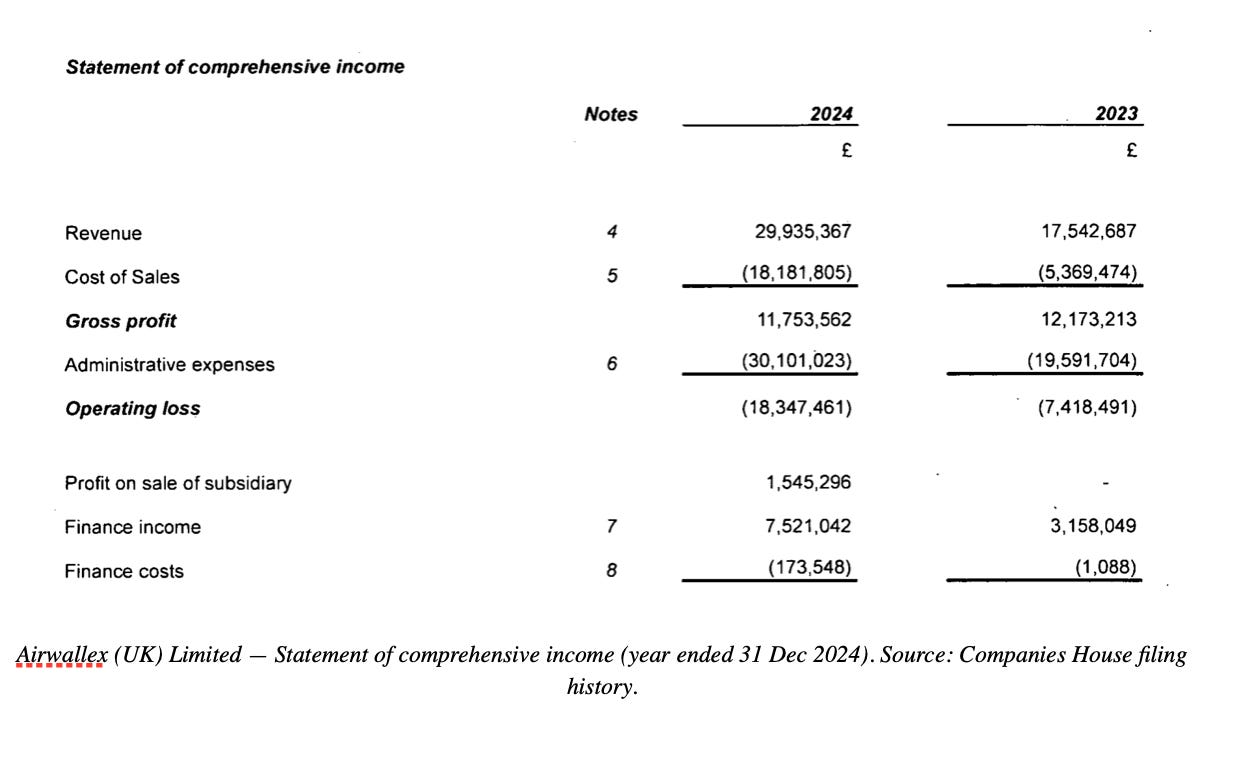

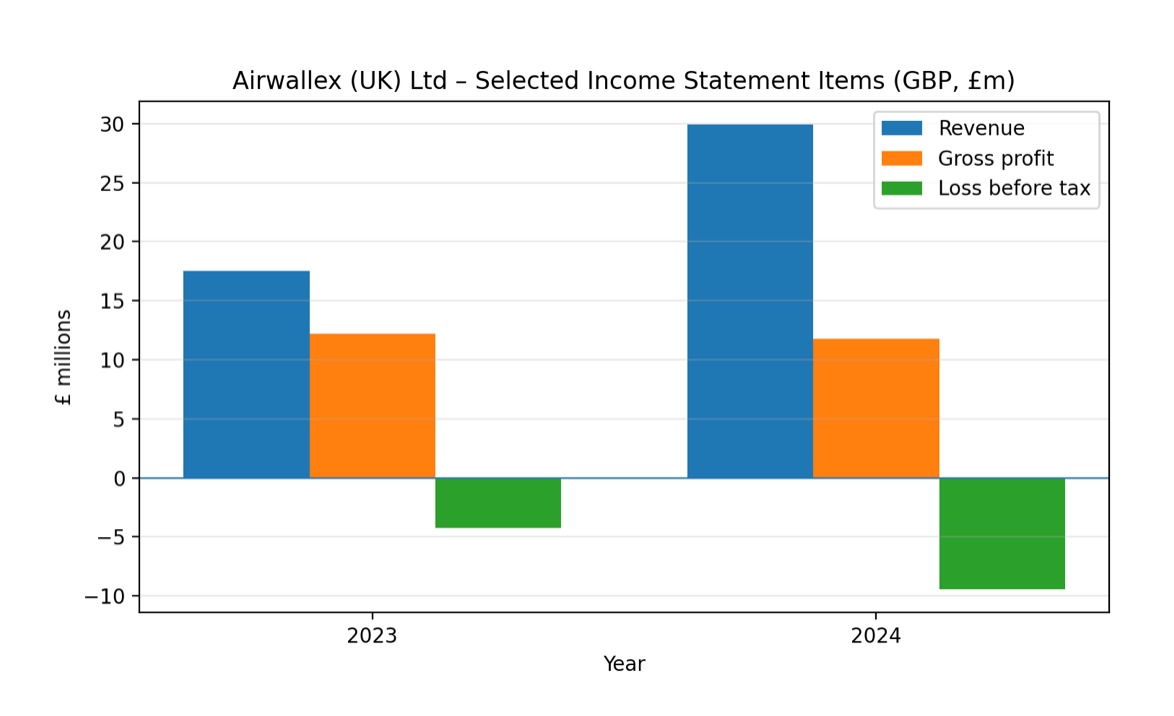

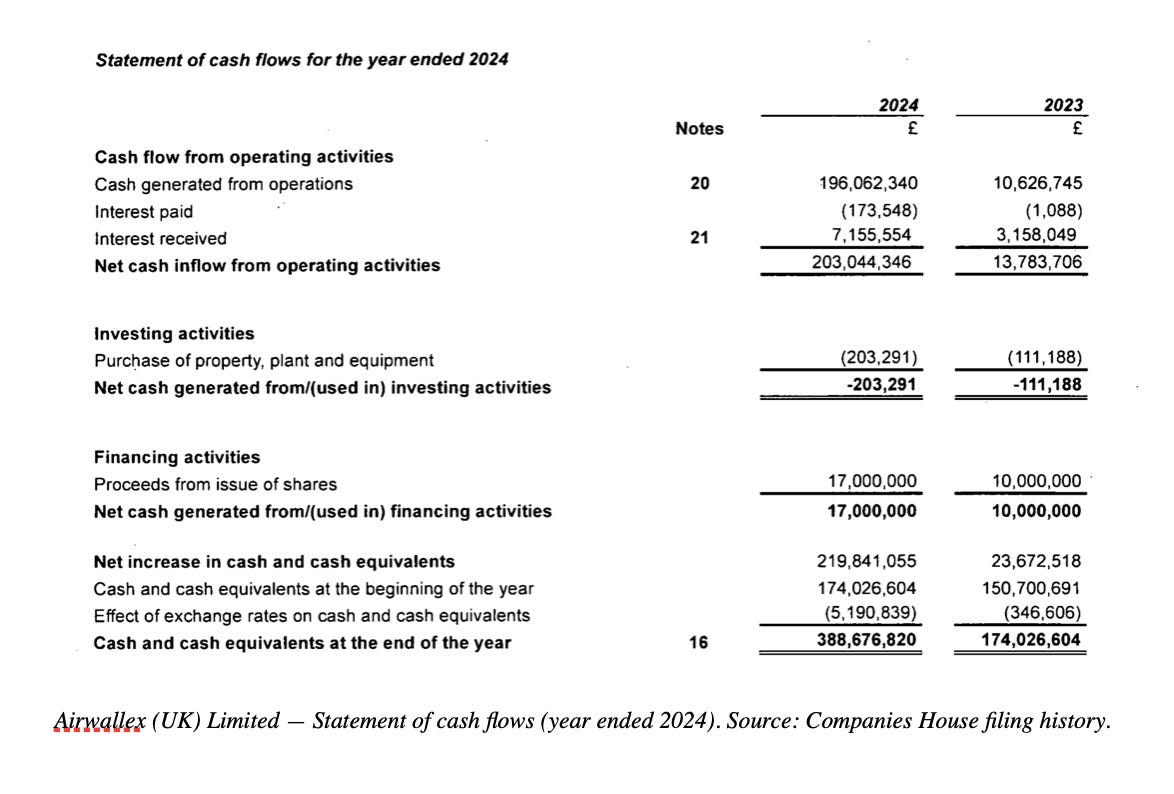

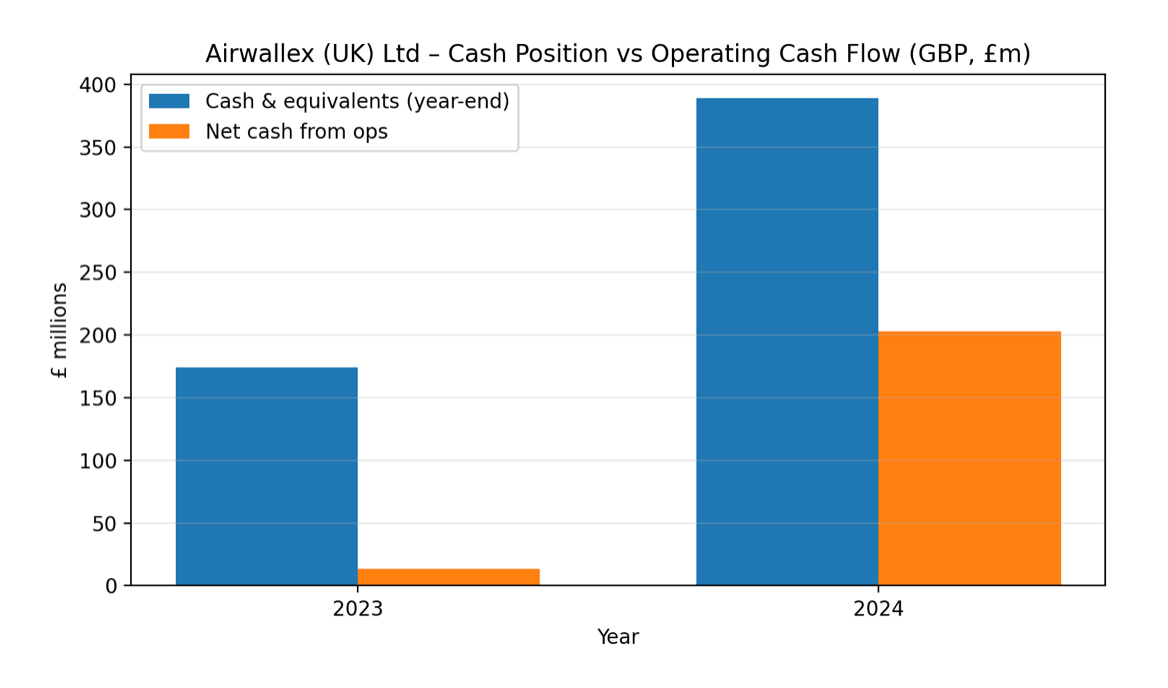

Public filings: what we can see

Airwallex is privately held, so full consolidated financials are not publicly available. The most concrete audited numbers in the public domain come from statutory filings of subsidiaries (example: Airwallex (UK) Limited accounts filed at Companies House).

A caution: these accounts describe one legal entity (and sometimes its local group), not the global business. But they are still useful for understanding cost structure, cash movement, and how aggressively the company is funding regulated footholds.

Does Airwallex have a moat or a growth story?

What “moat” means here

Airwallex is selling reliability, compliance, speed, and cost, largely to finance teams and developers. The moat, if it exists, is an engineered system that becomes harder to replicate as scale and complexity rise.

Airwallex itself frames the world as an infrastructure contest: “We don’t ride the rails of the old financial system. We’re building new ones.”

The components of the engineered moat

Regulatory licenses as ‘permission to exist’. Airwallex cites 80 licenses and permits worldwide. Licenses are not sufficient for a moat, but they are a barrier that slows copycats.

Local rails + global abstraction. Each new market has its own payment schemes, settlement rules, and compliance quirks. Building direct connectivity (and maintaining it) is a compounding engineering burden.

Risk and compliance tooling. A payments network is a magnet for fraud. If you manage risk well, your effective cost of revenue and loss rates are structurally lower.

Workflow lock-in. Once a company’s treasury, payables, and payout flows are integrated, switching costs become real: migration risk, operational downtime, and compliance re-approvals.

Developer experience and platform adoption. Good APIs create distribution via other software vendors and marketplaces.

Where the moat could fail

The moat is not unassailable. Three failure modes matter:

Commoditization pressure: if customers treat Airwallex like interchangeable pipes, pricing compresses toward the cheapest provider.

Regulatory friction: one serious compliance failure can force product withdrawals, license constraints, or expensive remediation.

Complexity debt: a product suite can become a sprawl suite if the organization cannot maintain quality across geographies.

Capital allocation

Funding rounds as strategy signals

In May 2025, Airwallex raised a Series F at a US$6.2B valuation, with disclosed operating metrics and an explicit plan to expand infrastructure into new markets.

In December 2025, the Series G priced at US$8B and paired financing with a major strategic move: establishing San Francisco as a second global headquarters and planning to deploy “more than $1 billion from 2026–2029” to scale U.S. operations.

M&A: buying licenses

The Paynuri acquisition is a clean example of ‘capital allocation as time arbitrage.’ Instead of waiting years to build Korean regulatory standing organically, Airwallex bought an entity holding Payment Gateway and Prepaid Electronic Payment Instrument licenses plus an FX business registration.

This is consistent with an ‘Outsiders’ style logic: do fewer, high-conviction allocations that move the needle, especially when they compress time-to-market. The risk is that you inherit compliance liabilities and integrate multiple regulatory cultures at once.

Competitive landscape: who is Airwallex really up against?

Airwallex’s competitors change depending on where you stand in the stack:

At the top (workflow): banks + treasury platforms + spend suites.

At the middle (payments): Stripe/Adyen-style acquiring, plus local PSPs.

At the bottom (FX/transfers): Wise-style cross-border rails and banks’ FX desks.

This is the hidden advantage and hidden danger of a platform. Advantage: multiple entry points to land customers. Danger: you can end up fighting three different competitive wars at once, each with its own pricing norms.

A practical watchlist

If you had to monitor only a handful of variables over the next 24 months, these are the ones that matter most:

Take rate stability: does net revenue grow in line with volume, or is pricing compressing?

Multi-product penetration: does the “half of customers use multiple products” figure keep rising?

Regulatory outcomes: i.e., AUSTRAC audit findings and follow-on remediation requirements.

Loss rates and fraud metrics: chargebacks, suspicious matter reporting volumes, and client off-boarding rates.

Org complexity: headcount growth vs gross profit growth; operational incidents; product reliability.

Capital allocation discipline: are new markets entered via disciplined sequencing (licenses, local rails, compliance) or via “flag planting”?

Key conclusions (in plain English):

Moat thesis: the moat is an engineered one: licenses + local rails + risk/AML tooling + developer-friendly APIs + workflow lock-in. If it works, it looks more like infrastructure than just another fintech.

Strategic posture: the business is aggressively global, with M&A used to buy regulatory footing (e.g., Korea via Paynuri).

Financial shape (public datapoints): run-rate revenue moved from “approaching $400M” (Dec 2023) to $720M (Mar 2025) to $1B (Oct 2025) to $1.2B (Dec 2025).

Primary risk: regulatory/compliance execution is existential in payments. The AUSTRAC audit is the core business model being examined under a lamp.

What would change my mind: evidence that Airwallex’s “platform breadth” is causing operational sprawl (costs rising faster than gross profit, product quality regression) or that regulators begin treating them as a repeat concern.

Airwallex is trying to do something ambitious and decidedly unglamorous: make cross-border money movement feel like software. If they succeed, the result is a faster transfer product and a durable piece of financial infrastructure that becomes more valuable as global commerce keeps splintering into new corridors, schemes, and compliance regimes.

Sources:

[1] Airwallex Series G press release (Dec 8, 2025): $330M raised; $8B valuation; key operating metrics; $1B+ planned US investment 2026-2029. https://www.airwallex.com/newsroom/awx-raises-usd330m-series-g-at-usd8b-valuation-establishes-sf-as-dual-global-hq.

[2] Airwallex Paynuri acquisition press release (Jan 21, 2026): Korea licenses; global metrics Dec 2025. https://www.airwallex.com/newsroom/airwallex-acquires-paynuri-to-unlock-global-opportunities-for-korean

[3] Airwallex statement on AUSTRAC audit (Jan 22, 2026). https://www.airwallex.com/newsroom/airwallex-affirms-commitment-to-a-robust-and-market-leading-financial-crime

[4] AUSTRAC media release ordering Airwallex audit (Jan 22, 2026). https://www.austrac.gov.au/news-and-media/media-release/austrac-orders-audit-airwallex-suspected-amlctf-compliance-failures

[5] AUSTRAC notice to appoint external auditor (PDF, Jan 22, 2026). https://www.austrac.gov.au/sites/default/files/2026-01/Notice%20to%20Appoint%20External%20Auditor%20-%20Airwallex%20Pty%20Ltd%20-%2022%20January%202026.pdf

[6] Airwallex blog: Celebrating $1 Billion in ARR (Nov 3, 2025) incl. ARR growth chart. https://www.airwallex.com/blog/celebrating-1-billion-in-arr

[7] Airwallex Series F press release (May 21, 2025): $300M; $6.2B valuation; $720M annualized revenue; $130B annualized volume; 150k customers. https://www.airwallex.com/newsroom/airwallex-raises-usd300-million-at-a-usd6-2-billion-valuation-to-build-the-future-of-global-banking

[8] Airwallex CEO letter (Mar 11, 2024): cash-flow positivity Dec 2023; ~$400M run-rate revenue; ~$80B annual volume. https://www.airwallex.com/blog/a-message-from-our-ceo-and-co-founder-2024

[9] Airwallex company overview: Who we are (metrics, timeline, licenses). https://www.airwallex.com/who-we-are (accessed 2026-01-26).

[10] Companies House filing history: Airwallex (UK) Limited (accounts PDFs). https://find-and-update.company-information.service.gov.uk/company/10103420/filing-history

[11] FCA Register: Airwallex (UK) Limited (Authorised Electronic Money Institution). https://register.fca.org.uk/s/firm?id=0010X00004ATvqpQAD

[12] MAS Financial Institutions Directory: AIRWALLEX (SINGAPORE) PTE. LTD. (Major Payment Institution). https://eservices.mas.gov.sg/fid/institution/detail/230232-AIRWALLEX-SINGAPORE-PTE-LTD

[13] Airwallex Help Centre: How is Airwallex licensed and regulated?. https://help.airwallex.com/hc/en-gb/articles/900001757106-How-is-Airwallex-licensed-and-regulated

[14] Airwallex Careers blog (Sep 23, 2025): mindset vs experience quote attributed to Lucy Liu interview. https://careers.airwallex.com/blog/career-growth-for-builders/